The present-day financial world is not just about numbers and transactions; it’s about crafting a future that’s unfolding right before our eyes.

Fintech or financial technology is the driving force behind this transformation. It’s not a distant prospect – the future is now, and the tech maestros of London are shaping it.

From simplifying transactions to revolutionizing how we invest and manage money, fintech apps and technology are the architects of change across industries.

In this article, we’ll explore the key trends in fintech development. Moving on, we’ll introduce you to the tech pioneers who’ve laid the groundwork for fintech innovations in London.

Furthermore, we’ll also look into the crystal ball of the financial future and explain what’s next for fintech. And lastly, we’ll also navigate the challenges and opportunities that lie ahead.

So buckle up as we dive into the currents of fintech development, revealing the essential trends that are shaping the financial world.

- Ignite Financial Innovation!

- Pioneer the Future of Finance with Groundbreaking Fintech Solutions.

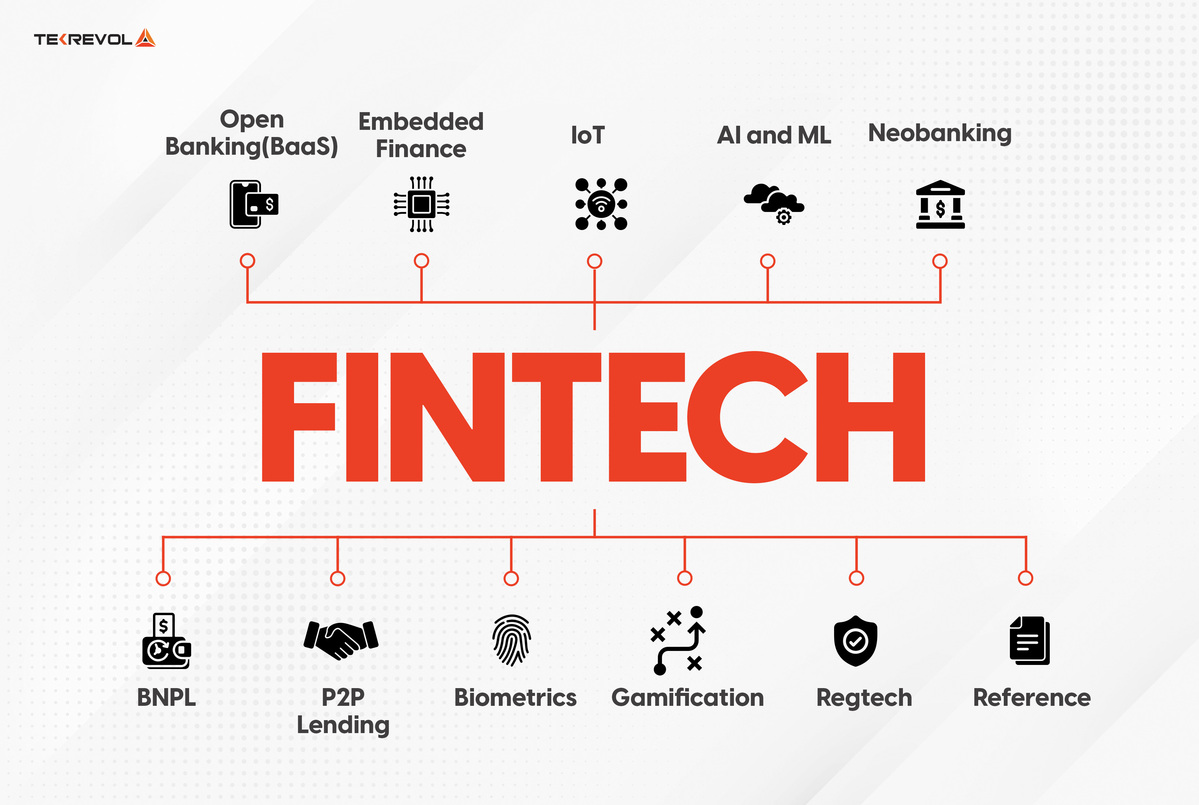

What are the Key Trends in Fintech Development?

There are numerous exciting trends in fintech software development that are shaping the future of financial services.

London’s tech experts, including the top-tier fintech app development companies, are at the forefront of these innovations, and we’ll back up our insights with real-world statistics from reliable sources.

