Struggling with urgent cash needs and looking for a quick, hassle-free loan solution?

In a rapidly evolving world, urgent cash loan apps in UAE are becoming the go-to solutions for quick access to funds. They require minimal paperwork and offer fast approvals. With a 20% increase in usage, it’s clear that these apps meet the growing need for immediate financial aid.

The Global Digital Lending Market was valued at $5.58 billion in 2019 and is expected to rise to $20.31 billion by 2027. It is clear that the trend is turning toward mobile-based lending, and if you are in the lending industry and do not understand this notion, you are seriously missing out.

Apps like Cashnow are currently very popular in the United Arab Emirates. This increasing tendency suggests that it’s time to develop an immediate loan app in UAE to satisfy consumers’ desires for loans with little to no hassle.

In this blog, we’ll break down everything you need to know about developing a successful instant loan app in the UAE.

So, let’s get started!!

- Is your loan app idea ready for development?

- Connect with our experts to start building your standout app today.

What are Cash Loan Apps?

A money lending app also known as an instant loan app is a software-based application that seeks to facilitate the lending business through a faster method. These apps let users apply for diverse forms of loans including personal loans, business loans, or peer-to-peer (P2P) loans from their mobile devices.

For borrowers, the process is seamless. They can apply for a loan, provide documents similar to a physical format, and get approved for a loan within days, all within the comfort of their homes.

For the lender parties, these applications present some benefits, as they provide an easier means of data collection, automatic interest rate computation, and improved means of portfolio management.

Loan apps are not just convenient, but a way for businesses to tap into new markets for increased income. Being both, a start-up or an established bank, an instantly approved loan app can open up a global market base for you to provide services with just a click of a button. If you do not, then you might miss great opportunities in business and give your competition the upper hand.

The lending platform market worldwide was worth almost $6 billion recently and is expected to experience an annual growth rate of 25% until 2030.

This is why it is important to partner with a proficient Mobile app development company in Dubai and adopt a mobile loan solution into the existing banking system. It is crucial to remain relevant and address the increasing need for faster and more digitalized financial services in the UAE.

- Take the first step toward creating your instant loan app in UAE!

- Our team helps you bring your vision to life with expert development support!

