Imagine scrolling down your favorite online store and spotting that limited-edition smartwatch you’ve been eyeing or the perfect pair of sneakers. You quickly add them to your cart and then to checkout.

Suddenly, the reality sets in, and your bank balance decides otherwise. Wouldn’t it be really cool if you could buy whatever you want without ever having to stress about a full payment?

Tabby app UAE is the perfect answer to your preferences, offering a smarter, stress-free way to shop now and pay later. Tabby allows users to shop at their favorite brands, splitting purchases into four interest-free payments. It has made huge waves in the UAE because it makes it possible for people to make big purchases with convenient payments.

As buy now pay later apps in the UAE become increasingly popular, it’s pretty obvious they are also changing how customers spend their money. According to experts, it can reach over $4.41 billion by 2029 for the UAE BNPL market, reflecting huge demand for flexible and user-friendly payment options.

This is the perfect time for entrepreneurs to figure out how to build an app like Tabby. By creating a BNPL app, which includes ease, security, and user value, you will surely be able to tap into growing markets and satisfy the needs of the UAE shopper today.

What is Tabby App, and How Does It Work?

Tabby App is one of the most downloaded buy now pay later applications in the UAE. The app was launched in 2019 and became a household name by reaching more than 5 million downloads and 12 million users across the regions.

Flexible buying options at Tabby enable users to acquire whatever they may want immediately with an easy 14-day, interest-free installment plan. According to Tabby, providing users with an easy and secure manner in which they can carry their purchases without financial strains will always remain the objective for building a trusted choice of shopping throughout the UAE.

Flexibility in payment terms and a wide variety of partner merchants distinguish Tabby. Users pay over several weeks without an additional fee, while retailers benefit from increased sales as well as consumer loyalty. The application is very user-friendly, has a hassle-free shopping experience, and guarantees secure transactions and safe personal data.

How to Use Tabby

Getting started with the Tabby app is easy, even if you’re a complete newbie who wants to buy now pay later apps in UAE. So here’s what to do, step by step, to start shopping and paying with flexibility:

- Download the Tabby app from the App Store or Google Play. It’s free and will only take one minute.

- Sign up using a straightforward process that creates an account and links up a valid debit or credit card. You might need some quick ID verification.

- Explore Tabby’s partner stores and add items you wish to purchase to your cart.

- Choose Tabby as your payment method, verify your details, and enter the verification code sent to your phone during checkout.

- You will only pay 25% of the total amount at checkout. The remaining balance will be divided into three equal monthly payments.

- Your payment plan is now set! Sit back and enjoy your purchase, with future payments automatically deducted on schedule.

- Want to create the next big app like Tabby?

- Join forces with industry-leading development teams at TekRevol to turn your vision into reality!

How Does Tabby Make Money? Revenue Models for Buy Now Pay Later Apps

So, you’re telling me that Tabby doesn’t charge interest on their payments, nor do they have hidden fees. So, how on earth do they make money? Well, it’s a common question that many Tabby App users have asked at least once before signing up.

Here’s how Tabby generates revenue while still providing interest-free payments to customers:

Merchant Fees

Retailers who partner with Tabby pay a fee for each sale made through the platform. This fee is a small percentage of the sale and is worth it for retailers because Tabby’s payment options encourage customers to buy more.

By offering Tabby payment UAE options, stores experience higher sales and reduced cart abandonment rates, which makes paying these fees a good investment for them.

Late Fees

Tabby offers users interest-free installments, but there are late fees if a payment isn’t made on time. This fee isn’t meant to be a major income source, but it helps cover the costs if users miss payments. Tabby’s late fee structure is simple and clear, ensuring users know what to expect if they miss a due date.

Data Insights

With user consent, Tabby also leverages data to gain insights into consumer behavior. This data is mainly used to improve their service and personalize offers, but it can also be valuable for partnerships or targeted promotions.

Tabby+

Tabby offers a plus account, where the customer can pay for all their basic requirements, such as fuel, grocery, and electricity, in installments. However, people can access these extra services provided by Tabby+ for free by paying only 49 AED every month. Besides, the company offers free trials for all people so that they may begin using it and then understand how the system works.

Want to Achieve a Successful Launch? Read Our Comprehensive Guide On: Soft Launch vs. Hard Launch: What’s the Difference?

