US$7.8 billion—that’s the amount of investment just two fintech companies in Canada bagged in the first quarter of 2024, making it among the biggest five deals globally.

This isn’t some random success story; it’s a sign of massive growth and opportunity in Canada’s fintech landscape.

According to McKinsey, Canada’s fintech scene is experiencing its “springtime”—a phase where Fintech Innovation in Canada is thriving, catching global attention, and reshaping industries. But how does this impact Mobile App Development Canada?

Fintech apps are revolutionizing the way Canadians handle money.

Whether it’s through digital wallets, AI-powered budget tools, or personalized investment platforms, these solutions are setting new benchmarks for simplicity and efficiency. This rapid progress has businesses scrambling to partner with a mobile app development company in Toronto to keep pace.

Here’s a truth: the best time to jump into Fintech App Development was years ago. The second-best time? Right now. With Canadian Fintech Startups leading the charge, this is your moment to seize the opportunity in this growing tech sector.

This blog will cover:

- The key drivers behind Canada’s fintech boom.

- How fintech trends are shaping mobile app development.

- The top fintech startups are leading the charge.

- What the future holds for fintech in Canada.

Stick around; this is your ultimate guide to understanding fintech’s influence on mobile app development in Canada.

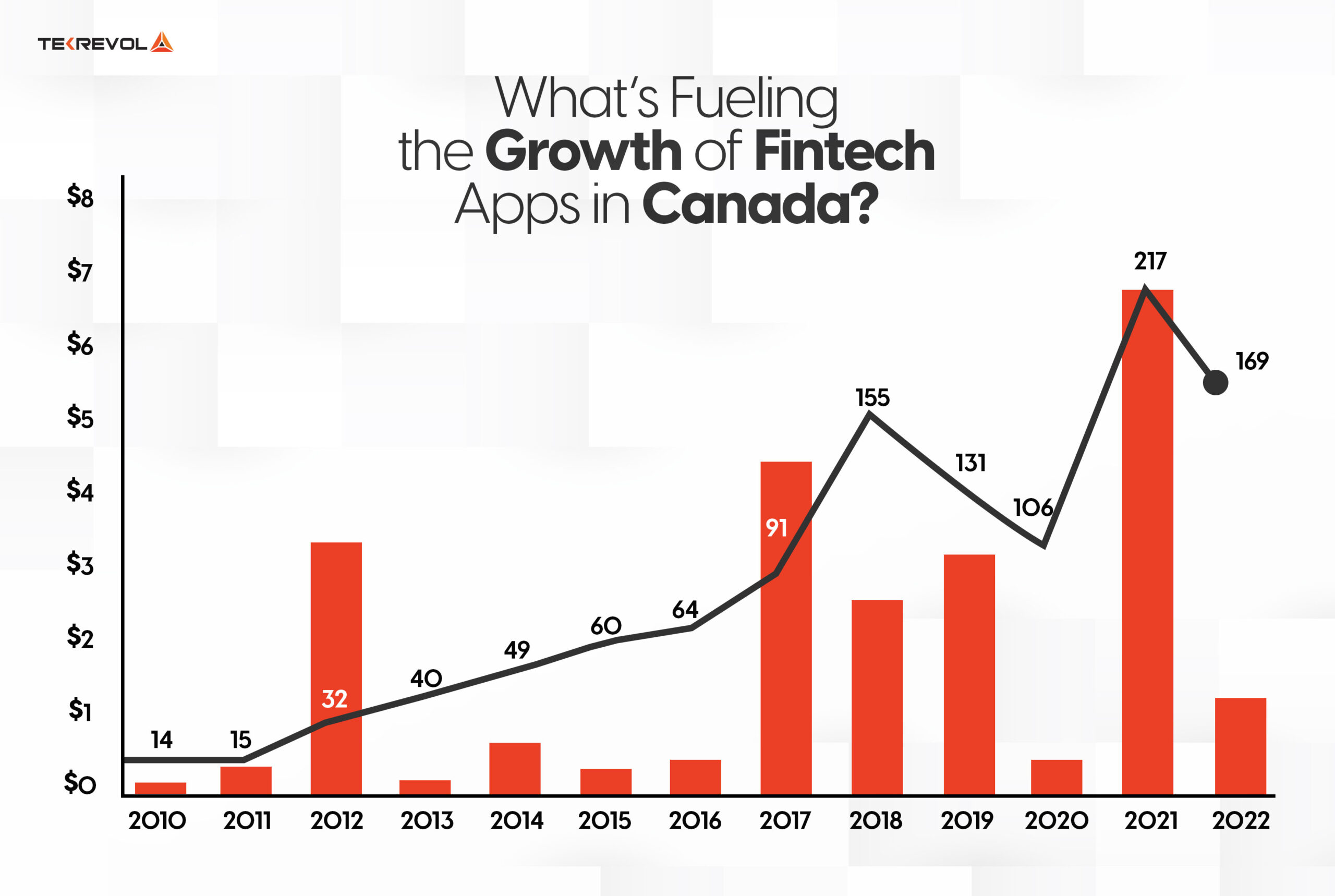

What’s Fueling the Growth of Fintech Apps in Canada?

Canadian fintech startups are leading this charge with remarkable momentum. Just in 2023, these companies secured $1.4 billion in funding, driving a meteoric rise in the industry’s compound annual growth rate (CAGR) to a robust 20%. From AI-driven payment apps to digital-first banking, the pace of evolution is breathtaking.

But what’s fueling this unstoppable growth in Fintech Trends? Here are the key forces propelling fintech to the forefront of Mobile App Development Canada.

Factors Driving Fintech Adoption in Canada

-

Increasing Smartphone Penetration

It’s hard to ignore the impact of smartphone proliferation. With over 85% of Canadians owning a smartphone, the demand for instant access to financial services has spiked. This has created a fertile ground for fintech app development, where seamless, mobile-first solutions are in constant demand.

-

Open-Minded Regulations Supporting Fintech Innovation

