Imagine it’s 2030, and your investment portfolio adjusts automatically as market winds shift. And that loan application? A chatbot, not a cracky branch manager, approves it in minutes.

Is this Science fiction? Not at all. This is the reality that Generative AI is cooking up for financial services, and SPOILER ALERT: it’s starting now!

While “AI” is flung around like free candy at a fintech conference, Generative AI isn’t just hype – it’s the technology we have all been waiting for ages to come.

Generative AI in financial services is all about winning hearts with personalized customer experiences, fraud detection that outwits even the smartest scammers, and many more!

But here’s the catch: Only experts with clear strategies can harness the full potential of Generative AI. Saying that we have curated an exquisite guide for you that comes with everything you want to know about Generative AI in financial services!

So, without any further ado, let’s begin!

What Is Generative AI, And Why Does It Matter In Financial Services?

The AI Generative is the Leonardo da Vinci of the AI world- it doesn’t only analyze, but creates things you can’t even imagine!

Generative AI in financial services is like having an artist who can develop financial plans, the sweetest chatbots, or even fraud detection tools that operate faster than your espresso machine in the morning.

Traditional AI is all about pattern recognition and prediction, whereas generative AI generates entirely new content – reports, customer communications, or even simulated datasets.

Generative AI 101 – Breaking Down the Basics

Generative AI is powered by advanced machine learning models, such as GPT (Generative Pre-trained Transformer) or GANs (Generative Adversarial Networks). These models learn patterns in existing data to create human-like text, images, or other types of content.

It’s like having a super-intelligent intern who can read every financial report ever written and can draft a perfect version for you in seconds.

But why does Generative AI Matter In Financial Services? Financial services are drowning in data, and generative AI brings this ocean of information alive and transforms it into actionable insights. Didn’t get our point? Well, you will in the thread ahead!

Why Generative AI is Super Perfect for Financial Services?

The financial industry thrives on efficiency, precision, and customer trust. Here is where AI Development Services comes in handy to be your superhero in a tailored suit:

- Speed and Accuracy – AI can draft customer communications, summarize reports, and even simulate market scenarios—tasks that used to take hours are now done in minutes.

- Personalization – Generative AI can tailor financial advice to individual customers, making them feel like VIPs. Who doesn’t want a financial strategy as personalized as their coffee order?

- Data Utilization – It analyzes historical and real-time data, turning it into forecasts, personalized offers, or fraud alerts.

- Ready To Turn Your AI Plans Into Results?

- From customer personalization to operational efficiency, we build AI strategies that work for financial services.