Blockchain and Cryptocurrencies

Blockchain is like a super-secure digital ledger that keeps track of transactions. It’s a big deal in fintech because it can make transactions faster, cheaper, and more secure.

Cryptocurrencies, like Bitcoin, use blockchain technology. They’re like digital money that isn’t controlled by banks or governments. People are using them for online payments and even investing.

Blockchain is like a super-secure digital ledger that keeps track of transactions. It’s a big deal in fintech because it can make transactions faster, cheaper, and more secure.

Cryptocurrencies, like Bitcoin, use blockchain technology. They’re like digital money that isn’t controlled by banks or governments. People are using them for online payments and even investing.

According to Statista, the global blockchain technology market is projected to grow to $39 billion by 2025.

This means we might see more fintech apps in the future using blockchain and cryptocurrencies to make money stuff easier for us.

The fintech app development cost associated with these technologies is also becoming more competitive, making them accessible to a wider range of businesses.

For premium fintech app development services, it is advisable to engage a specialized bespoke app development company that can easily tailor solutions to meet your unique business requirements and deliver a seamless user experience.

Artificial Intelligence in Financial Services

Artificial Intelligence (AI) means computers and apps can learn and make decisions like humans, but really fast.

In fintech, AI is used to predict what you might buy or invest in. For example, when you shop online, AI suggests other products you might like.

In banking, AI helps spot unusual transactions to prevent fraud. It’s like having a smart helper in your financial apps, making things safer and more convenient.

According to PwC’s global Artificial Intelligence study, the authors have utilized the findings to create an AI Impact Index, where they examine the pace of change and identify the areas in which businesses can anticipate the highest returns.

In that report, the potential AI consumption impact for the Financial Services sector was rated 3.3 out of 5. This has inspired many companies to seek guidance on how to build a fintech app that leverages AI for enhanced customer experiences.

Open Banking Initiatives

Open banking is about sharing your financial data securely with different apps and companies. It’s like giving permission to access your bank account but in a safe way.

This trend is opening doors to new fintech apps that can help you manage your money better.

For instance, you can connect your bank account to budgeting apps or even get personalized loan offers from different lenders.

It’s all about giving you more choices and control over your finances.

According to the Open Banking Impact Report of March 2023, the adoption of open banking services continues to grow with 10 – 11% of digitally-enabled consumers now estimated to be active users of at least one open banking service.

This is up from 7 – 8% in December 2021, which creates a fertile ground for businesses looking to launch a successful mobile app.

Moreover, this growth underscores the importance of fintech app development UK services in innovating within the financial sector.

Personalization and User Experience

Personalization in fintech means apps tailor themselves to your needs.

For instance, if you use a budgeting app, it might give you tips based on your spending habits. Or an investment app might suggest a portfolio that matches your goals.

User experience is about making fintech apps easy and enjoyable to use. It’s like having an app that’s not confusing, loads fast, and looks nice.

In the future, fintech apps will become more like personal financial advisors, helping you make better money decisions.

According to a report by Accenture, nearly six in ten consumers would be willing to share significant personal information, such as location data and lifestyle information with banks for personalized services.

London’s Tech Gurus: Pioneers in Fintech Innovation

When it comes to fintech innovation, London stands out as a hub of expertise and creativity. In this section, we’ll explore the pioneers who have played a significant role in shaping the fintech landscape in the city.

Anne Boden – Founder of Starling Bank

Anne Boden is the brain behind Starling Bank, a digital bank known for its user-friendly mobile app.

She aimed to make banking simpler and more convenient for everyone. Today, Starling Bank has millions of customers and has won numerous awards for its innovation.

Taavet Hinrikus – Co-founder of TransferWise (now Wise)

Taavet Hinrikus co-founded Wise, a fintech giant that revolutionized international money transfers.

Wise makes sending money abroad cheaper and faster than traditional banks. Taavet’s vision was to make global finance fairer for all.

Eileen Burbidge – Partner at Passion Capital

Eileen Burbidge is a venture capitalist who has been a driving force in London’s fintech domain.

She co-founded Passion Capital, an investment fund that supports early-stage fintech startups. Eileen’s expertise and investments have helped many fintech companies take off.

Success Stories and Contributions to the Industry

Revolut – A Fintech Unicorn

Revolut, founded by Nikolay Storonsky and Vlad Yatsenko, is a fintech unicorn that offers a range of financial services, from currency exchange to cryptocurrency trading. Their innovative approach to banking has attracted over 15 million customers worldwide.