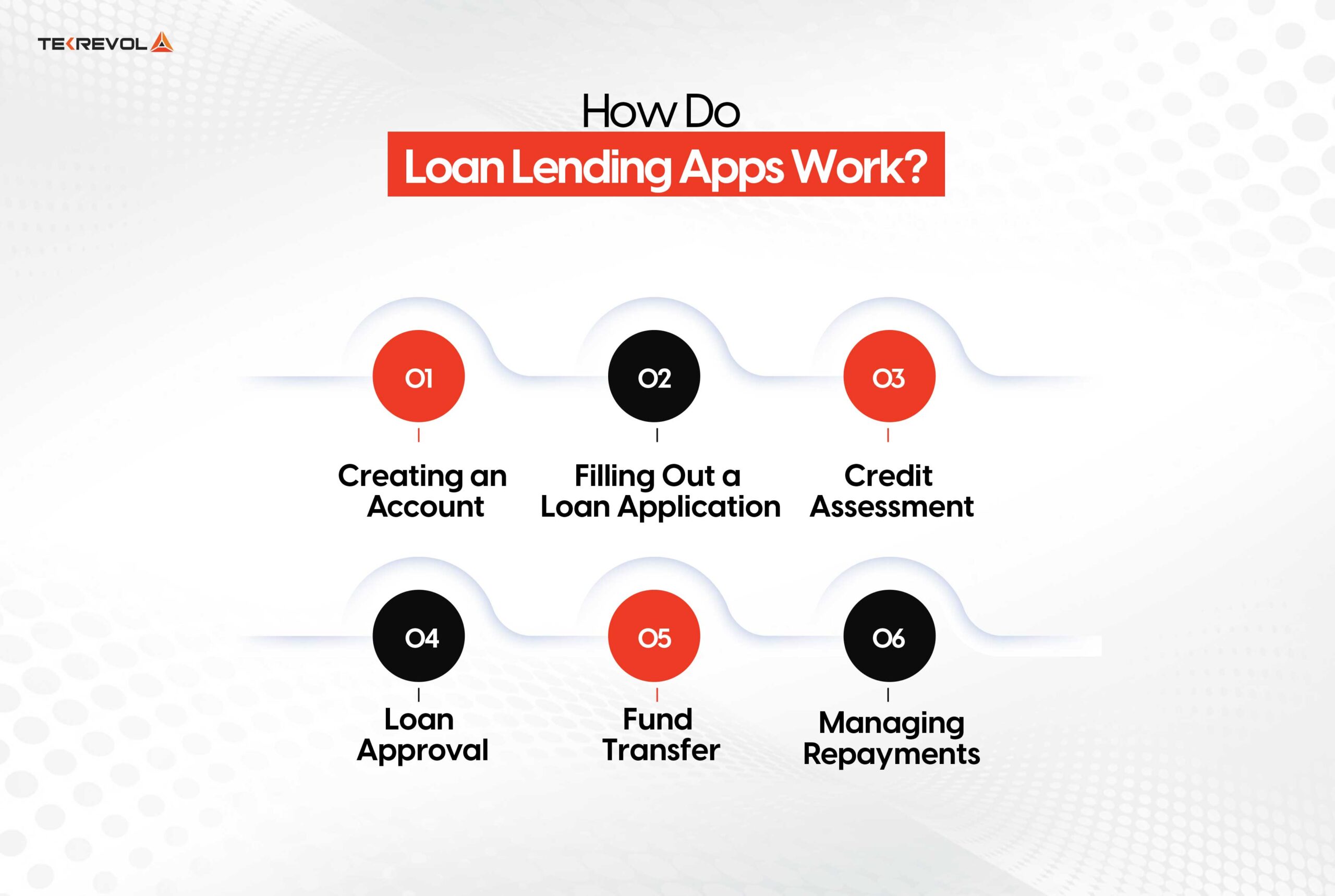

How Do Loan Lending Apps Work?

Instant loan apps enable borrowers to access loans and lenders to access borrowers through online platforms. Here are some real-life examples to demystify the process step by step.

1. Creating an Account

The process of collection starts when borrowers open their accounts. They’ll input their name, address details, their income, and any other details that may be needed for identification purposes.

Example: Consider an app similar to UAE’s Cashnow. A user starts the program and provides information, and the process of applying for a loan begins without visiting banks.

2. Filling Out a Loan Application

Borrowers then choose the kind of loan they require and invest a couple of minutes on the application form. Some apps may also request little paperwork like proof of income or recent bank statements etc.

Example: In Finbin apps, one could select between personal loans or payday loans and then, submit a couple of documents confirming income such as a salary slip or utility bill.

3. Credit Assessment

After the application is submitted, the app, with the help of algorithms and artificial intelligence, assesses the credit risk of the borrower by verifying credit rating and history. This step usually takes place in real-time or in minutes, if not within a few minutes of posting the original content.

Example: Currently we have apps like Tala which gives an instant loan decision using AI-made algorithms that analyze your capacity to repay.

4. Loan Approval

The loan is granted if the applicant meets the qualifications. Individual lenders in peer-to-peer (P2P) lending programs can also choose whether or not to support a certain loan.

Example: On a P2P platform such as Lenddo, a borrower who meets the lender’s requirements is immediately awarded a loan, and a peer-to-peer lender decides whether to convert a loan to its balance sheet.

5. Fund Transfer

After approval, the loan sum is credited directly to the borrower’s bank account or electronic wallet. This transfer could take anything from several hours to a couple of days depending on the particular platform.

Example: In the apps like Credy once a loan is approved the amount is credited within a few minutes to the user’s bank account or any linked digital wallet of the user.

6. Managing Repayments

After the funds are delivered, borrowers can use the app to make payments, create reminders, and track their payback cycle. Lenders also receive the necessary information to manage both the repayment process and their loan portfolio.

Example: In apps like Pockit, the borrowers are reminded of the upcoming payments, and they can further clear the payment on the go through the app. With the help of applications like Pockit, lenders can track their investments along with the repayment schedule of the borrowers.

How to Get Trust from Loan Users: Safety and Transparency in Loan Apps

According to the financial sector, trust is one of the major determinants of success among digital lending platforms. Users want assurance that their personal and financial information is safe, and also about loan terms being straightforward and fair. Improving security with strong encryption, secure payment gateways, and multi-factor authentication can help bring much improvement.

Moreover, loan apps need to be transparent by clearly stating interest rates, payment schedules, and any fees. Having an easy-to-use interface with instant access to terms and conditions and customer support instills confidence and promotes long-term interaction with the platform.

