Are you interested in learning how to create an innovative app to split payments software like Tamara in 2025? Due to the growing desire for flexible payment alternatives, developing an app that allows users to pay in instalments is no longer a trend; it is becoming a requirement.

So what is Tamara app? Tamara UAE can be seen as an example of how such solutions are becoming increasingly important in managing shared costs.

Currently, through the incorporation of BNPL and effective bill division, Tamara business model has dominated the Middle East market. However, transforming this concept into a fully-fledged app requires numerous crucial stages and is a costly undertaking. Development expenses may range from $30,000 up to $300,000, so it is essential to grasp the significance of such a level of expenditure to maintain proper expectations and resource control.

If you want to enter into this fast-growing market, you’ve come to the correct place. This blog will outline the basic stages required to create a Tamara app, providing readers with a clear route to follow if they wish to create one comparable to it.

- Ready to bring your split payments app idea to life?

- We help you build a feature-rich, secure, and scalable app!

How Does Split Payment Tamara App Simplify Group Transactions?

Split payment apps are designed to make it easier to manage shared expenses such as restaurant bills, rent, travel expenses, and group gifts. These programs eliminate the complication of knowing who owes what and who should pay, allowing consumers to pay their balance as quickly as possible.

Tamara, a well-known Buy Now Pay Later (BNPL) provider in the Middle East, is one market participant interested in this opportunity. It currently has over 3 million active users who trade millions of times per day, which improves the split payment feature even more.

Tamara app Saudi Arabia’s success demonstrates that there is a huge market demand for such apps, which not only add convenience but also transparency to group payments and are critical in today’s economy.

The Growing Demand for BNPL Services: Key Statistics to Know

The demand for Buy Now, Pay Later (BNPL) services has surged in recent years, supported by impressive statistics:

- Global BNPL market reached US$ $378.3 billion in 2023, and is projected to grow at a CAGR of 40% from 2024 to 2032.

- Another forecast estimates it expanded from US $231.5 billion in 2024 to US $343.5 billion in 2025, with a blistering 48.4% annual growth, potentially soaring to US $1.43 trillion by 2029.

