Building a fintech solution sounds exciting, right? But let’s be real—it’s not without its challenges. The fintech and investment management software market is rapidly expanding now exceeding more than $340 billion and going strong.

So, there are plenty of opportunities for companies eager to shake up their industry, develop new technology, and make it available to the general public. However, there is a catch—this rising industry is not without challenges.

Now here is a shocking figure that may come your way—93% of the fintech market faces compliance issues. It’s not hard to see why. Between strict data privacy regulations, growing cybersecurity threats, and investor protection regulations, it may seem like you are trapped in a maze.

But here’s the thing, compliance is not just about avoiding penalties. It is about building the organization’s credibility and reassuring its clients that it is indeed standing with them.

This blog will focus on the major fintech compliance challenges and other critical issues, and offer guidance on how to address them efficiently.

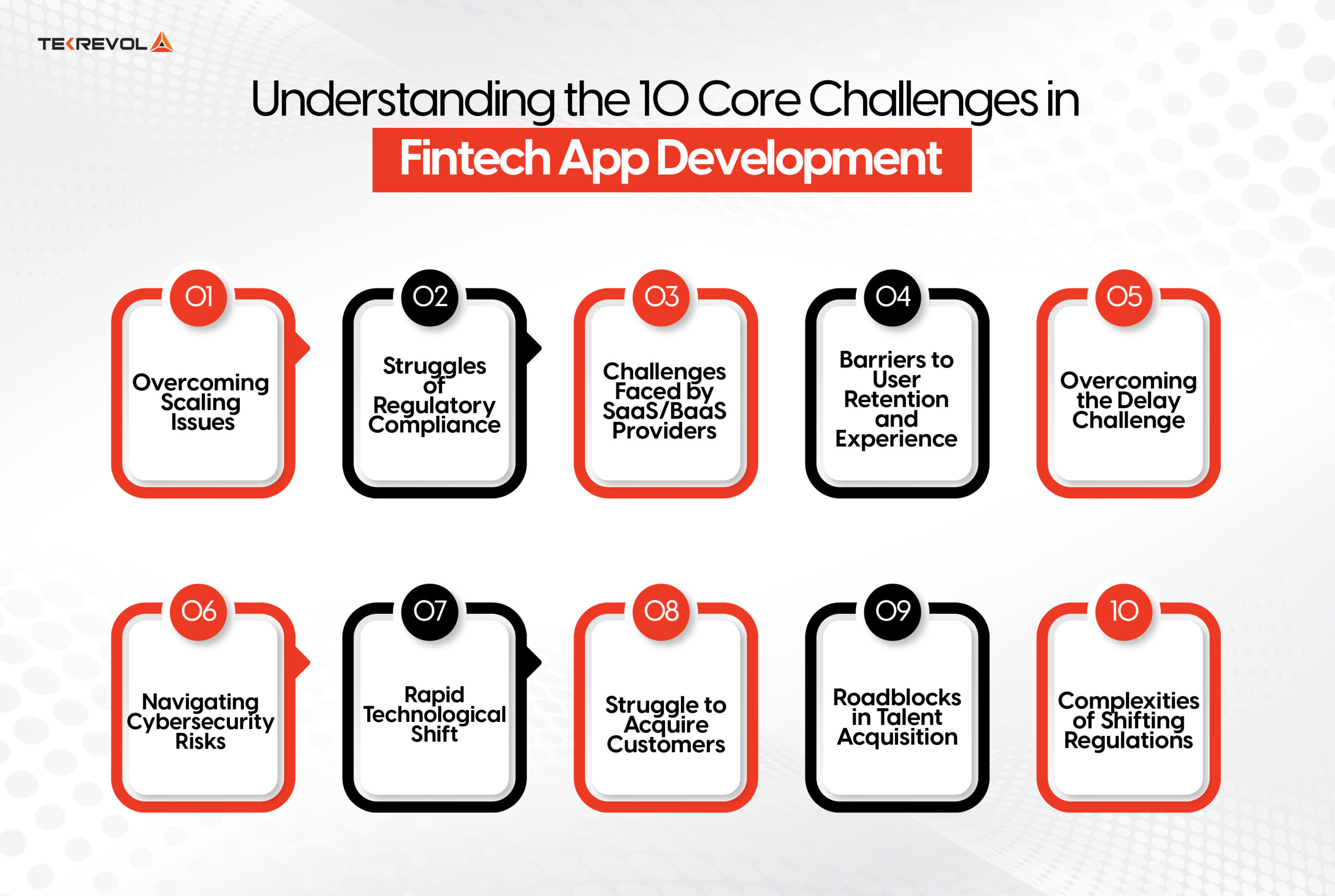

Understanding the 10 Core Challenges in Fintech App Development

Fintech development is a dynamic and stimulating activity, though it also has its challenges. Many barriers, including regulation, security, and others, prevent fintech companies from developing and providing solutions. It is time to discuss the most significant issues affecting fintech development and real-life strategies for addressing them.

Overcoming Scaling Issues

One of the most pivotal hurdles that startups experience is scaling, especially when user acquisition is exponential to their infrastructure. Not only that but half of the fintech operations have reported problems with scaling their systems as they grow.

When poorly managed, scalability destroys user experience – that is, slow loading time, failed transactions, and crashing apps. This makes the customers angry and leaves the investors with no assurance.

Solution:

When it comes to avoiding the problem of scale, start with the thought of growth in mind. You don’t need huge investments initially but having the right tech stack is very important. Consider these best practices:

- Take advantage of cloud computing as needed to achieve increased flexibility.

- Use microservices as architectures to prevent the creation of large, focused systems.

- Utilize Agile and implement CI/CD to adapt to the fluctuating requirements.

- Facing scalability challenges?

- Let TekRevol help you overcome them with innovative and tailored solutions.

Struggles of Regulatory Compliance

Another key challenge in fintech is compliance, which can differ greatly depending on your operational geography. Not meeting these standards affects your business adversely and can result in severe penalties.

For example, a fintech bank N26 had suffered a $10 million fine in Germany for delayed anti-money laundering reports.