What Makes Tabby a Huge Success in the UAE Market?

Tabby has successfully reached a very important milestone for the MENA region – entering the billion-dollar startup club with its unicorn valuation of $1.5 billion – and ranking among the top five BNPL providers worldwide by capitalizing on the demand in the UAE for flexible payment solutions: the buy now pay later market is projected to grow at 24% and should reach a total of $15.5 billion by 2024.

One reason Tabby is successful is that it truly understands the needs of UAE consumers. By making shopping easy and hassle-free through zero-interest installment plans, it helps users manage their budget without added costs. For retailers, it means more sales and reduced cart abandonment – a win-win solution that has been broadly welcomed across the UAE.

Tabby stands out from the rest because it has strategic partnerships with popular retailers that enhance its visibility and reach. Likewise, the design of this app is modern, user-friendly, and, therefore, appeals more to Gen-Z and millennial shopperswho want seamless digital experiences.

The app also accommodates more than 15,000 international brands, including some heavyweights such as Adidas, IKEA, H&M, Bath & Body Works, Nike, Marks & Spencer, and Vivo, among others. It has led the charge of the MENA buy now pay later market through Tabby with both a consumer-centric approach and some robust retail partnerships.

- Ready to redefine the UAE fintech space?

- Partner with TekRevol, the experts in scalable, innovative solutions for the UAE market.

Essential Features for Your Buy Now Pay Later App Like Tabby

Global Buy Now, Pay Later (BNPL) transactions are predicted to increase by nearly 450 billion USD between 2021 and 2026. Clearly, there is a growing demand for BNPL apps. As seen with Tabby in the UAE, more players are entering this market. Here are the essential features you should consider:

1. Sign-up/Login

A quick registration process allows users to create accounts easily. Secure authentication methods like OTPs and biometrics ensure safety. Tabby uses these features to protect user data while providing a smooth onboarding experience, encouraging more people to join the platform.

2. Online Shopping Integration

Tabby offers a seamless e-commerce experience by integrating with top retailers in the UAE. Users can browse product catalogs and enjoy user-friendly navigation within the app. This integration makes shopping convenient, allowing users to access BNPL options directly at checkout without hassle.

3. Split Payments

Flexible installment plans let users choose their payment schedules at their convenience. Tabby offers interest-free options, attracting users who prefer to manage their finances responsibly. This feature makes larger purchases more accessible, encouraging users to shop without worrying about upfront costs.

4. Automatic Deduction

Scheduled debits ensure that users never miss a payment due date. Tabby UAE app allows for different types of payments, such as credit cards and digital wallets, which makes it easy to administer personal finances without any manual interference.

5. Advance Payments

Tabby allows early repayment options, giving users the flexibility to pay off their balances sooner. There are no penalties for early payments, encouraging responsible financial behavior. This feature helps users save on interest and maintain better control over their spending.

6. Account Management

There is also a clear dashboard view of purchases, payments, and balances. This makes it easy for users to manage and monitor their profile settings and preferences through the account management feature provided by Tabby. Therefore, users can easily track their finances and get organized.

7. Merchant Analytics

Tabby provides the merchant with real-time sales tracking and customer insights. Using this, the business gets to know how users behave and what trends they are. Hence, businesses can adjust their offerings accordingly so that the services they improve can satisfy the customers.

8. Payment Links

Tabby simplifies transactions using payment links, which provide quick access. Users are able to share the links via email or SMS to facilitate easy purchases. This enables the users to go through the payment process frequently in the app.

9. Disputes Tab

The disputes tab offers easy access to customer support for issue resolution. Users can track and manage disputes efficiently. Tabby’s commitment to resolving issues quickly fosters trust and enhances user satisfaction, ensuring a positive experience during transactions.

10. Reminders

Tabby sends timely payment notifications to alert users about upcoming due dates. Additionally, promotional messages inform users about offers and updates. This proactive communication helps users stay on track with payments and encourages them to explore new deals.

11. Cashback and Rewards

Tabby has loyalty programs that encourage repeat usage. Users can earn cash back on purchases and get a referral bonus for bringing in new customers. This feature rewards users and promotes app growth through word-of-mouth.

12. Credit Score Checking

Tabby assesses users’ creditworthiness to ensure responsible lending. Transparent criteria build trust, allowing users to understand how their credit scores affect their borrowing options. This feature empowers users to make informed financial decisions based on their credit health.