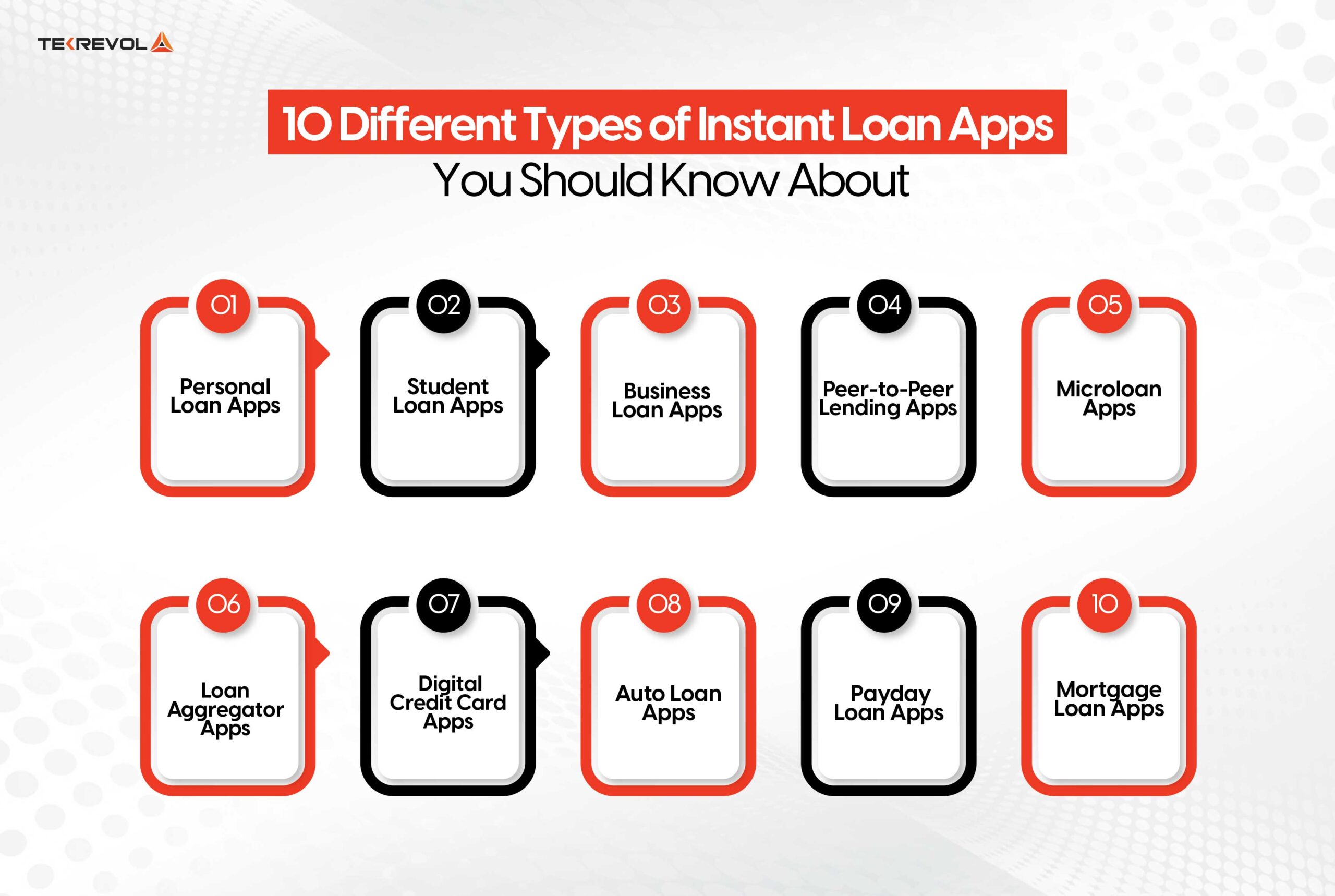

10 Different Types of Instant Loan Apps You Should Know About

As we are in the modern generation, instant loan applications have gained popularity due to the diverse services they provide. From paying bills to covering business expenditures to financing education, these apps provide instant loan options. Now, it’s time to look at the different types of loan apps and what kind of borrowing each one can suit best.

1. Personal Loan Apps

Personal loan apps are meant for people to borrow for personal reasons like home remodeling, vacation, or any exigency. These apps tend to provide quick access to funds and lenient payback terms as well, which is why people apply for them with haste.

Examples: MoneyTap, Lendingkart, Bajaj Finserv Personal Loan

2. Student Loan Apps

Student loan applications are intended for financing students’ educational needs, these comprise tuition fees, books, and other living expenses. If students need an urgent cash loan, they provide loans as quickly as possible. They typically charge relatively low interest rates and offer repayment schedules that are favorable to students.

Examples: Prodigy Finance, CommonBond

3. Business Loan Apps

Business loan applications can be helpful to small and medium-sized enterprises because they receive financing for the growth of a company or for purchasing inventory, among other things. These apps make the application process easier and provide business-related financial services.