European and US regions are known to be non-negotiable when it comes to the implementation of key regulations for fintech companies. These include:

| Regulations | Description |

| GDPR (General Data Protection Regulation) | Regulates the manner in which customer information is collected and utilized within the EU. |

| GLBA (Gramm-Leach-Bliley Act) | Protects and controls the flow of sensitive financial data in the United States. |

| EFTA (Electronic Fund Transfer Act) | Shields United States customers from fraudulent activities and mistakes when making transfers of funds. |

Note: local KYC and AML regulations have to be incorporated into your fintech operations to address the risks successfully.

Solution:

Compliance is not merely about being in line with the laws, but about creating a healthy image of yourself in the eyes of your customers. Here’s how you can ensure compliance:

Establish a Compliance Audit Team: This team goes through your app and brings it in line with current regulations as needed.

Integrate Data Security Measures: Make use of the encryption process, and the multi-factor authentication process, and observe data residency compliance.

Leverage AI for Compliance Monitoring: Organizations use AI technologies for activities such as risk evaluation and regulation changes.

- Concerned about compliance?

- TekRevol is here to help you navigate complex fintech regulations with ease.

Challenges Faced by SaaS/BaaS Providers

For many fintech startups, outsourcing back-end and front-end operations is the best approach to cutting costs and development time, leveraging SaaS, and BaaS players. These vendors offer features such as payment processing, and marketing automation, among others, thus solving the problem of having to develop all these features from the ground up.

While this approach works well initially, startups often face significant challenges as they scale, such as:

Vendor Lock-In: Startups often rely on specific providers, and any changes in policy or rising tariffs could severely impact their operations.

Data Transparency Issues: Outsourcing data to third-party vendors means that storing and securing the data will be the responsibility of the provider. This may bring conflict with specific legal rules such as data localization laws.

Limited Innovation: Leveraging vendors presents some challenges as startups become limited by what the vendor offers in terms of customization and what is available in their package.

These are some of the issues that make it imperative for startups to consider readjusting their SaaS/BaaS plans as they advance.

Solution:

While it’s impractical to eliminate SaaS/BaaS vendors, startups can mitigate these challenges with a strategic approach:

Diversify Providers: Do not concentrate on sourcing products from just one supplier. Combine several service providers to gain higher possibilities and reduce avertible risks.