13. Multi-language Support

Tabby caters to a diverse user base in the UAE by offering multiple language options. This inclusivity enhances user experience, ensuring that everyone can navigate the app comfortably. Supporting various languages helps reach a broader audience and fosters user engagement.

14. Secure Data Encryption

Tabby prioritizes user information protection through secure data encryption. Compliance with data protection laws and PCI DSS standards ensures the safe handling of payment information. This commitment to security builds trust, making users feel confident while transacting.

15. Push Notifications

Engaging users with timely updates and personalized messages keeps them informed. Tabby utilizes push notifications to remind users of payments and promote new offers. This feature enhances user engagement, ensuring that users remain connected to the app’s benefits.

16. In-app Chat Support

Tabby provides real-time assistance through in-app chat support, enhancing the customer service experience. Users can quickly get help with their inquiries or issues. This immediate support feature fosters user satisfaction and encourages continued app usage.

Want to Develop An App for Music Lovers? Read Our Comprehensive Guide on: 10 Offline Music Apps To Try in 2024

Building Your Tabby-Like App: A Step-by-Step Development Guide

As of October 2024, Tabby’s annual revenue had already touched $750 million. Today, it has grown to be the leading BNPL app in the region. Developing an app like this will require more than just basic features; it demands insight into the market along with a commitment to innovation.

Here are the steps to follow to build your app-like Tabby UAE:

Step 1: Market Research and Analysis

Understanding user needs is crucial. Conduct surveys and focus groups to gather insights on what users expect from a BNPL app. Additionally, competitor analysis will be performed by studying other apps in the UAE, such as Afterpay, Postpay, Tamara, and Affirm. This research will help identify what works and what doesn’t in the current market.

Identify common user pain points.

- Analyze successful features of competitors.

- Gather demographic data to understand your target audience.

Step 2: Define Your Unique Value Proposition

Identify areas in the market where your app is unique or different. It must have a clear USP. For instance, Tabby’s USP is: “Tabby lets you split your purchases into 4 monthly payments so you can worry less and aim for more.”

Consider how your app can provide similar value and establish your own USP to differentiate from competitors. Brand differentiation is essential for creating a memorable identity.

Step 3: Planning and Feature Selection

Setting priorities on features as in demand by the market and feasibility- for example, the users’ needs to be prioritized, and only those the development team can effectively provide; also creating a roadmap by having clear timelines and well-developed milestones.

List essential features such as:

- User-friendly payment options.

- Integration with popular retailers.

- Robust account management tools.

Step 4: Designing the User Interface and Experience

Start with wireframing and prototyping to visualize the app flow. This helps you plan how users will interact with your app. Conduct user testing to gather feedback on usability and make adjustments based on real user experiences to enhance satisfaction.

Focus on clean and intuitive design, ensuring easy navigation similar to what users experience with Tabby.

Step 5: Developing the App

Select the right technology stack that suits your app’s needs. For front-end development, responsive and intuitive interfaces should be developed to provide a seamless user experience on all devices. A scalable framework supporting future growth is to be chosen, with secure coding practices to safeguard user data.

Step 6: Integrating Payment Gateways

Partner with trusted payment providers to ensure secure transactions. Consider multiple currency support to accommodate users from different backgrounds in the UAE, enhancing accessibility and convenience.

Research payment gateways that offer:

- Low transaction fees.

- Fast processing times.

- Strong security measures.

Step 7: Compliance and Legal Considerations

Understand the licensing requirements that apply to the UAE market. Obtain the necessary approvals to operate legally. Understand your terms and conditions for informing users of their rights and obligations while using the app. Seek the advice of lawyers navigating regulatory requirements and drafting transparent user agreements for building trust.

Step 8: Testing and Quality Assurance

Conduct functional testing to ensure all features work correctly. Performance testing is crucial to check app stability under load, especially during peak usage times. Security testing protects against vulnerabilities, ensuring user data remains safe. Implement automated testing to streamline the process and use real-world scenarios to test app performance.

Step 9: Launching the App

Implement soft launch strategies by beta testing with a limited audience. This allows you to gather valuable feedback before a full-scale deployment. Once ready, release your app on major app stores to reach a wider audience. Monitor user feedback closely during the beta phase and prepare marketing strategies to create buzz around the launch.