Canada’s regulatory framework provides a welcoming environment for Canadian Fintech Startups. Initiatives such as open banking make financial data sharing secure through APIs, inspiring innovation while bolstering consumer trust. This harmonized regulatory support ensures fintech solutions thrive under safe and transparent conditions.

-

Shifting Preferences for Digital-First Options

Canadians are no longer willing to endure cumbersome traditional banking processes. From faster payments to AI-driven budgeting tools, fintech apps deliver unmatched ease and transparency. This growing preference for digital-first solutions has fintech trends driving the creation of hyper-personalized, user-friendly applications.

-

AI-Powered Financial Solutions

At the core of Fintech Innovation Canada lies artificial intelligence, which is transforming how Canadians interact with their money. Look at what AI brings:

- Smart Personalization: Tailored advice and insights based on user habits.

- Fraud Detection: Real-time alerts for suspicious transactions.

- 24/7 Customer Support: AI-driven chatbots enhancing responsiveness.

This ongoing pursuit of smarter, faster tools is redefining mobile app development company in Toronto partnerships as businesses seek to ride the AI-powered fintech wave.

Canadian fintech is no longer just keeping up; it’s setting the standard for modern finance. From cutting-edge technology to consumer-driven innovation, the future is now—and businesses either adapt or risk falling behind.

How Fintech is Revolutionizing Mobile App Development

Fintech is shaking up more than just the banking world—it’s rewriting the rulebook for mobile app design. With rapidly growing demands for smarter features, tougher security, and hyper-personalized options, Mobile App Development in Canada has reached a new threshold of innovation to keep up.

But how exactly are Fintech Trends reshaping the way apps are developed?

1. Enhanced Security Features in Fintech Apps

Security isn’t merely an add-on; it’s the foundation of every great fintech app. With the surge in online banking and mobile payments, the need for advanced security measures has skyrocketed. Today, the best fintech app development teams weave security right into the app’s DNA.

Biometric authentication has gone beyond passwords, transforming into key security features like fingerprint and facial recognition that lock sensitive data behind strong physical proofs.

Combined with end-to-end encryption, these systems protect user data from external threats, even if breaches occur. On top of this, AI-driven fraud detection quietly monitors app activity, flagging suspicious behavior in real-time.