Examples: Credorax, Kiva

4. Peer-to-Peer Lending Apps

The P2P lending apps allow borrowers to borrow directly from other individuals without input from banks and other financial institutions. The borrowers benefit from receiving loans with lower interest rates, while the lenders get an opportunity to earn higher returns on their money.

Examples: Faircent, iQuity

5. Microloan Apps

Microloan apps offer credit advances for small sums of cash to help in case of an emergency or the absence of funds for a few days or hours. These are easy to secure and they do not come with much paperwork as opposed to other types of loans.

Examples: SmartCoin, CashBean

6. Loan Aggregator Apps

Loan aggregator applications provide a marketplace where borrowers may compare loan offers from lenders, including banks and financial institutions. These apps help to find the most favorable terms, interest rates, and payment plans for a loan.

Examples: Lendingkart, PaisaBazaar

7. Digital Credit Card Apps

Digital credit card apps provide customers with virtual credit cards or credit limits for the purchase of goods and services using a smartphone or for withdrawing cash. Such apps help users to use credit without the need for a plastic card in their hand.

Examples: LazyPay, Slice, Freecharge

8. Auto Loan Apps

Auto loan applications are created to offer credit interest in vehicles solely for car purchases, which means that procuring an automobile is relatively easier. They usually work closely with car dealers to provide affordable loan products for both, new and used cars.

Examples: Emirates NBD Auto Loans, Flex

9. Payday Loan Apps

Payday loan apps grant short-term loans with repayment required on the borrower’s next paycheck. They include small quick and expensive loans designed to address urgent needs or exigent circumstances before the next paycheck.

Examples: CashNetUSA, Check ‘n Go, Payday Advance

10. Mortgage Loan Apps

Popular examples of mortgage loan apps include services that allow an individual to easily apply for a home loan or mortgage. These apps assist users in applying for loans to fund their home purchases and property investments.