- Ready to launch your app in the UAE?

- Count on TekRevol’s proven track record in developing top-performing apps for the UAE market.

Step 10: Post-launch Support and Maintenance

Plan for regular updates to improve features and fix bugs. Establish user support channels to provide assistance and gather ongoing feedback. This commitment to user satisfaction will help retain customers and encourage growth. Schedule regular updates to introduce new features and maintain active communication channels for support.

Wonder What Software Will Dictate Our Future? Read More on: 18 Types of Software Development that Will Dominate 2025 and Beyond

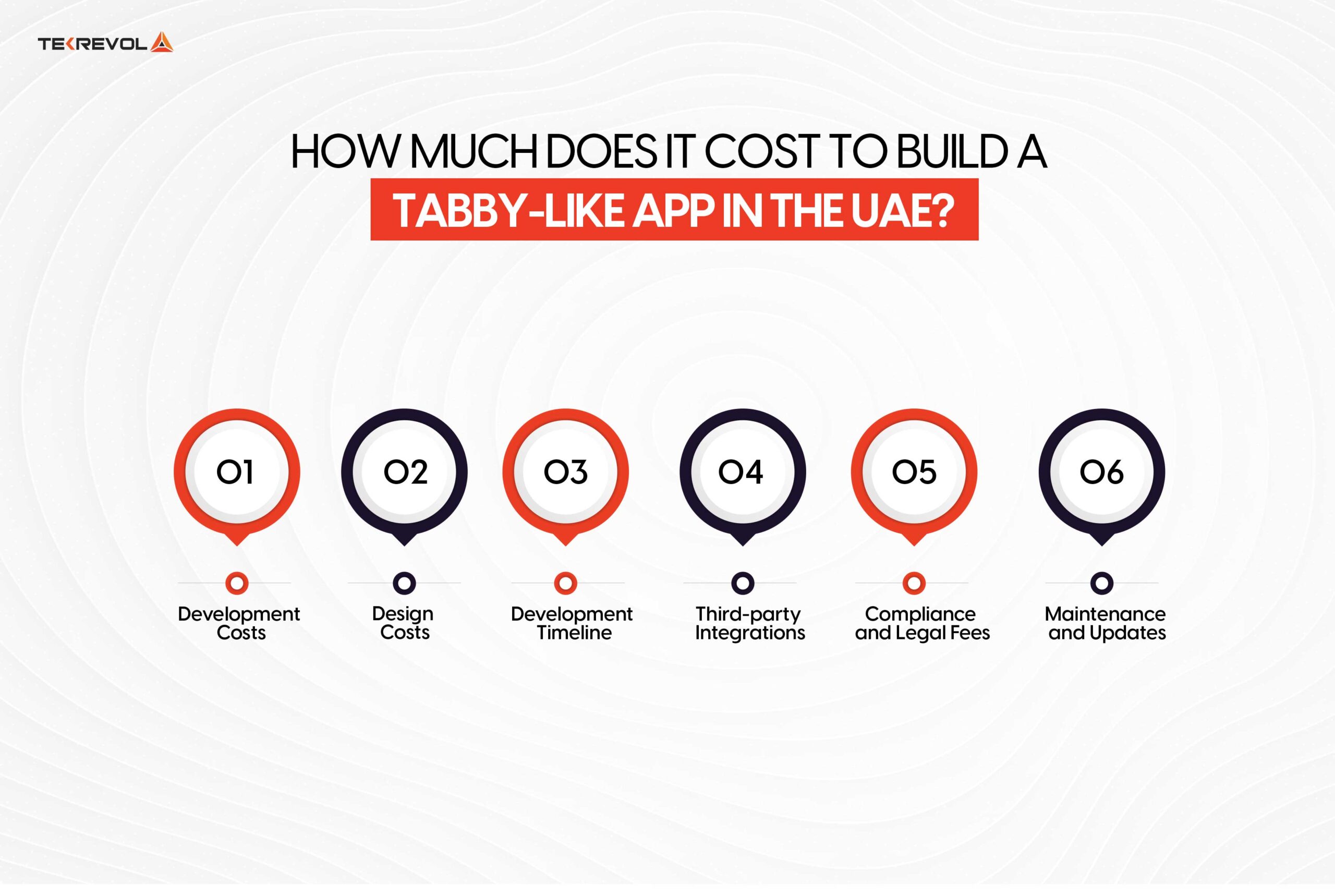

How Much Does It Cost to Build a Tabby-Like App in the UAE?