Canadians recognize these advancements. A recent survey revealed that 78% of users would switch to apps with superior security features, underlining an undeniable truth—secure fintech apps inspire loyalty and trust.

2. Open Banking and Its Game-Changing Role

Open banking is revolutionizing the way apps streamline users’ financial lives. By securely connecting bank accounts to third-party fintech platforms, users get access to personalized financial insights, quicker payments, and comprehensive transaction tracking—all from one digital hub.

Canada’s push toward open banking by 2025 has energized Canadian Fintech Startups to innovate. This framework will expand opportunities for app developers to craft groundbreaking solutions that merge convenience with complexity.

Why it matters: Apps tapping into open banking not only simplify financial tasks but redefine what’s possible in mobile app development in Canada.

3. The Rise of Digital Wallets and Contactless Systems

Canadians love their digital wallets—so much so that 63% use platforms like Apple Pay weekly. This has pushed Fintech Innovation Canada to focus on designing apps that support not just digital payments but also features like loyalty rewards and peer-to-peer transfers.

Effortlessness matters in a world moving toward contactless everything. When users breeze through checkouts, pay friends instantly, and manage loyalty points in-app, those apps become indispensable.

4. AI and Data Analytics for Hyper-Personalization

Need proof that AI is transforming fintech app development? Look no further than apps that analyze spending patterns, predict financial needs, and serve up advice tailored to individual users. This personalization is powered by data analytics, delivering a user experience that feels intuitive and responsive.

With 82% of Canadians stating that personalized app features increase their usage, the path forward for developers is clear—integrate smarter, tailored solutions to foster longevity in user relationships.

What’s Next for the Industry?

From blockchain to bigger investments in AI and open banking, the evolution of fintech is opening countless doors for innovation. Businesses looking to seize this moment know partnerships are key.

Partnering with a mobile app development company in Toronto allows for the perfect blend of expertise and resources to create fintech solutions that shine in this competitive market.