Monzo – Banking for the Digital Age

Tom Blomfield, along with his co-founders, started Monzo, a digital bank that puts the power of banking in your pocket. With its distinctive coral-colored cards and user-friendly app, Monzo has grown into one of the UK’s most beloved fintech companies.

Collaborative Ecosystem in London’s Tech Community

London’s fintech success story isn’t just about individuals; it’s also about a collaborative ecosystem:

Fintech Accelerators

London boasts several fintech accelerators like Level39 and Techstars, which provide startups with mentorship, resources, and connections to investors.

Regulatory Support

The Financial Conduct Authority (FCA) in the UK has been proactive in supporting fintech innovation. Their “sandbox” allows startups to test their ideas in a controlled environment.

Networking Events

London hosts numerous fintech networking events and conferences, fostering connections among entrepreneurs, investors, and industry experts.

- Tap into FinTech Excellence!

- Revolutionize Your Financial Experience with Cutting-Edge Apps.

The Future Landscape of Fintech Apps

As technology continues to evolve, the future of fintech apps is set to be exciting and transformative. In this section, we’ll explore the key aspects that will shape the landscape of fintech apps in the coming years.

Integration of Emerging Technologies

Fintech app developers of the future will embrace emerging technologies to provide even better services:

Artificial Intelligence (AI) and Machine Learning

Fintech app developers will use AI to offer personalized financial advice, detect fraud, and make investing easier. AI will help apps understand your financial behavior and suggest ways to save or invest smarter.

Blockchain and Cryptocurrencies

We’ll see top fintech app development companies using blockchain for secure and faster transactions. Cryptocurrencies may become mainstream for everyday purchases and investments.

Augmented Reality (AR) and Virtual Reality (VR)

These technologies may change how fintech app development services interact with financial data. You might use AR glasses to see your budget in real time or VR to attend virtual financial meetings.

Regulatory Landscape and Compliance Challenges

Regulations play a crucial role in fintech, and they’ll continue to evolve:

Data Privacy

Prioritizing data privacy will be essential for fintech mobile app development, ensuring that your personal information remains secure and used only for your benefit.

Cross-Border Transactions

As fintech apps expand globally, complying with various international regulations will be a challenge. Custom fintech app development will require apps to navigate complex rules for cross-border transactions.

Cybersecurity

With the rise in cyber threats, fintech apps will invest heavily in cybersecurity measures to protect users’ data and finances.

Evolving Customer Expectations and Needs

Fintech apps will need to stay in tune with changing customer expectations:

Personalization

Users will expect highly personalized experiences, with fintech apps providing tailored financial advice and solutions.

Instant Gratification

People will want quick access to their funds, speedy loan approvals, and instant solutions to financial problems.

Financial Education

Fintech apps will play a role in educating users about managing their money wisely, helping them become more financially literate.

Crafting Next-Gen Apps in Fintech

Creating the next-gen app in fintech involves a combination of smart strategies, user-focused design, and robust security measures. Let’s explore the key aspects to consider when crafting these cutting-edge financial apps.

Development Strategies and Best Practices

To build top-notch fintech apps, developers should follow these strategies and best practices:

Agile Development

Use agile methodologies to develop and iterate your app. This means building and improving in small, manageable steps, making it easier to adapt to user needs and changes in the industry.

Scalability

Ensure your app can handle a growing number of users and transactions. Scalability is crucial to accommodate increased demand.

Continuous Testing

Regularly test your app for bugs and security vulnerabilities. Automated testing tools can help ensure the app’s reliability.

API Integration

Collaborate with banks and other financial institutions to integrate their services seamlessly into your app. This makes it easier for users to manage their finances in one place.

User-Centric Design Principles

Creating a fintech app that users love means following user-centric design principles:

Simplicity

Keep the fintech app design interface simple and easy to navigate. Users should quickly understand how to perform essential tasks.

Personalization

Tailor the user experience based on individual preferences and financial goals. Provide relevant insights and suggestions.

Accessibility

Ensure the app is accessible to all users, including those with disabilities. This includes features like voice commands and text-to-speech.

Feedback and Support

Offer responsive customer support and gather user feedback to continuously improve the app by adding new fintech app features catering to users’ needs.

Security and Privacy Considerations

Fintech app security and privacy are paramount in fintech app development:

Encryption

Encrypt user data and financial transactions to protect them from unauthorized access.