We have learned by now what is Tabby, how to use Tabby and how does Tabby make money. It is time to go directly to the business of knowing how much does it cost. A good reliable mobile app development company in Dubai can give a huge difference in quality and budget, yet knowing the cost influence factors of developments is important.

Development Costs

The frontend and backend are the foundation of an app and can take around 400-800 hours of development work, which depends upon the complexity. In the UAE, that would place the average at AED 220 to AED 240 an hour, thus making necessary development worth somewhere in the area of AED 88,000-AED 192,000.

Feature complexity is a significant factor in total costs. Advanced functionalities, such as real-time analytics, personalized recommendations, and automated payment reminders, increase development time and can add AED 37,000 to AED 110,000 to the budget based on feature choice.

Design Costs

The designers put much time into the users’ experiences to ensure they are satisfied. A good and well-thought-out user interface makes the user experience smoother and interesting; usually, it lies between AED 18,500 and AED 55,000.

Other branding elements, such as logos, icons, and visual assets, are equally important in establishing a recognizable identity. These design elements usually fall between AED 7,500 and AED 30,000, depending on the complexity and scope.

Development Timeline

The cost is highly influenced by the development timeline. The additional resources needed in an expedited timeline may add costs of 20% to 30%. The standard timelines for development range from 4 to 9 months, depending on the complexity of the app.

Third-party Integrations

All of this must be safeguarded using payment gateways. Depending on the supplier, these services come with the cost of integration and transactional fees. So, this kind of cost must be in the budget by allocating about AED 11,000 to AED 37,000.

APIs and services that enhance app functionality, such as geolocation or user analytics, add to the total cost. Expect API integration costs to range from AED 7,500 to AED 18,500, depending on the features required.

Compliance and Legal Fees

Licensing is essential for financial services in the UAE, with government fees typically ranging from AED 18,500 to AED 55,000. Securing the necessary licenses ensures compliance and builds trust with users.

Legal consultation is crucial for drafting terms and privacy policies. Expect to allocate AED 7,500 to AED 18,500 for legal services to meet UAE regulations and establish clear user agreements.

Marketing and Promotion

Pre-launch campaigns create awareness before the app’s release. These efforts, including social media ads and influencer partnerships, generally cost around AED 11,000 to AED 37,000.

Ongoing marketing helps attract new users and retain existing ones. Setting aside AED 3,700 to AED 18,500 per month for sustained advertising is recommended to support growth.

Maintenance and Updates

Technical support will address customer complaints and allow the app to maintain operational readiness. A monthly technical support expense falls between AED 3,700 and AED 11,000.

Feature enhancements keep the app relevant in a competitive market. Regular updates may cost between AED 18,500 and AED 55,000 annually, depending on the scope of improvements.

Total Estimated Cost Range

| Type of App | Estimated Cost Range |

| Basic MVP | AED 147,000 – AED 220,000 |

| Full-featured App | AED 330,000 – AED 1,100,000 |

Based on the Complexity Level

| Complexity Level | Estimated Cost | Development Time |

| Basic | AED 147,000 – AED 220,000 | 2-3 months |

| Intermediate | AED 220,000 – AED 330,000 | 3-6 months |

| Advanced | AED 330,000 – AED 1,100,000 | 9+ months |

Development Teams

The team size and expertise impact project costs. Local developers may charge more but provide a better understanding of the UAE market. Outsourced teams may be cost-effective, though they may need more communication.

Hourly Rates in Different Regions

| Region | Hourly Rate (in AED) |

| US | AED 350-370 |

| UAE | AED 220-240 |

| Western Europe | AED 295-330 |

| Eastern Europe | AED 295-330 |

| Australia | AED 260-330 |

| Asia | AED 90-150 |

Understanding these factors will help you budget effectively for building a Tabby-like app in the UAE, enabling you to plan each stage and control expenses for a successful launch.

- Wonder how much would your Tabby-like app cost?

- Get a free cost estimate from TekRevol’s fintech experts and make informed decisions.