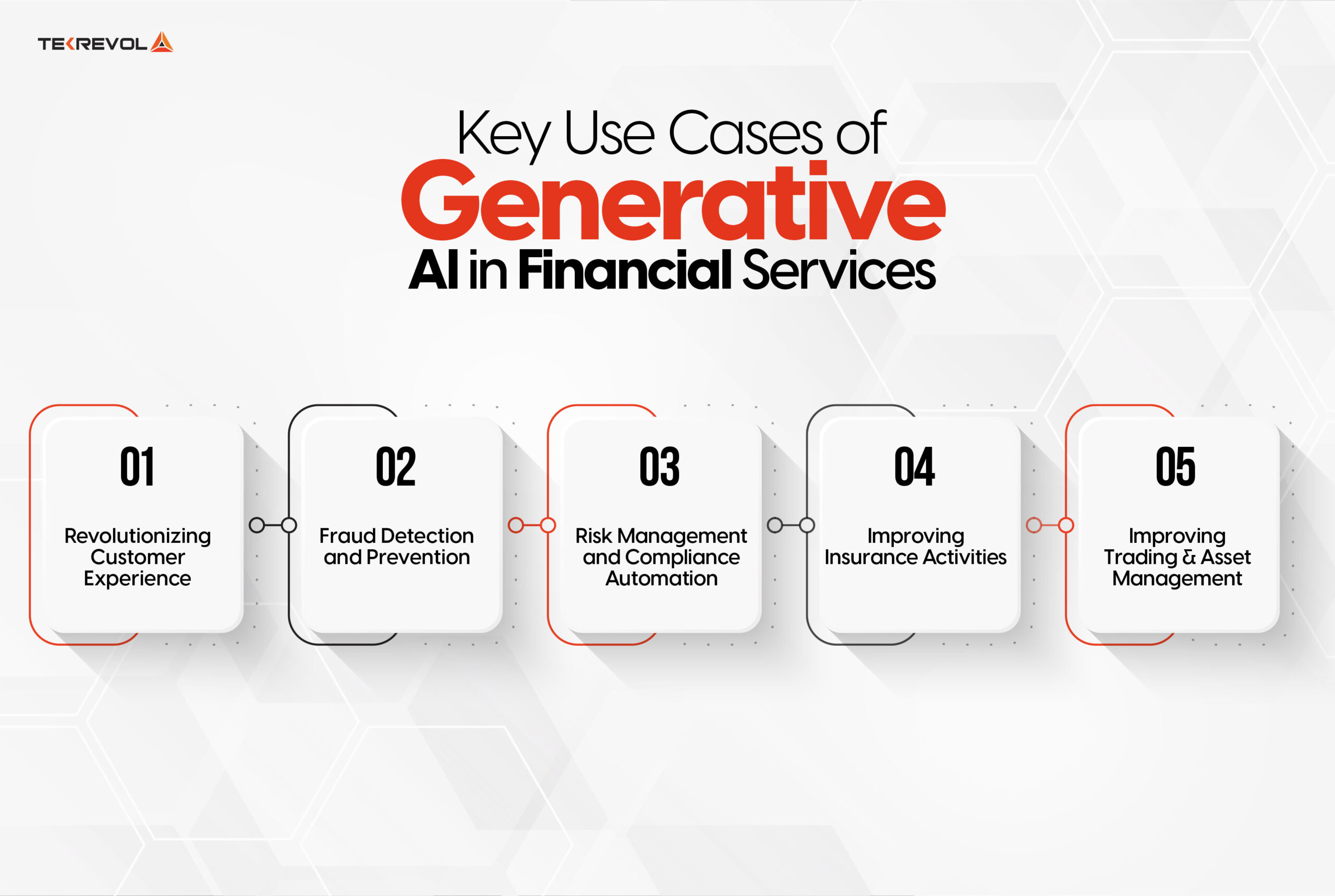

Key Use Cases Of Generative AI In Financial Services

Generative AI in financial services isn’t about the flashy tech – it’s about reshaping how institutions operate, serve customers, and stay competitive.

From automating compliance tasks to crafting personalized customer experiences, Generative AI Solutions are powering transformative changes across the industry.

Let’s explore the key use cases in detail below:

1. Revolutionizing Customer Experience

Generative AI is like having your financial advisor, chatbot, and data analyst in one. It provides hyper-personalized experiences that keep the customers engaged.

- Personalized recommendations – AI analyzes customer behavior to recommend savings plans, investment portfolios, or credit card offers tailored to individual needs.

- Virtual assistants – You can imagine it as Siri, but for banking. They solve your overdraft mysteries and remind you about bill payments.

- Dynamic Sentiment Analysis: Generative AI uses natural language processing (NLP) to analyze customer feedback, ensuring you’re happy about your bank’s services.

2. Fraud Detection and Prevention

The real benefits of Generative AI for the financial industry are most apparent in fraud detection. It identifies patterns in real time, making life hard for fraudsters.

- Transaction Monitoring: By analyzing billions of transactions, AI can detect anomalies faster than traditional systems.

- Synthetic Data Creation: Generative AI creates synthetic data to stress-test fraud detection models, making them more resilient to changing threats.

3. Risk Management and Compliance Automation

With Generative AI, Compliance teams don’t have to live in the Excel world anymore. It optimizes regulatory workflows and decreases error rates.

- Document Summarization: AI summarizes long regulatory requirements that can save hours of labor done manually.

- Risk Scenario Simulations: Generative AI models simulate market scenarios and help financial institutions stress-test portfolios with excellent precision.

4. Improving Insurance Activities

From underwriting to claims settlement, AI applications in banking and finance seamlessly extend to insurance.

- Claims Settlement: Generative AI accelerates the settlement of claims by analyzing historical data and auto-recommending.