Build Core Capabilities In-House: For critical activities, it is advisable to keep the development of these solutions in-house so that you are in the driver’s seat as the business expands.

Collaborate with Experienced Developers: Consult with the fintech development teams, which are aware of the specificities of SaaS/BaaS, and incorporate architectures free of the need for third parties.

- Take charge of your scalability!

- Reach out to TekRevol for expert fintech solutions that eliminate dependency risks.

Barriers to User Retention and Experience

Another issue that has a strong impact on fintech business is how to retain users and align their needs with the offered solutions. The most sophisticated app continuously faces the risk of ineffectiveness due to the lack of ease in operation or its failure to provide customers with what they expect.

For instance, a cross-border P2P payment app with a complex interface or unreliable payment operations is likely to lose users shortly. Even minor problems such as wrong formatting of account balances that users need to see become a reason enough to switch to a different platform.

One of the top priorities that can help you maintain your audience is making their experience as convenient as possible.

Solution

To drive customer loyalty, fintech apps must keep the goal of providing utility and a positive experience in mind. Here’s how you can do it:

Design for Simple and Easy Reach: In addressing the needs of the users, your app should meet the needs without having to be told. For example, placing important details such as the account balance at the first interface visible on the screen.

Strike the Right Balance Between Security and Usability: Security is, of course, important but overly complex authentication mechanisms can often turn people off. Employ different security levels, e.g., where authorization is necessary only where the option is provided to make a transaction, but not where account information is displayed.

Optimize the Customer Journey

Follow the user’s flow from the initial point to the last one and erase all possible barriers in your application. Tackle potential problems as they arise to provide an optimally engaging experience.

- Struggling with user retention?

- TekRevol builds intuitive fintech solutions that balance security with convenience.

Overcoming the Delay Challenge

When it comes to fintech start-ups, time is always of the essence. Negative outcomes that arise from delayed product development are a lack of opportunities, slow business growth, and huge losses. However, these delays are not rare, especially if startups try to handle the intricate process of creating or expanding a fintech solution independently.

Dealing with various legal complexities and deciding on how to utilize emerging technologies turn the process into a real war.

Solution:

Hitting the markets fast doesn’t mean compromising on quality, it means employing better strategies. Here’s how:

Set Milestones: Divide the project into several sub-stages or steps that are easier to control. Begin by seeking to confirm your concept with a beta site and then follow up with creating the minimum marketable product (MMP). Improve the product with features that are relevant to the user from time to time.

Leverage Expertise: Work with a professional fintech solutions software development company, who have profound expertise in fintech issues and risks, including fintech compliance challenges and security problems. With their help, you can avoid mistakes and progress faster.

- Ready to bring your fintech idea to life faster?

- TekRevol’s experienced team guides your journey with streamlined processes and proven expertise!

Navigating Cybersecurity Risks

One of the pain points that fintechs are faced with is cybersecurity, and it only gets worse as the company grows. Fintech software is one of the most common targets for hackers as far as the theft of personally identifiable data, including bank details, is concerned.

A 2023 research shows that the finance sector is the most vulnerable to data breach and this makes it necessary for firms in the sector to embrace security. Small to medium businesses in the US are the most vulnerable to cyberattacks as it costs them an average of $ 200,000 per attack.

Cyber security should not be something that is added at the end or after the app is developed but something that is a fundamental aspect of the fintech business.

Solution

Preventing your fintech software from being hacked requires integrating security measures throughout the development process. A proactive approach to cybersecurity involves the following best practices:

Data Encryption: Encrypt any information you obtain, process, and transmit through your software to reduce the chances of access by unauthorized third parties.

Third-Party Compliance: Take advantage of the extra services to ensure compliance with data privacy laws and implement strict security measures.

Secure Coding Practices: Adopt coding practices that prevent secure attacks and reduce the possibility of the occurrence of threats.

Regular Security Audits: One should undertake regular security audits to determine potential flaws that could be exploited in the future.

Enhanced User Protection: Employees should be provided with features like MFA, fraud detection, and real-time alert systems.