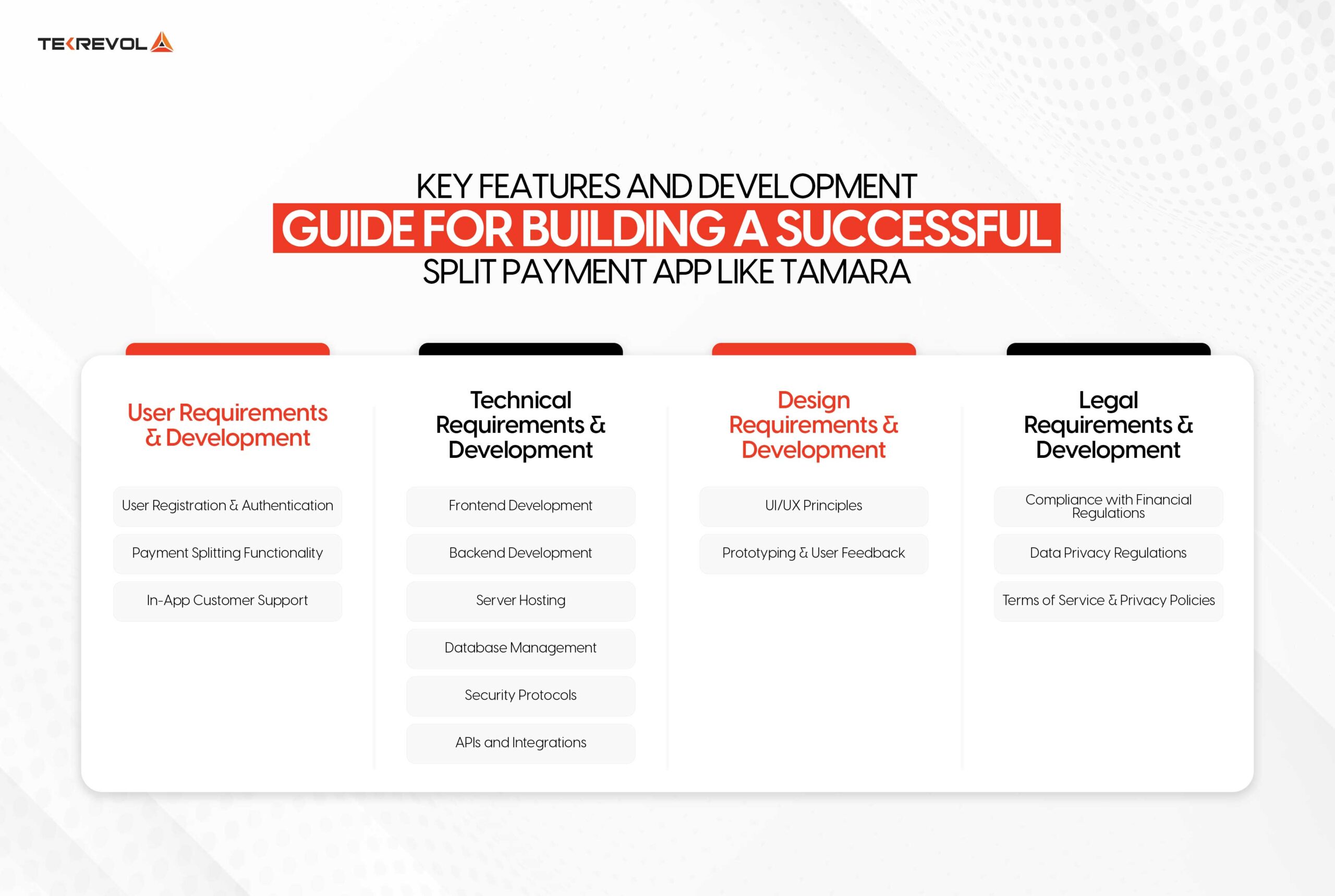

Key Features and Development Guide for Building a Successful Split Payment App Like Tamara

When developing a split payment app, it is crucial to pay attention to the various features that would help to create the best app to suit the users’ needs and be functional and safe at the same time.

These are some of the critical factors that need to be considered in the system to ease its functioning and acceptance by the users are as follows.

User Requirements & Development

-

User Registration and Authentication

As the app’s primary aim is to assist content creators in onboarding their projects into the platform, user registration and authentication processes must be thoroughly incorporated into the app. It should allow people to sign up via email, phone number, or social network account.

Thus, two-factor authentication and encryption are required to protect debit and credit card data. The app should also handle commonly used payment services like PayPal, Stripe, and Braintree, as well as payment instalment plans like Tamara.

-

Payment Splitting Functionality

One of the key features of any split payment software is the ability to easily split payments with other users. Aside from splitting a restaurant bill or a group gift, the app should let users choose how to split expenditures.

Maintaining a record of each transaction is critical to ensuring that all users understand their contribution. Notifications and reminders for unpaid invoices also make the software more convenient for following payment schedules.

-

In-App Customer Support

Payments are one of the features that can be difficult for consumers, and they may have questions about how the app works. Ensuring that customers can readily contact customer support within the app—whether via chat, email, or a list of commonly asked questions—ensures that their overall experience is favourable.

Technical Requirements & Development

-

Frontend Development

The design of an effective interface for a split payment app is significant to avoid conflicts and look aesthetic. You have two primary options for frontend development:

Native Development:

For applications that are specific to each platform, consider Kotlin for Android and Swift for iOS.

Cross-Platform Development:

Frameworks such as React Native or Flutter provide the flexibility of creating one app that works for Android and iOS while not having to worry about performance.

-

Backend Development

The back end is the crucial support for any split payment application since it is designed to oversee user data and manage transactions. Some of the common frameworks are Django, Ruby on Rails, or Node.

It should also be noted that lists are flexible and provide great support and this is achieved through the use of its relatives namely js. These frameworks offer flexibility and can be enhanced to work with high-security databases.