Examples: Rocket Mortgage, Quicken Loans, Better.com

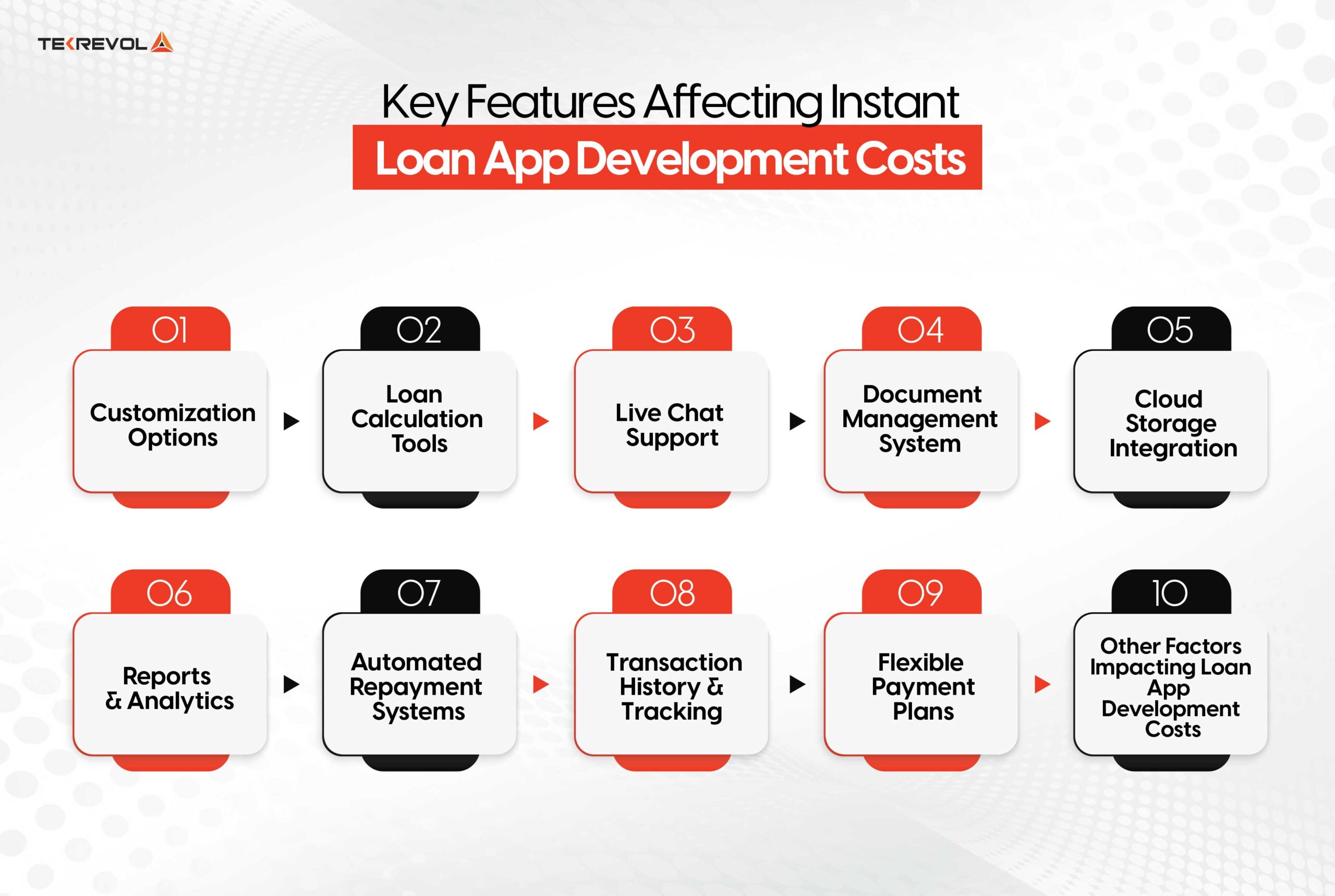

Key Features Affecting Instant Loan App Development Costs

The FinTech lending market is on track to grow to $4,957.16 billion by 2030, reflecting a robust CAGR of 27.4% from 2021 through 2030.

Developing an instant loan app requires incorporating features that fundamentally affect the app’s cost. Features that are complicated and use specific specifications will in turn lead to a high overall development cost. Below is the list of essential attributes that determine the cost of creating a money lending application:

1. Customization Options

The degree of customization seems to have a very significant influence on the cost of your instant loan application. If there is a desire to create a unique app that meets all expectations of the users where each feature is applicable for a certain function then it takes a lot more time. Special services including loan products, interface design, and financial tools also increase the cost.

Why it impacts cost: Custom development occupies more hours and needs technical skills which results in increased prices.

2. Loan Calculation Tools

Loan calculator should definitely be included in the app for better user experience but putting dynamic loan calculation in the app takes a heavy toll on the costs. An application like a live calculator that can take inputs for loan amount, repayment period, and an appropriate interest rate should be developed on the backend using complex algorithms.

Why it impacts cost: When creating such advanced functionalities, programmers need to have strict programming and work with real-time data, thus extending the project’s time and costs.

3. Live Chat Support

Most instant loan apps have a non-intrusive interface that will not require an always-on customer support service, but having a live chat can greatly improve the flow of communication. It can also assist in the process of transforming users into borrowers because they can get their questions or concerns resolved quickly.

Why it impacts cost: The use of chatbots for dealing with requests or providing on-demand services means AI integration, and it increases the value of the application.

4. Document Management System

Every app you develop should have a mechanism of how to handle various forms such as IDs, proof of income, and bank statements. An effective document upload, verification, and management process is vital especially to enhance the speed at which the loans are approved.

Why it impacts cost: Building a reliable document storage solution requires both back-end and security development such as using encrypted storage and verification, which is expensive.

5. Cloud Storage Integration

There is a need to have a safe space to store very sensitive loan-related data, and so cloud storage is very relevant. It provides flexibility and security, a major factor in the management of the large data flow in the financial industry and the personal data of borrowers. However, the incorporation of cloud storage and guaranteeing safety is an elaborate activity that contributes to the app cost.

Why it impacts cost: The great demand for cloud storage solutions & need to encrypt the data and perform regular maintenance on it drives up costs. Especially if the data involves personal finances.

6. Reports & Analytics

Another additional feature that can attract more lenders is the detailed reports and analytics of the lenders. It enables tracking of loans, repayments, and interest by the lenders. To achieve this, a strong backend platform for data processing and analysis is required and such solutions are usually costly to build.

Why it impacts cost: Due to the demand for creating strong applications, this feature is complex requires skills in data processing, storage, and reporting, and can be very expensive.

7. Automated Repayment Systems

Automated repayment enables the users to perform easy configurations and repayments of their EMIs, also known as Equal Monthly Installments. The flexibility of changing or scheduling, for example, regular payments, as well as incorporating a system that can safely process such kinds of payments, create additional layers of challenge to the application creation.

Why it impacts cost: A safe, accessible means of repayment involves complex coding and continuously updating the security of the app, which can add to the duration and cost of development.

8. Transaction History & Tracking

A complete transaction history is required for users to have confidence in the system. The ability to include previous loan disbursements, repayments, and interest computations promotes openness. It is so critical to manage and preserve data efficiently and securely to create a highly useful and easily retrievable record of transactions.