- Fraud Detection: AI detects suspicious claims instantly, reducing losses for insurers.

5. Improving Trading and Asset Management

Generative AI is changing portfolio management and trading strategies by analyzing large datasets in real time.

- Market Sentiment Analysis: Generative AI predicts market movements by scanning social media, news, and historical trends.

- Portfolio Optimization: Through AI-driven financial solutions, AI builds dynamic portfolios according to client preference and risk appetite.

Use Cases at a Glance

Here’s a handy table summarizing how generative AI is transforming financial services:

| Use Case | Application | Generative AI Benefits |

|---|---|---|

| Customer Experience | Virtual assistants, personalized financial advice | Enhanced customer satisfaction and retention |

| Fraud Detection | Real-time anomaly detection, synthetic data for stress testing | Reduced fraudulent transactions and improved security |

| Compliance Automation | Automated audits, document summarization | Saved time, reduced compliance errors |

| Insurance Operations | Faster claims processing, fraud identification | Lower costs, improved customer trust |

| Trading and Asset Management | Market sentiment analysis, portfolio optimization | Better investment strategies, higher returns |

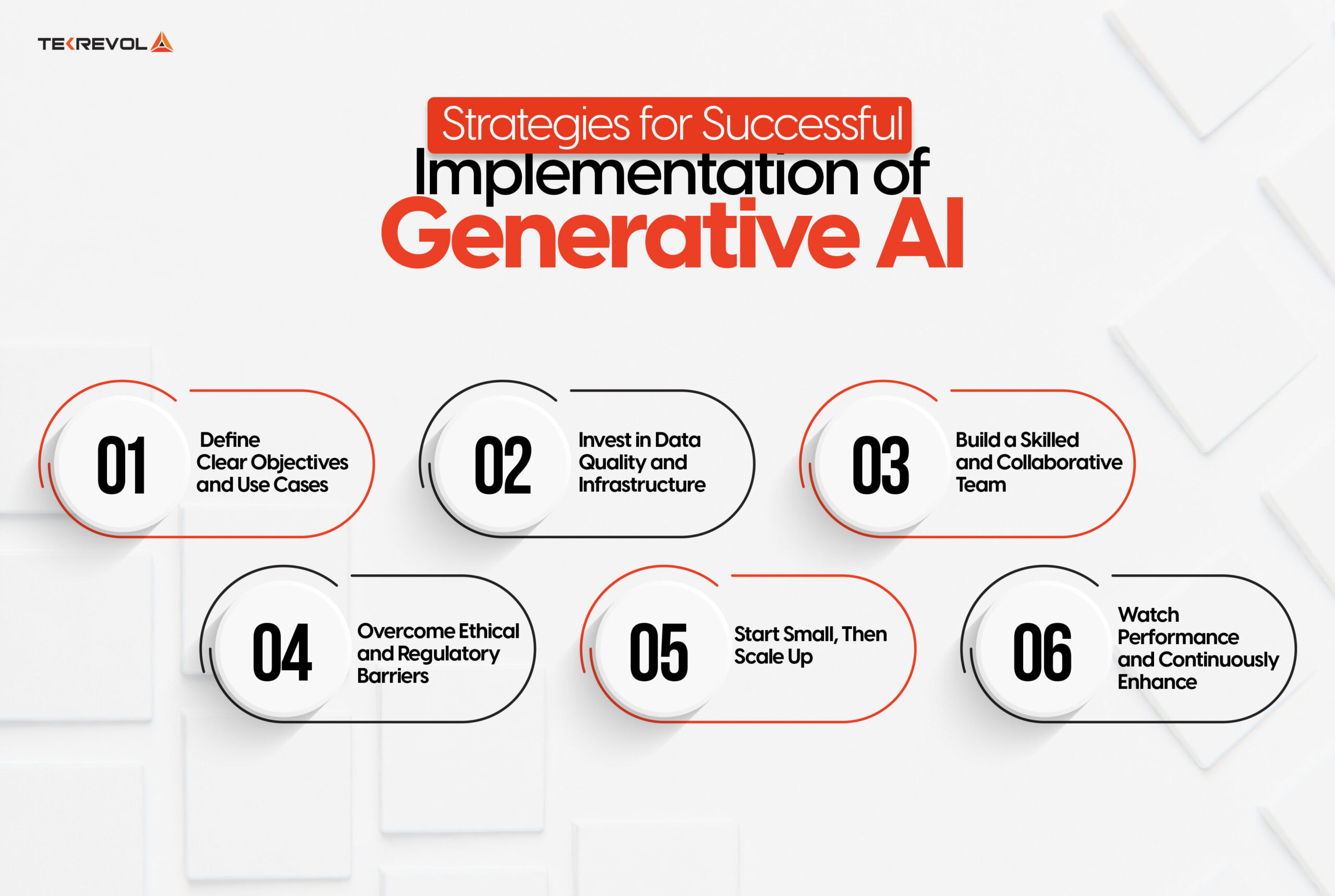

Strategies For Successful Implementation Of Generative AI

Applying generative AI to the world of financial services might feel like trying to land an aircraft during a thunderstorm – high stakes, high complexity, and huge margins for error.

But if only it’s executed well, Generative AI can transform how financial institutions used to work, innovate, and create value.

The benefits of generative AI are mind-boggling, but still, generative AI is not a magic wand. Clear planning, strong governance, and a tech-savvy team are all needed for successful deployment.

Let’s break down the key strategies for deploying generative AI in finance.

1. Define Clear Objectives and Use Cases

Jumping into generative AI without clear goals is like building a house without blueprints – you’ll be wasting your money only. Start by identifying where generative AI can add the most value to your organization.

- Identify Pain Points: Is customer service your strongest part? Are manual compliance tasks eating up your team’s productivity? Generative AI-powered financial solutions can automate these areas.

- What’s really important? Focus on applications that provide measurable returns, such as fraud detection, portfolio optimization, and personalized marketing strategies.