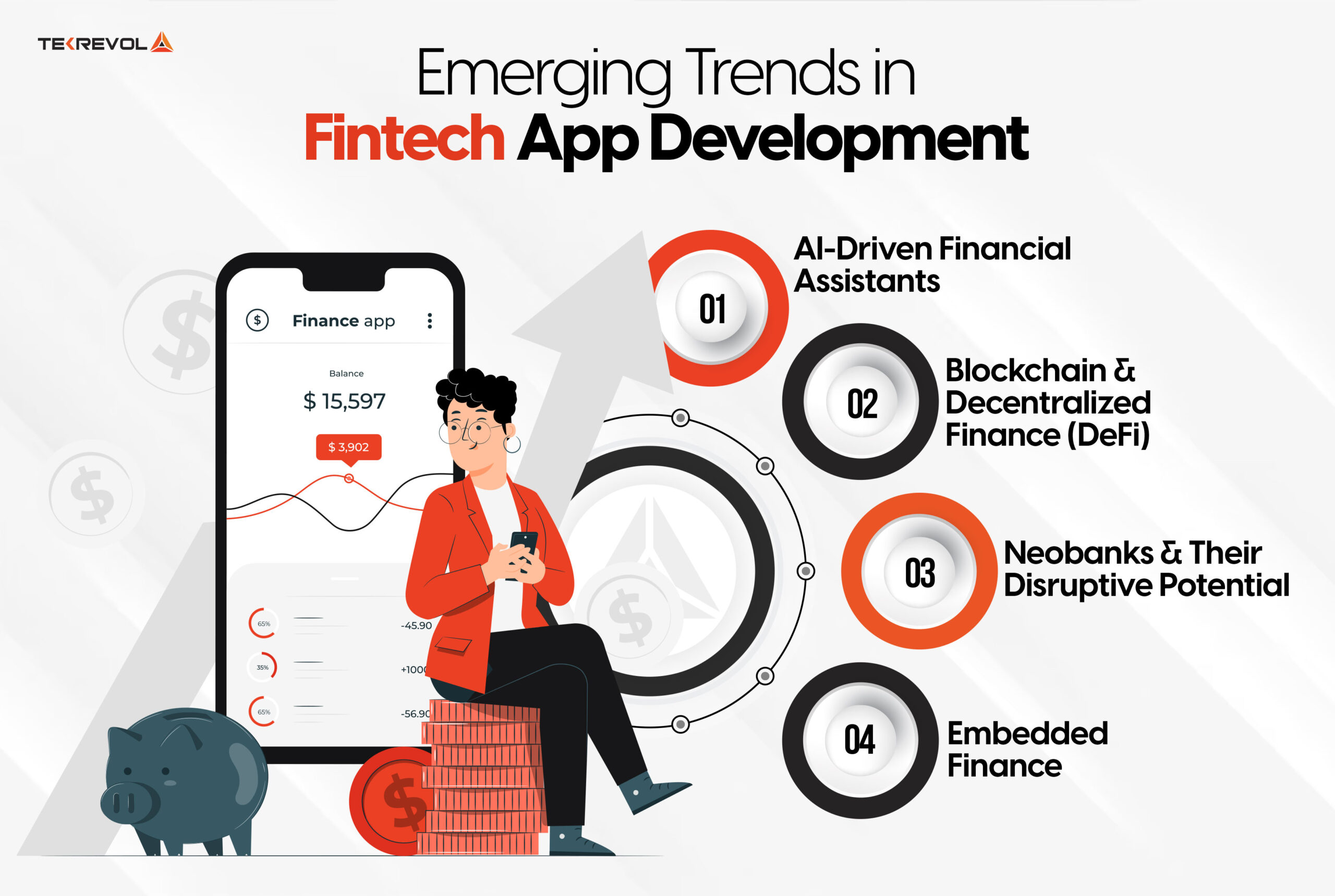

Emerging Trends in Fintech App Development

Fintech is unlocking a new wave of opportunities and reshaping the financial services landscape in Canada. By transforming traditional concepts with cutting-edge technology, Fintech Innovation Canada is taking center stage in how we approach financial solutions.

From AI-powered assistants to decentralized systems, here are the most influential fintech trends shaping the future of fintech app development in Canada.

1. AI-Driven Financial Assistants

Canadian startups like Finn AI and Wealthsimple are at the forefront of Fintech Innovation Canada, setting new standards with AI integration. Vancouver-based Finn AI delivers effortless online banking by harnessing conversational AI for seamless customer interactions.

Meanwhile, Wealthsimple employs AI tools to simplify investment management, allowing users to optimize their portfolios with minimal friction.

The numbers speak volumes. The AI fintech market is poised to grow by an impressive 25% each year, hitting $17.79 billion by 2025. These advancements aren’t just about flashy features; they reflect a deeper shift towards smarter, more intuitive fintech solutions that cater to individual user needs.

Why it matters: AI doesn’t just automate processes—it anticipates customer needs, delivering personalized experiences that redefine user satisfaction and make fintech app development more efficient than ever.

2. Blockchain and Decentralized Finance (DeFi)

Blockchain and decentralized finance (DeFi) are no longer just industry buzzwords. They’re innovative solutions influencing today’s financial systems. Blockchain technology ensures secure, transparent transactions, while DeFi offers decentralized infrastructure to replace traditional banking models.

Leading the way are Canadian Fintech Startups like Ether Capital, which focuses on blockchain investments, and Dapper Labs, famous for projects like NBA Top Shot. Together, they’re demonstrating how blockchain can serve diverse markets, from finance to digital collectibles.

Why it matters: Trust and transparency are cornerstones of finance, and blockchain solidifies these attributes. By integrating this tech, companies can deliver innovation that transforms the way users interact with financial systems.

3. Neobanks and Their Disruptive Potential

Neobanks are disrupting traditional banking with agile, user-centric models. Canadian players like Koho and Wealthsimple exemplify this shift, offering fee-free accounts, real-time analytics, and automated investment tools.

Koho’s $190 million funding milestone underscores investor confidence in its mission to democratize financial access, while Wealthsimple’s 30% annual growth reflects rising demand for intuitive, mobile-first banking.

