The adoption rate of fintech apps is truly overwhelming, especially among the Millennials and Gen Z. A report conducted by Fortune states that every 9 out of 10 people in the US use at least one fintech application regularly to manage their finances.

Seeing this unprecedented growth and adoption rate, financial institutions like banks, trading corporations, investors, and up-and-coming entrepreneurs are becoming more inclined towards investing in fintech app ventures.

From hassle-free payment apps and digital wallets to crypto trading and wealth management applications, the digital finance sector is prone to undergo significant changes in terms of security, user experience, and ease of use.

Simply put, the fintech app market is still unsaturated, and there’s room for passionate entrepreneurs to capitalize on. And if you’re one of those entrepreneurs looking to invest in building a successful fintech app business, read on!

This blog will share a comprehensive 10-step fintech app development process, covering everything from the latest trends to the cost of building a fintech app. But first, let’s understand the different types of fintech apps.

Types of Fintech Apps

The term ‘Fintech’ combines ‘finance’ and ‘technology’ and refers to financial services streamlined through technology.

Fintech apps are primarily divided into the following five categories:

Investment & Trading

Investment and trading apps include everything from crypto trading to stock exchange apps.

Top Investment & Trading Apps

- Robinhood

- Acorns

- Coinbase

Digital Wallets

Digital wallets refer to virtual wallets used for day-to-day transactions and online purchases

Top Digital Wallets

- Cash App

- Venmo

- Apple Pay

Online Banking

Online banking apps allow users to manage their bank accounts effortlessly

Top Online Banking Apps

- Wells Fargo

- Bank of America

- Chime

RegTech

RegTech fintech apps are used for compliance management and fraud prevention

Top RegTech Apps

- Quantexa

- Ascent

- Mindbridge AI

Personal Finance

Personal finance apps are used for budgeting, investing, and wealth management

Top Personal Finance Apps

- Mint

- EveryDollar

- Personal Capital

Fintech App Development – A Step-by-Step Guide

Here’s a detailed breakdown of the fintech app development process.

Narrow Down Your Niche

The first step in fintech app development is having clarity on what your app is really about and what audiences you are targeting. We have explained the types of fintech apps above to give you a brief overview of which category your fintech app idea falls in.

Narrow down your niche to clearly understand your target market and the problems your app will solve for them.

Obtain Necessary Licenses

Operating in the financial sector requires getting the necessary licenses and closely following the rules and regulations. Consult with legal authorities to get the mandatory licenses like GST registration, IP licenses, etc., for your fintech app and play by the book to avoid any legal barriers.

Once you get the go-ahead from the federal and state legal bodies, you’re all set to move toward the development process.

Define App Scope & Vision

The third step in fintech app development is to clearly define the app scope and set up the USP of your app. In this phase, you need to create checklists for the features and functionalities you want and the problems you want to solve through your app.

You can use free market survey tools like SurveyMonkey to figure out the limitations in the existing fintech ecosystem or talk to the people working in the financial sector to get better insights on the most pressing concerns.

Create a Project Roadmap

Once you have clearly defined the app scope, figured out the market you want to target, and identified the problems you want to solve, create a comprehensive project roadmap to streamline the development process.

The project roadmap will help you break down the complicated app development process into multiple stages. You can book a free consultation session with our app development team to get expert insights for your project roadmap.

Choose Technology Stack

Before moving to the hardcore development stage, you need to choose a technology stack for the design, development, and testing of the app. But first, you must figure out which platforms your target audience uses between iOS and Android, especially if you have tight budget restrictions.

Ideally, you should go for native iOS and Android app development to create both iOS and Android versions of your app so that no party would feel left out.

However, even with a tight development budget, you can go for React Native or Flutter app development and use the same code to build both versions. You can read our detailed guide to choosing the right technology stack for your app to make an informed decision regarding the tech stack.

- Having Troubles Choosing the Right Technology Stack for Your App?

- Let's get in touch with our product development team for a free consultation session and confidently choose the right technology stack for your app.

Create Wireframes & Prototypes

Wireframes work as the foundation for the app’s user interface design. After deciding on the technology stack for your fintech app, your next step should be creating wireframes and converting those wireframes into prototypes and app screens.

Adobe XD, Figma, and Webflow are the tools recommended by UI/UX designers for wireframing and prototyping. However, you can choose whatever tools you feel comfortable with. Make sure to follow the project roadmap and stick to the plan to avoid getting into unanticipated situations.

Build an MVP

MVPs are the minimum viable products that are fast, scalable, and easy to test. Instead of going for full-fledged fintech app development firsthand, build a minimum viable version to quickly test and validate your idea without going all-in.

Building an MVP for your fintech app will help you reduce risks and save resources and give you an edge in the eyes of investors and venture capitalists.

You can read our detailed MVP development guide to better understand the subject and confidently launch your fintech app’s MVP.