Why it impacts cost: Managing transaction tracking necessitates careful attention to detail as well as improved data management security mechanisms, which adds development expenses to app growth.

9. Flexible Payment Plans

Allowing users to select or customize their payment schedule, whether monthly, biweekly, or in any other format, adds a unique complexity to the program. Therefore, the app must include the capacity to calculate repayments for these accounts while also ensuring that loan terms, interest rates, and payments are consistent.

Why it impacts cost: Adding new payment options necessitates complex logic and calculations, which are harder to implement and thus more expensive than other features.

10. Other Factors Impacting Loan App Development Costs

Aside from the features noted above, several other elements characterize the development cost of an instant loan app. These include:

Regulatory Compliance: Make sure your app supports local financial regulations such as KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations.

Security Protocols: The importance of security characteristics such as encryption to secure user information and secure financial transactions.

Cross-Platform Development: When developing apps for both Apple and other smartphone apps, clients will end up using more time and resources when developing Apps hence the cost will be slightly higher.

Ongoing Maintenance & Updates: Routine updates, fixing bugs, as well as preserving functionality and safety aspects of the app will be a part of long-term expenses.

- Looking for the Best Features to Build an Instant Loan App?

- Get expert insights and a complete roadmap from our experts to navigate the development process seamlessly.

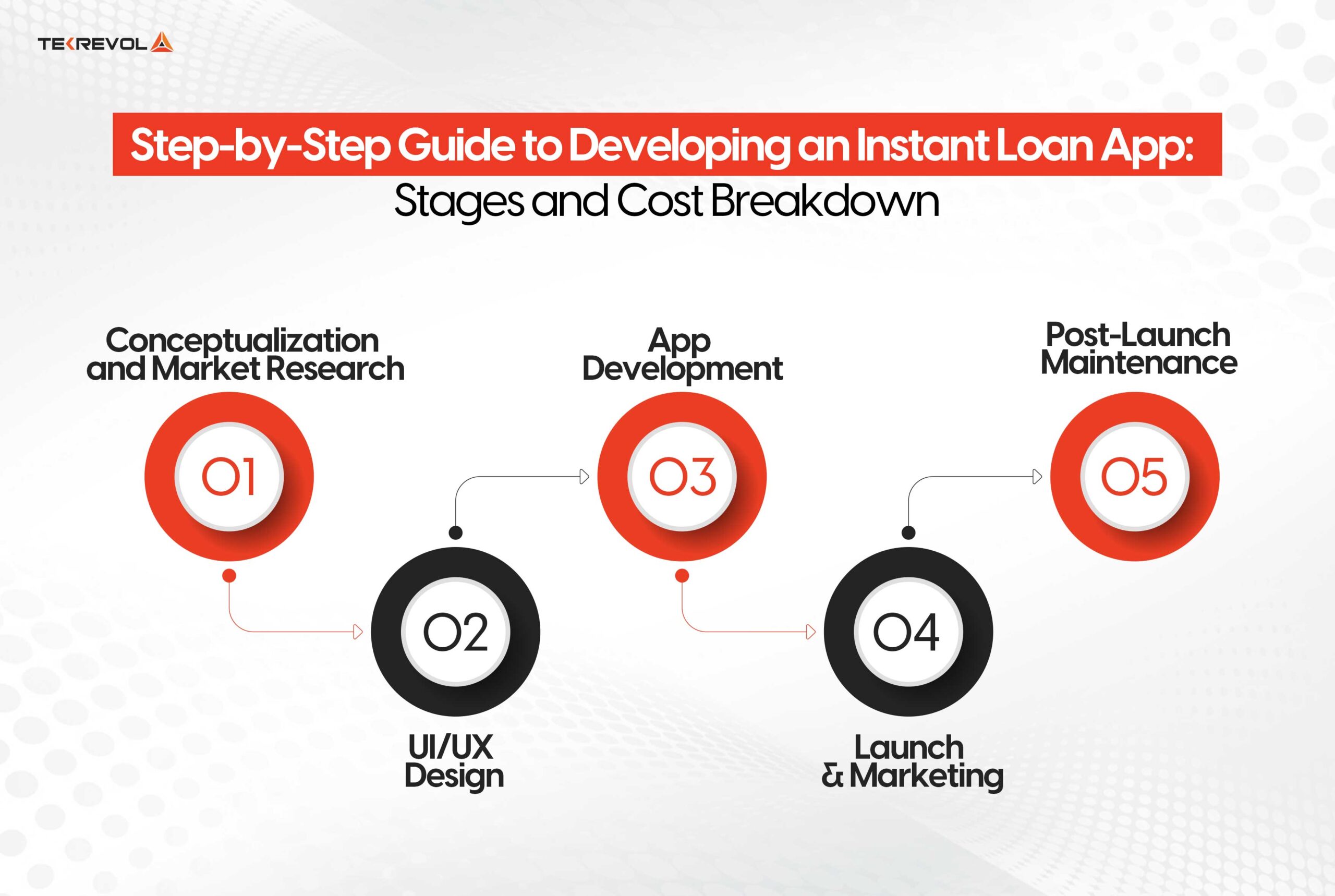

Step-by-Step Guide to Developing an Instant Loan App: Stages and Cost Breakdown

The process of creating an instant loan app is not just a one-step operation, and every step defines what the end product will be and its price. Here are the steps that outline the money lending app development process alongside the costs and activities in each stage.

1. Conceptualization and Market Research

The first stage of creating a loan lending app entails the research and planning stage. It comprises arriving at a basic concept of the app, determining its potential users, assessing competitors, and recognizing market requirements. Another important aspect that is also considered during this stage is the compliance rules and security measures needed for the application.

Key Activities:

- Demographic analysis of the target market

- Competitors scanning

- Studying market trends and legal requirements

- Setting up basic functionalities of the app and its security requirements

Cost Estimate: $5,000 – $10,000

Why it matters: A clear plan from the initial stages helps avoid expensive problems and missteps throughout the process of development.

2. UI/UX Design

The design phase concentrates on the layout and interface of the application and its ease of use. To achieve that, designers should create a series of wireframes, a prototype, and the main layout of how the user will flow through the application. It is important at this stage to ensure that the application is visually appealing and responsive on the different devices.

Key Activities:

- Wireframing and prototyping

- Making the design of an easily navigable and appealing user interface

- Responsive design for smartphones and tablets

- Setting the boundaries for decent UX in the loan application and repayment processes

Cost Estimate: $8,000 – $20,000