Strategic Value for B2B: Neobanks streamline operations for businesses through APIs, enabling seamless payroll management, expense tracking, and cross-border payments—all while reducing overhead costs tied to legacy systems.

4. Embedded Finance

Embedded finance is transforming the way financial services coexist with everyday platforms. By integrating banking-like features directly into e-commerce or apps, it makes financial tools virtually invisible yet incredibly accessible.

Take Shopify, for example, a pioneer in embedding financial solutions with its Shop Pay Installments, enabling customers to split payments directly from the platform itself. With global embedded finance expected to grow by 40% annually, reaching $7 trillion by 2030, this trend is increasingly shaping Mobile App Development Canada.

Why it matters: By simplifying access to financial tools, embedded finance creates a seamless user experience that businesses and consumers crave.

What’s Next?

AI, blockchain, embedded finance, and neobanking go beyond just being fintech trends—these technologies are defining the future of finance. Success lies in adopting them early and partnering with professionals who understand their complexities.

For businesses looking to lead the charge, collaborating with a mobile app development company in Toronto ensures that solutions are not only cutting-edge but also scalable and compliant with regulations.

The opportunity to innovate in Fintech App Development is here. Are you ready to seize it?

The Key Challenges in Fintech App Development

Fintech app development presents significant opportunities for businesses, but it also demands careful navigation of complex challenges.

From evolving regulations to the delicate balance between innovation and security, here’s a concise, professional breakdown of the hurdles and actionable strategies to address them.

1. Navigating Regulatory Hurdles

Fintech operates in a tightly regulated landscape, particularly in markets like Canada. Regulations such as PIPEDA (data privacy), AML (anti-money laundering), and open banking frameworks require rigorous adherence. Non-compliance risks fines, legal action, and eroded client trust.

Solution: Collaborate with legal experts and fintech-savvy development teams. For instance, partnering with a Toronto-based mobile app development firm ensures localized knowledge of Canadian regulations. Proactive compliance integration during development minimizes risks and future-proofs your app.

2. Balancing Innovation and Security

Innovation drives differentiation. AI-driven analytics, blockchain integrations, and real-time payment solutions are now industry standards. However, these advancements expand the attack surface for cyber threats. A single breach can devastate a company’s reputation and client relationships.

Solution: Prioritize security as a core component of innovation. Implement enterprise-grade encryption, multi-factor authentication, and AI-powered fraud detection systems. Conduct regular penetration testing and adhere to frameworks like ISO 27001 to align security with user experience.

3. Building User Trust and Driving Adoption

Despite fintech’s convenience, 45% of Canadians remain wary of sharing financial data via apps. For B2B clients, trust is even more critical, as enterprise decisions hinge on reliability and data integrity.

Solution: Foster transparency through clear communication. Detail data protection protocols in straightforward terms (e.g., “bank-level encryption” vs. technical jargon). Provide whitepapers, compliance certifications, and case studies to reassure clients. Additionally, invest in user education—webinars, tutorials, and responsive support teams can demystify your app’s security measures

Ready to Lead the Future of Fintech with Mobile App Development in Canada?

Canada’s fintech landscape is brimming with potential, but staying ahead requires more than ambition. With breakthroughs in AI, blockchain, and open banking, the opportunities to innovate are immense—yet so are the challenges.

From navigating regulatory frameworks to ensuring airtight security, building a standout fintech app demands expertise, technological know-how, and a clear strategic vision. This is where the right partner makes all the difference.

TekRevol has been at the forefront of Fintech App Development, empowering businesses to push boundaries and create impactful solutions. With over 500 successful apps built for 300+ satisfied global clients, we bring unparalleled industry experience to every project.

Whether you’re envisioning a neobank, a digital wallet, or an AI-powered financial platform, our team is ready to make your vision a reality.

Why TekRevol?

- Proven expertise in mobile app development in Canada.

- Scalable, secure, and user-friendly fintech solutions.

- End-to-end development support, from concept to execution.

The best time to build your fintech app was yesterday. The second-best time is now.

Contact TekRevol today—together, we’ll shape the future of Fintech Innovation Canada.

664 Views

664 Views January 24, 2025

January 24, 2025