-

Server Hosting

Server hosting is crucial to avoid downtimes and to enable app functioning without interruption. Popular cloud hosting providers based on their flexibility and security include AWS, Google Cloud and Microsoft Azure.

-

Database Management

For handling user data, one should use a strong database such as PostgreSQL, MySQL, or MongoDB for efficient handling of data. These databases provide the required capacities for working with a vast number of users, keeping data safe, and completing transactions without latency.

-

Security Protocols

Security is one of the most significant concerns of financial apps. It is recommended to enable SSL/TLS for secure data transfer and use two-factor authentication to enhance security. The requirement to abide by strict financial regulations is that they keep your application legal and users safe.

-

APIs and Integrations

When working with the application, it is critical to integrate it with payment gateways like Stripe or PayPal to facilitate purchases. WebSockets can be used for real-time communication, while Google Analytics or Mixpanel can be utilized to track user behaviour and performance data.

Design Requirements & Development

-

UI/UX Principles

When developing your app, you should take a user-centered approach. The overall design should be modular and uncluttered, particularly when it comes to the payment mechanism, which should not impose unnecessary burdens on users. The site will have a clean and current appearance, which will improve the user interface and usability of the app.

-

Prototyping and User Feedback

To avoid getting lost in the project, sketch the app and outline the user flow and layout before constructing it. Create a mock-up model and solicit input from people who are expected to use your product. Implement these changes and include all comments to ensure that the finished product is satisfactory to the user.

Legal Requirements & Development

-

Compliance with Financial Regulations

To gain popularity in many parts of the world, your app must follow local financial laws and regulations. This helps to avoid legal issues and maintain a strong user-trust relationship. Find out the relevant requirements for application finance in each of the regions where your app will give services.

-

Data Privacy Regulations

Privacy is yet another crucial consideration that should not be overlooked. Make sure your app is GDPR compliant if you’re targeting Europe, CCPA compliant if you’re targeting California or any other applicable laws in the country. This will ensure that both your consumers and your company do not violate the law of data privacy or the exploitation of such information.

-

Terms of Service and Privacy Policies

Appropriate terms of service and privacy policies should be explicitly established for the application you are developing. These legal agreements will specify how your application processes information, user obligations, and the security measures you provide for monetary transactions. This phase is critical for your organization and for establishing confidence between it and the users of your service.

How Much Does It Cost to Develop a Split Payment App Like Tamara?

The cost of developing a split payment app similar to Tamara UAE depends on several key factors:

1. Development Complexity

The scope of these elements defines the level of development expenditure required to design them. A basic app with the necessities will be less expensive than one with additional features like real-time notifications, multiple currency compatibility, and instalment payment.

2. Geographic Location of the Development Team

Costs of development fluctuate based on the geographical location of your team. For example, developers working in North America or Western Europe cost much more than ones from Asia or Eastern Europe, which affects expenses.

3. Integration with Retail Partners

If you need to connect to several retail partners or many payment options via APIs, then the cost will be higher. Every integration makes the project more complicated and increases the number of development hours required.

4. Backend Infrastructure and Server Costs

Developing a highly effective and efficient backend for such apps as the Tamara buy now pay later app, particularly when processing millions of transactions is very important. When implemented with some great cloud framework like AWS or Google Cloud, it becomes more and more reliable but pricey.

5. Ongoing Maintenance and Support

Once the app is developed and released, it requires regular updating to fix the bugs or issues, along with new software and features. There should be strong technical support to make sure that the functions of the app are working and that it is not susceptible to hacking.

6. Marketing and User Acquisition

App development is a crucial factor in the creation of an app; however, a good marketing plan is equally as important. You need to allocate funds for user acquisition campaigns, social media marketing, and partnerships to reach more users.

Under these conditions, it is reasonable to estimate the cost of developing an application like Tamara UAE for split payments at $ 30,000 – $ 300,000 for the development of a simple/complex app and the creation of a large platform.

Challenges of Developing a Split Payment App Like Tamara

Creating an app like a massive split payment app like Tamara has several challenges that have to be considered for success. However, it is important to note that many of these challenges are manageable in case you hire a reputable mobile app development company that will guarantee a smooth development process and quality end product.