Why it matters: The reason for the proper design of the app is to increase the level of the audience’s loyalty and consequent usage of the application.

3. App Development

During this phase, developers ensure that the loan app comes to life. The backend is designed to accommodate tricky sequences such as loan processing and approval, the disbursement of the loan among other things, and loan repayment.

However, at the same time, the front is designed and optimized for the ease of using and navigating through the site. This is where key third-party service integrations like payment gateways, credit score APIs, and cloud storage are located to provide more features.

Key Activities:

- Developing a back end to handle activities that are supplementary to the loans’.

- End-user interface as part of the front-end development

- Using 3rd party services (like payment processing, credit scoring)

- Maintaining a high level of security measures and data protection regimes

Cost Estimate: $25,000 – $100,000

Why it matters: The development phase is the most profound and costly as this phase determines the performance or security of the mobile application.

4. Launch & Marketing

The development process is then followed by the launch, which involves submitting the app for beta testing. This phase also includes implementing marketing methods to boost the exposure of the app and attract its first group of users or audiences who will download it. It is also critical to solicit feedback from beta testers in order to fine-tune the product before to released.

Key Activities:

- Making the app available for download on app stores (Apple Store and Google Play Store)

- Engaging in beta testing to first find issues that people with a beta testing license may encounter

- Managing marketing campaigns and promotional exercises

- Targeting the first customers and their engagement

Cost Estimate: $10,000 – $50,000

Why it matters: The right digital marketing also plays an important role in attracting initial attention and active usage of the produced application in a highly competitive environment.

5. Post-Launch Maintenance

When developing an app, frequent maintenance and enhancements are required to ensure its long-term viability. This could be to fix current bugs, support new system updates, or incorporate new features supported by new OS versions or recommended by users. The concept of maintenance refers to the regular changes that are made to the software to keep it functioning, secure, and useful for clients.

Key Activities:

- Continual patching, and application enhancements.

- Tracking how apps are performing and what end users are saying

- To fix bugs and add new features compatible with the latest versions of operating systems.

- Offering assistance to users with their inquiries and concerns

Cost Estimate: $5,000 – $15,000 per month

Why it matters: Regular maintenance will make your app remain relevant, secure, and competitive thereby keeping the users happy in the longer run.

Top 5 Instant Cash Loan Apps in UAE

If you’re interested in building your own best instant loan app in Dubai, it is necessary to identify the main competitors and factors that contribute to the app’s success. By emulating the best practices, you can develop the most unique loan app. Here are the top 5 loan apps in the UAE, offering fast and reliable financial solutions:

1. Cash Now

Cash Now is one of the best loan apps in UAE, that offers instant cash loans in 1 hour without documents in uae. For any urgent need, including a medical condition or an unplanned bill, this app provides simple routes to request a loan, making it a trustworthy option for immediate cash within the UAE.