Strategies for Success in the Competitive UAE BNPL Market

The BNPL market is rapidly growing in the UAE, with the sector expected to be over $4.41 billion by 2029. Competition is stiff as numerous new providers are entering the BNPL scene. You have only one chance, so let’s look through some tried and tested strategies that can help your BNPL app grow.

Partner with Banks and Financial Institutions

Aligning with a trusted bank or financial institution is a powerful way to build immediate credibility. Banks offer established trust, which can give your app a leg up, especially in the UAE, where brand reputation matters.

Plus, these partnerships can provide financial support that helps with scaling your app. Tabby’s partnerships with local financial entities add an extra layer of reliability, making it easier to attract new users who trust established brands.

Extend to Other Industries

Although the concept of BNPL initially emanated from the retail industry, travel, healthcare, and education are close on their heels with this opportunity. Expansion to other industries will allow your app to further explore fulfilling the need for flexible payment options in high-value purchases, such as medical treatments or educational courses.

Tabby’s focus on retail works well, but there’s room for a BNPL app that provides tailored solutions across sectors. Offering a BNPL option in healthcare, for example, can appeal to users looking for ways to manage healthcare costs affordably.

Implementing Credit Checks

Implementing credit checks is crucial to managing risk. Using reliable data to assess users’ payment histories and creditworthiness helps ensure that your BNPL model is sustainable. By balancing easy access to credit with responsible lending, you can offer flexibility to trusted users while minimizing potential losses.

For example, many successful BNPL apps use credit data to limit loan amounts for new users and expand limits for reliable users, promoting both accessibility and security.

Building Trust with Users

Trust is everything in a finance app. Clear, transparent policies for users’ responsibilities and fast, dependable customer support all contribute to the customer experience. More often than not, users tend to remain with the app if they are treated well and questions and concerns are readily addressed.

As an example, Tabby establishes trust by having clear terms and customer-friendly policies. The best way to build that kind of trust is by ensuring the terms of the application are very clear to its users. Thus, you boost your brand’s reliability while keeping a long-term hold on the users.

Marketing and Branding Strategies

In order to gain a competitive edge in the UAE, branding and marketing must show relevance to local culture. Change your messaging to best align with the values and preferences of UAE users.

Influence marketing also works well targeting localized usage by showing the world that influencers can make your app relatable in order to introduce it to their followers.

Several BNPL companies in the UAE have tapped into influencer partnerships in order to increase awareness and make their offerings more accessible and trusted.

Continuous Innovation

The market of BNPL continues to change rapidly and, thus, demands the latest innovation to meet user needs. That is easily done by updating features from time to time based on user feedback. Introduce more new features, such as payment schedules or loyalty programs, to keep users continually attracted to you.

Part of the reason why Tabby has been successful is due to the regular feature updates, which shows that it listens to user needs. You can keep your users and grow your app reputation in the competitive UAE market by doing the same.

These strategies provide a solid roadmap to establishing your BNPL app as a trusted choice in the UAE, creating a strong foundation for growth in this fast-growing sector.

Fan of Video Chat Apps Like Omegle? Read More On: 13 Apps Like Omegle That You Should Checkout In 2025

How TekRevol Can Help You Launch the Next Big BNPL App in UAE

At TekRevol, we believe in turning visionary ideas into life with innovative app design & development; we are well-equipped to enable you to launch a BNPL app in the UAE. An award-winning Dubai mobile app development company with years of experience, having developed strong, secure, user-friendly applications that uniquely focus on client needs, is what TekRevol represents today.

Our team is well aware of the UAE market, has knowledge of local regulations, and understands consumer behavior and trends that are critical for a successful BNPL solution.

We have delivered over 500 projects around the globe, including financial apps, and have received recognition for excellence by winning awards like Clutch Top B2B Company 2021 and Best App Development Company UAE 2022.

With an end-to-end process, we will be with you from the first brainstorming session until the last launch and subsequent maintenance, making sure your BNPL app performs at its best and brings in results.

Ready to bring your BNPL app to life? Contact TekRevol today for a free consultation and discover how we can help turn your vision into the next big thing in the UAE’s fintech market. Visit tekrevol.com or reach out to us at info@tekrevol.com to get started on creating a BNPL app that stands out.

- Looking for a top app development partner?

- Work with TekRevol’s experienced team to design, develop, and launch your app with confidence.

1195 Views

1195 Views December 18, 2024

December 18, 2024