Gather Feedback via Beta Testing

Once the MVP of your fintech app is ready, launch it for beta testing to validate your app idea and gather customer feedback about the loopholes and limitations. Beta testing is the second testing phase after alpha testing, where instead of testing software, human beings with expertise in the same domain as yours test the app for bugs, loopholes, and limitations.

Look for communities with the most engagement, like Reddit and Quora, to gather timely and relevant feedback. You can also submit your fintech app’s MVP on beta-testing websites like Betalist, Ubertester, KillerStartups, and PreApps to gather feedback from verified quality assurance engineers and software testing professionals.

Convert Feedback into Feedforward

Not all feedback will be relevant. Therefore, you must perform a detailed audit of the feedback and suggestions before complying with the changes.

Don’t let the negative feedback impact your enthusiasm – respond to the suggestions with an open mind and fix the loopholes and mistakes before launching the app to the audience.

Create a Launch Strategy

After the design, development, and testing phases of your fintech app are completed successfully, it’s time to prepare for the launch. Regardless of how ground-breaking your fintech app is, you need to create a launch strategy to position it as such in front of the right audience.

Without a proper launch strategy, your app will have little to no chance of making it to the top charts on the application stores. So, to avoid getting crushed by the competition, enter the arena fully prepared for what is to come.

You can consider strategies like partnership marketing, influencer marketing, freebie marketing, and social media marketing to make your fintech app an instant hit and further boost engagement on your app via word-of-mouth marketing.

- Partner with TekRevol for Fintech App Development

- We help ambitious entrepreneurs build scalable and sustainable fintech app businesses

Are Fintech App Businesses Profitable?

The fintech industry, among the gaming and healthcare, is the most profitable niche to invest in 2023. A report by Adroit suggests that the fintech industry will continue the exponential growth of 20.5% CAGR and hit the $699.50 billion cap by 2030.

Thus, it should not come as a surprise that in 2022 alone, out of 519 unicorns (billion-dollar companies), 113 were fintech startups.