2. LNDDO

Niddo is a UAE legit loan application registered under the Financial Services Regulatory Authority. It provides an affordable personal loan service that is easy to procure. There is no need to provide collateral or to fill out complicated documents making it easy for users who want to borrow money urgently.

3. Credy Loan

Credit Loan allows borrowers to make a fast and flexible decision about taking the loan as it provides personal and business loans. Further, it has a straightforward navigation process, and applicants can receive money as soon as possible.

It is important for individuals who need money to cover the prices of healthcare facilities, repair processes, or business ownership. It becomes even more convenient due to the option of flexible repayments.

4. CashU

CashU services are competitive and simple to use because of the variable repayment duration for the loan facility provided. The app is quite safe because it complies with all regulatory rules, and because it is available for usage in the UAE, it benefits anyone or organization looking for a quick loan. It is frequently used due to its simplicity and capacity to be customized in a variety of ways.

5. FinBin

With its powerful algorithms, FinBin offers a fast and efficient loan eligibility check, providing customized loan offers. The app is designed for ease of use, with flexible repayment options, making it an excellent choice for urgent cash loans.

Average Cost of Building a Loan Lending App in the UAE

The cost can go as low as $20, 000 or as high as $80, 000 or even more when it comes to creating an instant loan app. This price will depend on the extent of your business objectives and the sophistication of the specific app you want to develop.

If you want to deal with the problem of high costs, you may use ready-made SDKs for the development or part of it since this decision helps reduce the costs but does not exclude the possibility of obtaining a working solution.

Key Factors Affecting the Development Cost of a Loan App

App Complexity & Type

The complexity of the app will also dictate the price of the app, the more complex the app, the more it will cost you. Small apps with simple characteristics will cost less, and developing will cost more if the app has such features as an AI-driven credit scoring system, connections to banking systems, or a good UI.

Platform Choice

Whether you decide to build the app for Android only, iOS only, or both, platforms as in cross-platform app development will influence the cost. Developing the application for multiple platforms is more expensive and time-consuming.

UI/UX Design

The graphic interface of the website must be friendly, meaningful, and easy, to navigate to retain the users. Based on the complexity and quality of app UI/UX, the development cost also depends, as the elaborate designs cost more time and skills to create.

Feature Set

The features that you consider necessary such as loan management, application tracking, payment gateway integration, notifications, credit score analysis, etc.) – can significantly affect the development cost. Generally, the addition of more features means that more time will be spent on implementing them.

Application Architecture

A good architecture means that app resource usage increases proportionally to the number of users of the application. When creating an architecture for a loan lending app from scratch takes a lot of resources and professionals which also contributes to an increase in cost.

Location of Development Team

Across the three areas, the location of the development team is the attribute that is most directly connected to cost. When you coordinate with the leading mobile app development companies in Dubai, you are dealing with experienced talent, but that could mean higher costs as compared to engaging offshore outsourcing solutions.

Marketing Strategies to Make Your Loan App Stand Out in the UAE

As online lending products are flying off the shelves so to speak, it is important to have a good marketing strategy in place in order to bring on and retain users. Social media advertisements, SEO, and collaboration with creators and influencers can enhance visibility and credibility.

Content marketing may be in the form of a blog entry and tutorial videos on financial literacy that can establish the app as a go-to source for borrowers.

The loan apps will be able to differentiate themselves effectively in a highly competitive UAE market by using paid and organic marketing techniques.

How TekRevol Help You Build the Best Instant Loan App?

The process of developing a loan lending app is complex and must be approached with consideration for each stage. To successfully overcome this step and achieve your business objectives, it is necessary to cooperate with a reliable mobile application development company.

TekRevol is the leading app development company with experience and expertise in creating great and distinctive apps. Our team consists of more than 250 highly skilled professionals to provide our clients with bespoke state-of-the-art solutions.

If you want to uncover the potential of the loan lending application market and find a reliable contractor, TekRevol would be the right choice. You need to contact our specialists to discuss the specifics of your idea as well as receive guidance on each stage of the development process to ensure that your app will be unique on the market.

Regardless of whether you are in the stage of developing an idea or already have an idea of what to create, we will collaborate with you.

To gain a deeper understanding of our expertise and the quality of our work, we invite you to explore our portfolio and read client reviews on Clutch.

- Dreaming of building an app that stands among the best?

- Get a detailed strategy and experienced support to bring it to life.

![Mobile App Development Cost In Dubai [2025 Guide]](https://d3r5yd0374231.cloudfront.net/images-tek/uploads/2024/02/tekRevol_feature_image_cost_in_dubai.webp)