- Align to SMART goals: Ensure goals are specific, measurable, achievable, relevant, and time-bound. Obviously, if you’re thinking of “Cut loan processing by 30 percent in just a month through the implementation of generative AI,” – this is not going to happen!

2. Invest in Data Quality and Infrastructure

Let’s be honest – generative AI is only as good as the data it’s trained on. Poor quality, incomplete, or biased data will result in lousy outputs, which is exactly what a financial institution does not need.

Banks like JP Morgan have successfully implemented AI in financial operations by modernizing legacy systems and adopting cloud platforms for real-time data analysis.

Here’s how you can be the next JP Morgan:

- Clean and Organize Data: Financial data exists in silos or traditional CRM systems, transaction records, and risk management tools. Centralize this data and ensure its accuracy before feeding it into AI systems.

- Upgrade Infrastructure: Generative AI models require robust computational power. Cloud-based solutions are ideal for scaling and operationalizing generative AI.

- Ensure Real-Time Access: AI applications in banking and finance thrive on real-time data analysis, especially for fraud detection and risk management.

3. Build a Skilled and Collaborative Team

The role of generative AI in banking and financial management goes beyond algorithms, as you need people to make it work. Just like in any other industry, Without a skilled and collaborative team, no talent, even the most advanced AI tools, will be unused.

- Upskill Your Workforce: Educate employees about the concepts and tools of generative AI and their place in AI-powered workflows. Provide training on deploying AI models, prompt engineering, and ethical AI use.

- Bring on specialists: Hire data scientists, machine learning engineers, and AI ethicists to lead the implementation.

- Make cross-functional collaboration the norm: Generative AI is not an “IT department” project. Make sure to collaborate with the operation, compliance, marketing, and risk management teams to align business goals.

4. Overcome Ethical and Regulatory Barriers

AI in financial services is practiced in one of the most heavily regulated sectors, which means that issues related to compliance and ethics cannot be compromised.

- Transparency: Design AI systems that can explain the decisions being made. In the case of rejection, explain why the loan is being rejected.

- Bias Monitoring: Generative AI can sometimes unknowingly perpetuate bias in financial decision-making. Audit models regularly to catch and address biases.

- Stay Ahead of Regulations: Financial regulations like GDPR, Dodd-Frank, and Basel III must be factored into your AI strategy. Engage legal and compliance teams early to ensure smooth adoption.