1. Technical Challenges

Handling diverse scenarios such as splitting of bills, real-time transactions, and secure management of data necessitates a solid architecture. The app must have the capacity to accommodate increasing numbers of users and transactions.

2. Market Competition

The BNPL and split payment app market is quite saturated, and there are other players in the market such as Tamara. To be successful, your app must be as innovative as those that already exist on the market, well-integrated with Tamara payment systems, and have a proper user interface that can distinguish it from all the others.

3. User Adoption

However, making people download your app is not an easy task, even though you have the best app. To achieve this goal, there will be a requirement to integrate a user-friendly interface, marketing strategies, as well as strategic collaborations to persuade users to opt for your app instead of the others already available.

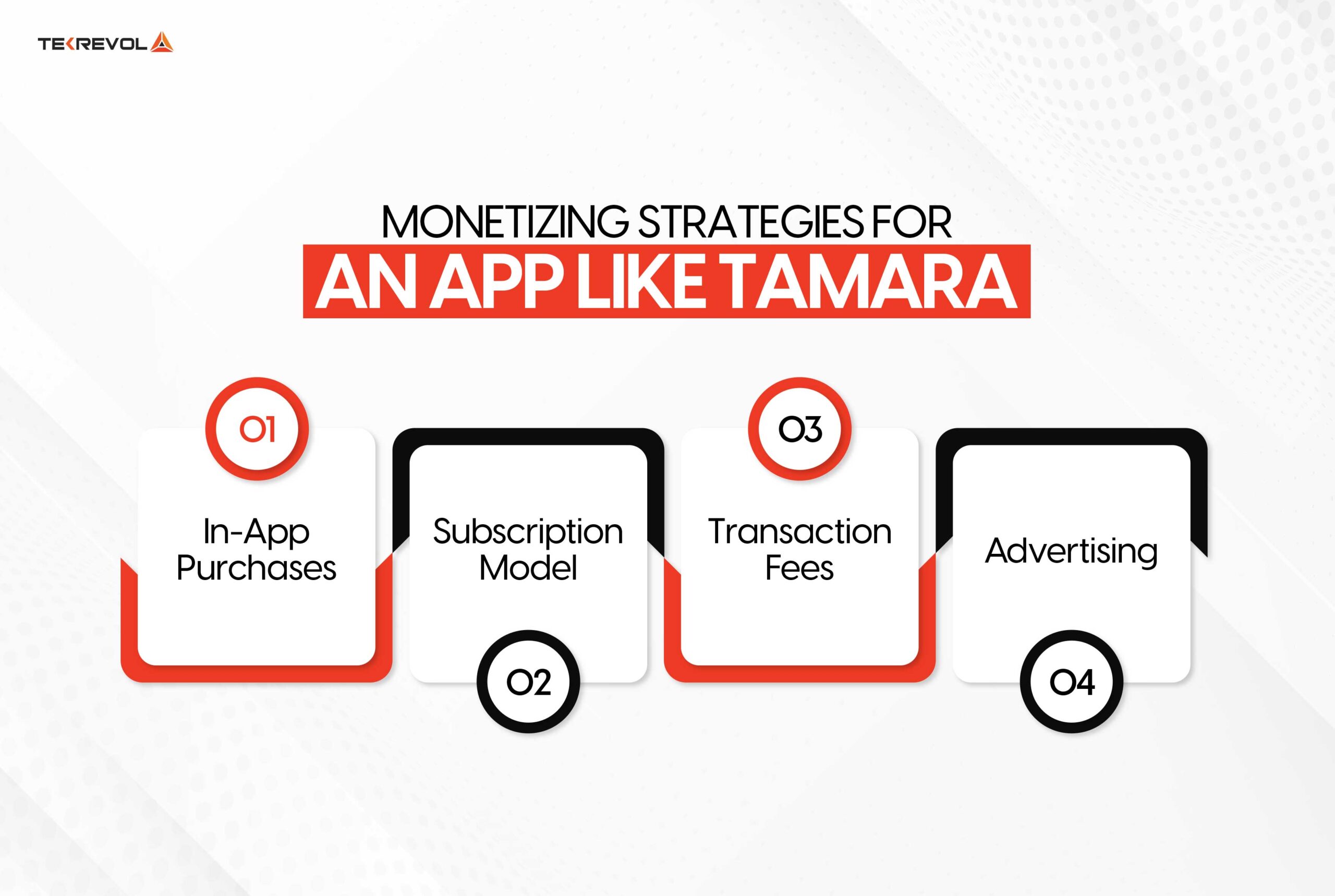

Monetizing Strategies For an App Like Tamara

Developing an application similar to Tamara requires following various business models for generating revenues. By using all of those types of monetization, one is able to give the service to a big group of users and work in different conditions. Feedback from the users and market analysis shall also assist in fine-tuning these practices for the best results.

Here are some effective ways to generate revenue with an app like Tamara:

In-App Purchases

The in-app Acquisitions model gives consumers the choice to purchase goods or features directly from the app, enhancing their experience. These features can be paying for extra data that isn’t often given to consumers or offering one-time special deals that let users access additional unique applications and downloadable files.

Subscription Model

It offers members-only plans for users who make frequent use of most of the paid features. Monthly options include saving benefits like priority customer support access, early access to new features, improved transaction records, and yearly options for subscribers.

Transaction Fees

Implement a fee system that will apply to all transactions done through the app. It can be a one-time, limited fee for the transaction or a percentage of the value of the transaction. These are fees for services that help create strategic partnerships and guarantee a stable income.

Advertising

Use an advertising technique that does not interfere with the user’s experience. Include ad visuals with headings relevant to store partners or financial offers. To avoid compromising user satisfaction as well as to get more revenues impose these ads strategically.