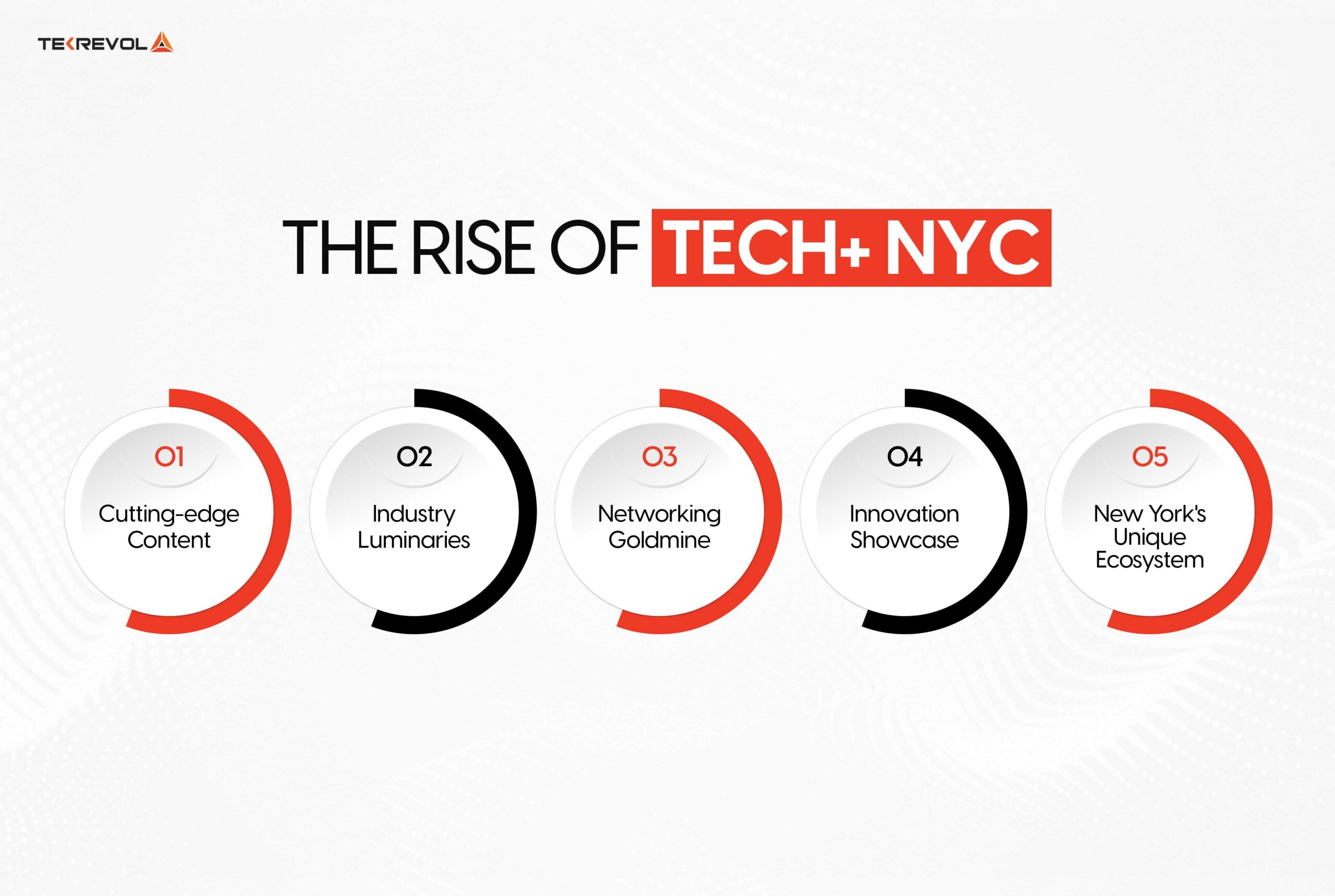

Fintech App Development Trends in 2023

Here are the top five fintech app development trends in 2023 that you should consider while starting your fintech app business.

Gamification

As people are becoming more inclined to replace traditional banking and investment with fintech apps, fintech companies are introducing interactive features to simplify their applications via gamification.

Fintech businesses are heavily investing in gamifying their user experience to retain Gen Zs and Millenials and introduce Gen X and baby boomers through ease of use and hassle-free digital banking.

Advanced Biometrics

The unprecedented growth of fintech apps has gathered the attention of hackers and online scammers. The occurrence of cyber crimes has increased dramatically. And to address this issue, fintech businesses are integrating advanced biometric features to enhance security and privacy.

Besides fingerprints, fintech companies have started integrating facial, and iris recognition features to ensure a seamless user experience and unimpregnable security layers.

Voice Command Integrations

Voice commands are becoming increasingly popular in the digital space. After the success of Siri, Alexa, and other similar AI-powered virtual assistants, fintech companies have started focusing heavily on incorporating voice command integrations.

Voice payments and banking will soon be ruling the fintech ecosystem, taking the user experience and security to an entirely new level. If you plan to start a fintech app business, voice command integration is something you can’t ignore.

Chatbot for Uninterrupted Support

Dedicated, end-to-end customer support significantly improves the user retention rate. Unfortunately, some fintech apps, mainly digital wallets, have awful customer support; users don’t even get a response from customer support for days. But with chatbot support, things will change dramatically.

After ecommerce and other consumer businesses, chatbots are making their way into fintech applications. The AI-powered chatbots will promptly analyze and answer customer queries within seconds, eradicating the need for extensive 24/7 customer support teams.

Blockchain Integration

Decentralization through blockchain is a game changer in digital finance, especially in crypto trading fintech apps. It helps increase security, secure transaction records, and protect confidential information from cybercriminals.

Besides enhancing security via decentralization, blockchain integration can help minimize payment processing time and foster a more transparent governing system. Thus, integration of blockchain technology in your fintech app business should be a must-have for you.

You can also read our blog on the top fintech apps to get a closer look at the business model of top-performing fintech apps and take inspiration for your app.

Fintech App Development Cost

Fintech app development can cost you anywhere between $40,000 – $300,000 and even more. The development cost primarily depends on the following three factors:

Scope

The cost of building a fintech app is directly proportional to its intricate features and functionalities. A simple MVP of your fintech app can cost around $40,000 – $100,000, but if you opt for advanced features like gamification, digital budgeting, and automated investing, the cost can increase up to $300,000.

Try our fintech app development cost calculator to get a free cost estimate.

Market

The development market is another critical factor that heavily influences the cost. According to Salary.com, the average hourly rate for hiring a flutter app developer in the NewYork is $46.13, while in Atlanta, the rate slightly goes down to $41.

The rates can dramatically decrease if you hire remote app developers or partner with an offshore custom software development company.

Development Time

The development time is the third crucial factor that significantly impacts the overall development cost. Shorter deadlines mean more resources, and more resources mean an increased development budget.

Most entrepreneurs prefer hiring a custom software development company instead of freelancers and remote developers. Freelance developers undoubtedly cost you slightly lower, but the quality and the deadlines are compromised in these scenarios.

Partner With TekRevol for Fintech App Development

TeRevol is a full-scale custom software development company offering full-fledged app development services in fintech, healthcare, real estate, and several other industries. We help entrepreneurs and financial corporations build scalable and sustainable fintech solutions with a state-of-the-art app development technology stack.

Our fintech software development services include building digital wallets, online banking apps, crypto trading apps, investment apps, RegTech apps, and more.

- Let's Discuss & Validate Your Fintech App Idea

- Get in touch for a free consultation with our fintech app development team for idea validation and cost estimation

3098 Views

3098 Views February 10, 2023

February 10, 2023