- Real-World Example: Banks using generative AI for credit scoring must ensure that their models comply with anti-discrimination laws while maintaining transparency with customers.

5. Start Small, Then Scale Up

One of the most effective ways to deploy generative AI in finance is to begin with small, controlled pilot projects. Many banks started by installing AI-powered chatbots in their customer support services as the entry point for deploying generative AI.

You can do the same. However, once you get a hold of it, try pushing your existing Generative AI model to do more complex tasks like document processing and credit scoring.

- Test and Iterate: Launch AI models in a single department, such as fraud detection or customer support. Measure their performance, gather feedback, and refine the system.

- Scale Gradually: Once the pilot delivers results, scale the solution across other areas, such as loan underwriting or claims processing.

6. Watch Performance and Continuously Enhance

Generative AI isn’t a “set it up and forget it” machine. It needs continuous tracking and optimization to ensure consistent results.

- Monitor ROI: By tracking the most important KPIs, such as time saved, fraud prevention rates, and improvements in customer satisfaction.

- Gather Feedback: Teams and customers should be encouraged to give feedback regarding AI-powered financial solutions. Apply the feedback to refine the models of AI.

- Remain Agile: The finance world is changing fast, just like AI capabilities. The models should be frequently updated to reflect new regulations, changing market trends, and other customer needs.

- Stop Dreaming, Start Deploying AI Today!

- Witness how Tekrevol’s tailored AI solutions can help you unlock next-level growth.

Overcoming Barriers to AI Adoption

While generative AI in financial services is transforming operations, decision-making, and customer experiences, it does not come without its challenges.

Think of AI adoption like playing chess-it’s exciting at first, but one wrong move can leave you staring at your horses and a checkmate. For financial institutions, the barriers to AI adoption range from outdated technology to talent shortages, all wrapped in a regulatory minefield.

But here’s the good news – these are all solvable challenges. Let’s look at the major pain points and actionable strategies for overcoming them.

1. Ancient Infrastructure and Legacy Systems

Legacy systems are the pain point for most financials. Those outdated, monolithic platforms weren’t created to support AI-powered finance solutions.

The Problem:

- Inherently, legacy systems are slow, siloed, and expensive, making it challenging to operationalize AI effectively.

The Solution:

- Adopt Cloud-Based Infrastructure: These cloud-based platforms will offer the flexibility and scale in computational power that generative AI models require.

- Hybrid Integration: Gradual integration with AI capabilities through existing systems instead of fully replacing systems to minimize the disruption factor.

2. The Talent Shortage

Generative AI isn’t actually about the technology – but it is about the people who manage and employ it. Sadly, there is a huge gap between the demand for AI expertise and the talent pool available.

The Problem:

- It’s really difficult to get Data scientists, AI engineers, and AI ethicists for most financial institutions.

The solution:

- Upskilling Current Employees: Provide AI-centric training to the existing teams to educate them on generative AI and its benefits.

- Partner with AI Experts: Partner with AI service providers who bring in the required expertise.

- Attract New Talent: Create a culture that welcomes innovation and offers competitive incentives to attract AI professionals.

3. Data Privacy and Security Concerns

Highly sensitive data are involved in financial activities, and thus, privacy and security are top priorities. Reliance on Generative AI on huge amounts of datasets puts one at risk of a data breach or misuse.

The Problem:

- Non-observance of data leads to fines, reputational damage, and loss of customer trust.

The Solution:

- Implement Strong Encryption Protocols: Store and process the data with secure cloud solutions.

- A Compliance-First Approach: Ensure that AI models comply with any regulations, such as GDPR, CCPA, or Basel III.

- Continuous Monitoring: Regularly audit AI systems for vulnerabilities and ensure strong governance.

Pro Tip: Financial institutions that prioritize data privacy and security during AI implementation see higher customer confidence and smoother regulatory approvals.

4. Navigating Complex Regulations

The role of generative AI in banking and financial management has outpaced regulatory frameworks, leaving institutions to navigate uncertain compliance waters.

The Problem:

- Regulations often lag behind technological innovation, creating gray areas for AI deployment.

The Solution:

- Be ahead of Regulations by collaborating with the compliance teams to interpret the existing frameworks and prepare for the new AI-specific laws.