Why Now Is the Ideal Moment for the Rollout of a Split Payment App

2025 is a turning point for financial technology (FinTech) in the Middle East and beyond. As there’s accelerating digital change, rising mobile payments, and changing consumer behaviors, split payment options aren’t simply cutting-edge—they’re necessary.

Three trends driving 2025’s FinTech landscape are:

Regulatory Support for FinTech Innovation

Gulf governments, particularly Saudi Arabia and the UAE, are adopting open banking and digital payment regulations to drive financial inclusion faster. The pro-innovation environment offers a favorable framework for introducing split payment and BNPL platforms.

Emergence of AI and Personalization in FinTech Apps

By 2025, AI is no longer a nicety—it’s a norm. New split payment apps need to provide intelligent expense tracking, AI-powered payment reminders, and intelligent financial tips to stay relevant and competitive. AI integrations also aid in mitigating fraud and enhancing user trust.

Gen Z and Millennial Preferences:

Younger generations value flexibility, real-time convenience, and transparency in financial matters. These digitally connected consumers are leading the rise of peer-to-peer payment experiences, presenting split payment apps as highly desirable and scalable in 2025’s digital economy.

If you’re going to develop a Tamara-type app, then right now is the perfect window of opportunity to invest in this high-growth sector.

Why Choose TekRevol for Developing an App Like Tamara?

Are you trying to make app like Tamara in real? TekRevol is the ideal technological solution provider to assist you achieve your objectives. TekRevol is a prime example of a future-oriented company at the forefront of digital transformation in the region, with extensive FinTech development experience and expertise in technologies like as AI and blockchain.

We understand the complexities of developing a software like Tamara split payment and the fees associated with the endeavour. This expertise enables us to provide not only the greatest technical solutions but also the most inexpensive ones to match your needs.

With our team of experts and proven techniques, you’ll find a trustworthy partner committed to turning your idea into a high-calibre, scalable app. Choose TekRevol to guarantee a remarkable and seamless development process.

- Create the Next Big App With TekRevol!

- We help you design, develop, and launch a split payment app that sets new industry standards.

![What is Visual Regression Testing [2025 Definitive Guide]](https://d3r5yd0374231.cloudfront.net/images-tek/uploads/2025/11/Feature-19.jpg)