Two-Factor Authentication (2FA)

Implement 2FA to add an extra layer of security for user logins.

Regular Security Audits

Conduct regular security audits to identify vulnerabilities and address them promptly.

Data Privacy Compliance

Stay compliant with data privacy regulations like GDPR or CCPA. Inform users about how their data is collected and used.

Secure Development Practices

Train your development team in secure coding practices to prevent common security flaws.

- Explore the Future of FinTech!

- Hire Fintech App Developers from TekRevol!

As the fintech landscape continues to evolve, there are both challenges and exciting opportunities on the horizon. Let’s look into these future prospects.

Navigating Regulatory Changes

Challenges

Complex Regulations

Fintech companies must navigate a complex web of financial regulations that vary from country to country. Keeping up with these changes can be challenging and costly.

Data Privacy

New regulations like GDPR and CCPA demand strict data privacy measures. Fintech apps must ensure they comply with these rules to protect user data.

Opportunities

Innovation-Friendly Regulations

Some governments are recognizing the importance of fintech and are working to create regulations that encourage innovation while safeguarding consumers. These opportunities can lead to more fintech growth.

Global Expansion

Companies that understand and adapt to different regulatory environments can expand their services globally, reaching a broader user base.

Addressing Cybersecurity Risks

Challenges

Sophisticated Threats

Cybercriminals are becoming more sophisticated, posing a constant threat to fintech apps and their users.

Data Breaches

High-profile data breaches can damage trust and reputation, causing financial and legal repercussions.

Opportunities

Advanced Security Solutions

Innovations in cybersecurity offer opportunities to develop robust security measures that protect user data and transactions effectively.

Consumer Trust

Fintech companies that invest in cybersecurity can gain a competitive edge by building trust with users who value security.

Opportunities for Collaboration and Innovation

Challenges

Competition

Fintech is a highly competitive space, and standing out can be tough. Competition may limit growth for some players.

Technology Evolution

Staying up-to-date with rapidly evolving technologies is a continuous challenge for fintech companies.

Opportunities

Collaborations

Partnering with traditional financial institutions or other fintech companies can open doors to new markets and services.

Innovation

Embracing emerging technologies like blockchain, AI, and IoT can lead to innovative products and services that capture users’ attention.

Conclusion

In wrapping up our exploration of fintech trends, innovations, and the impact of tech gurus, let’s take a closer look at what we’ve learned.

Recap of Fintech Trends and Innovations

Throughout the article, we’ve uncovered several key trends in fintech development:

- Blockchain and Cryptocurrencies: Blockchain technology and cryptocurrencies are reshaping how we handle transactions and investments, making things faster and more secure.

- Artificial Intelligence in Financial Services: AI is becoming a valuable tool in predicting financial behavior, providing personalized advice, and enhancing security in fintech apps.

- Open Banking Initiatives: Open banking is opening doors to more choices and control over our finances, with apps that help us manage money better.

- Personalization and User Experience: Fintech apps are evolving to offer tailored services that match individual needs, making financial decisions easier.

The Ongoing Evolution of Fintech in London and Beyond

London’s tech gurus have played a vital role in shaping the fintech landscape.

They’ve brought us innovative companies like Starling Bank, Wise, and Monzo, each contributing to the evolution of fintech in the city and worldwide.

London’s collaborative ecosystem, with accelerators, regulatory support, and networking events, has fostered an environment where fintech startups can thrive.

Looking Ahead: The Continued Impact of Tech Gurus on the Industry

As we look to the future, we see a promising landscape for fintech apps. Emerging technologies like AI, blockchain, and AR/VR are set to revolutionize how we manage our finances.

At the same time, regulatory changes and cybersecurity risks pose challenges that fintech companies must navigate.

Tech gurus and innovators will continue to drive the industry forward, creating fintech apps that meet evolving user expectations and needs.

Their contributions will shape the next generation of financial technology, making managing money more accessible, secure, and personalized for everyone.

The fintech industry is in a state of constant innovation and growth. With the right strategies, user-centric design, and a focus on security and privacy, the future of fintech apps looks promising.

As long as tech gurus remain at the forefront of these developments, we can expect exciting advancements that will benefit us all.

This includes the ongoing need to hire a bespoke app development company that understands all the complexities of the FinTech market, including the cost to build an app, the nuances of user experience, security requirements, and regulatory compliance.

2341 Views

2341 Views December 11, 2023

December 11, 2023