- Promote transparency by embracing Adopt Explainable AI (XAI) that can explain their decision-making processes.

Do You Know? Almost 68% of financial executives rate regulatory compliance as the most significant barrier to adopting AI.

Now that you know, a proactive compliance strategy can help eradicate this risk. Here’s a table that summarizes everything – so you don’t have to take notes yourself; it sounds like Generative AI speaking, right?

| Barrier | Challenges | Solutions |

|---|---|---|

| Outdated Infrastructure | Legacy systems are slow and incompatible. | Adopt cloud platforms hybrid integrations. |

| Talent Shortage | Lack of AI-skilled employees. | Upskill teams, attract new talent, partner with AI experts |

| Data Privacy and Security | Sensitive data raises privacy concerns. | Robust encryption, compliance-first approach. |

| Regulatory Uncertainty | AI innovation outpaces regulations. | Work with compliance teams and use explainable AI. |

- Need Help With Generative AI?

- Let Tekrevol handle the heavy lifting while you focus on growing your business.

Measuring ROI On Generative AI Investments

Using generative AI in financial services might feel like a leap of faith—exciting yet terrifying. However, faith does not impress stakeholders; results do. Knowing ROI is a requirement for determining whether your AI initiatives are truly moving the needle or only generating buzz.

Here’s how to properly measure ROI and know whether AI in financial services implementation really delivers value.

1. Define Clear Success Metrics

Before calculating ROI, you must define “success” for your AI initiatives. Metrics should be aligned with organizational goals, such as improved efficiency, cost savings, or customer experience.

According to a recent survey, AI adoption in financial services can help increase revenue by 30% through better customer engagement and improved decision-making, and you would surely want that, right?

Key metrics to track:

- Operational Efficiency: Save time and money by adopting AI in financial operations

- Cost Savings: Reduction in manual workloads, compliance errors, and fraud losses.

- Revenue Growth: Greater cross-selling, better loan approvals, and better strategies for personalization.

- Customer Experience Metrics: Better scores on customer satisfaction, decreased response times, and enhanced loyalty.

2. Compare Costs vs Benefits

Just like any investment, computing ROI begins with determining the cost of deployment and benchmarking it against measurable benefits.

Costs to Consider:

- Infrastructure setup (cloud platforms, hardware).

- Licensing fees for AI-powered financial solutions.

- Training and hiring AI talent.

- Ongoing maintenance and upgrades.

Benefits to Measure:

- Reduced fraud losses through advanced detection

- Improved productivity through back-office task automation.

- Enhanced customer satisfaction through personalization

3. Real-Time Tracking and Feedback

AI applications in banking and finance thrive when monitored in real time. Financial institutions must continuously track performance to refine processes and maximize ROI.

- Feedback Loops: Seek input from employees and customers to improve AI outputs.

- Monitor KPIs: Continuously evaluate efficiency, cost savings, and other KPIs tied to using AI to optimize financial operations.

Do ROI Really Matter?

Understanding the ROI of generative AI isn’t just about numbers—it’s about proving its long-term value. Whether it’s operationalizing generative AI to streamline operations or improving decision-making with AI-powered financial solutions, ROI analysis ensures you’re heading in the right direction.

If you’re not measuring your ROI on your Generative AI financial investments, you must be guessing. And when it comes to strategies for AI success in finance, guesswork simply won’t cut it. So, measure, refine, and watch your investment in generative AI transform your financial services game.

How Tekrevol Can Help Leverage Generative AI In Financial Services?

Generative AI is already transforming the financial services industry. However, successful implementation depends on the right strategy, expertise, and execution. Tekrevol specializes in helping financial institutions unlock the full potential of AI to streamline operations, enhance customer experiences, and optimize workflows with innovative solutions.

Our team of AI experts combines technical expertise with a deep understanding of AI applications in banking and finance to design and implement tailored AI-powered financial solutions that deliver measurable results.

Whether you’re looking to operationalize AI for fraud detection, automate compliance tasks, or offer personalized financial products to customers, Tekrevol ensures a seamless, efficient, and scalable process!

716 Views

716 Views January 7, 2025

January 7, 2025