- Ready to build a secure fintech app?

- Let us help you build secure, resilient fintech software.

Rapid Technological Shift

As the fintech sector continues to grow, the key to competition and growth depends greatly on the integration of new solutions such as AI, ML, and Blockchain.

For instance, there are AI chatbots in the banking sector, which help customers get round-the-clock support and at the same time, make the operating costs slim. Likewise, with the help of ML-based credit scoring, lenders can also make wiser decisions by minimizing credit risk and enhancing the percentages of approvals.

Yet, numerous fintech companies, particularly SMEs, are not able to create effective and robust systems that would allow them to address the current trends in technology. If they fail to adopt these technologies, they stand to be left behind by more adaptable competitors already experiencing the benefits of innovation.

Solution

The only way that your fintech business can compete with these giant companies is by dedicating resources to technology development. Investing time to research new trending technologies such as AI, ML, blockchain, etc will assist you in staying in touch with the market.

- Looking to scale your fintech solution with cutting-edge technology?

- TekRevol can help you integrate AI, ML, and blockchain to drive your business forward.

Struggle to Acquire Customers

Growing the number of customers can also be a difficult task for fintech businesses, especially as the market continues to evolve. As new players enter the market, it is challenging to differentiate and communicate relevant to prospective clients to make them convert into loyal customers. Pricing, marketing strategies, and branding are important as they contribute to growth and adoption by consumers.

Unfortunately, these challenges can lead to high customer acquisition cost that affects the profitability of the business. If fintech is not able to acquire a stable flow of new clientele, they run the risk of only stagnating, or declining in their performance.

Solution

To overcome such challenges, there is a need to look beyond the mere selection of marketing channels. The secret is to identify and focus on a problem that needs a solution for a particular audience, a problem that customers will be willing to pay to have solved for them.

As rightly pointed out, if your fintech app is not addressing a particular need, no marketing method will be fruitful.

- Looking to boost your fintech app’s market reach?

- Build products that meet customer needs and boost customer acquisition with TekRevol!

Roadblocks in Talent Acquisition

When fintech businesses are expanding, one of the biggest challenges becomes the ability to find and attract qualified technical talent. To create a competitive fintech product, it is vital to attract professional specialists in focused niches like mobile application development, AI and ML in financial services, UI/UX design, and cybersecurity.

However, attracting such professionals has remained a big challenge to SMBs due to factors such as competition from other firms that are willing to offer better remunerations than young professionals.

Also, some specializations like deep learning and advanced AI may not be available in abundance in specific geographical locations which is why it becomes a complex task for fintech CTOs to recruit the required skilled pool.

Solution

Lack of skilled tech talent is not an issue unique to fintech, it is a problem that many industries face today. Even if a company ensures competitive compensation, a supportive work culture, and invests in recruitment campaigns, outsourcing can offer a more efficient solution.

Instead of investing time and resources in recruiting and training employees in-house, fintech startups should work with a reputable App development company like Tekrevol. We provide startups with rapid access to a wide spectrum of professionals in sectors such as AI, data security, app development, and UI/UX, allowing them to scale more efficiently.

- Looking to scale your fintech business with top talent?

- Partner with TekRevol for specialized expertise and seamless development.

Complexities of Shifting Regulations

A major challenge that fintech companies experience is the struggle of having to always comply with ever-changing regulations. Since governments and relevant regulatory authorities continue to shift their policies to reflect changing financial dynamics, you would find it challenging as an SMB.

If these trends are not embraced then some companies may end up paying very steep fines, penalties, or even losing licenses to do business in particular areas.

For example, various fintech companies in the United States are regulated by several acts including the SEC, CFPB, and CCPA where each may be updated from time to time. Minor changes could be complex and time-consuming when it came to auditing and adjusting the fintech product, thus adding both time and cost elements.

Solution

To minimize the risks, one has to be very keen and make efforts to ensure that state and federal legal changes are monitored frequently. By reaching out to such departments, one can gauge trends of new regulations that are coming up.

To ensure your product stays compliant with the local and international laws, it is recommended to create a compliance team.

- Ready to simplify compliance?

- Let's discuss how we can help you navigate changing regulations efficiently.

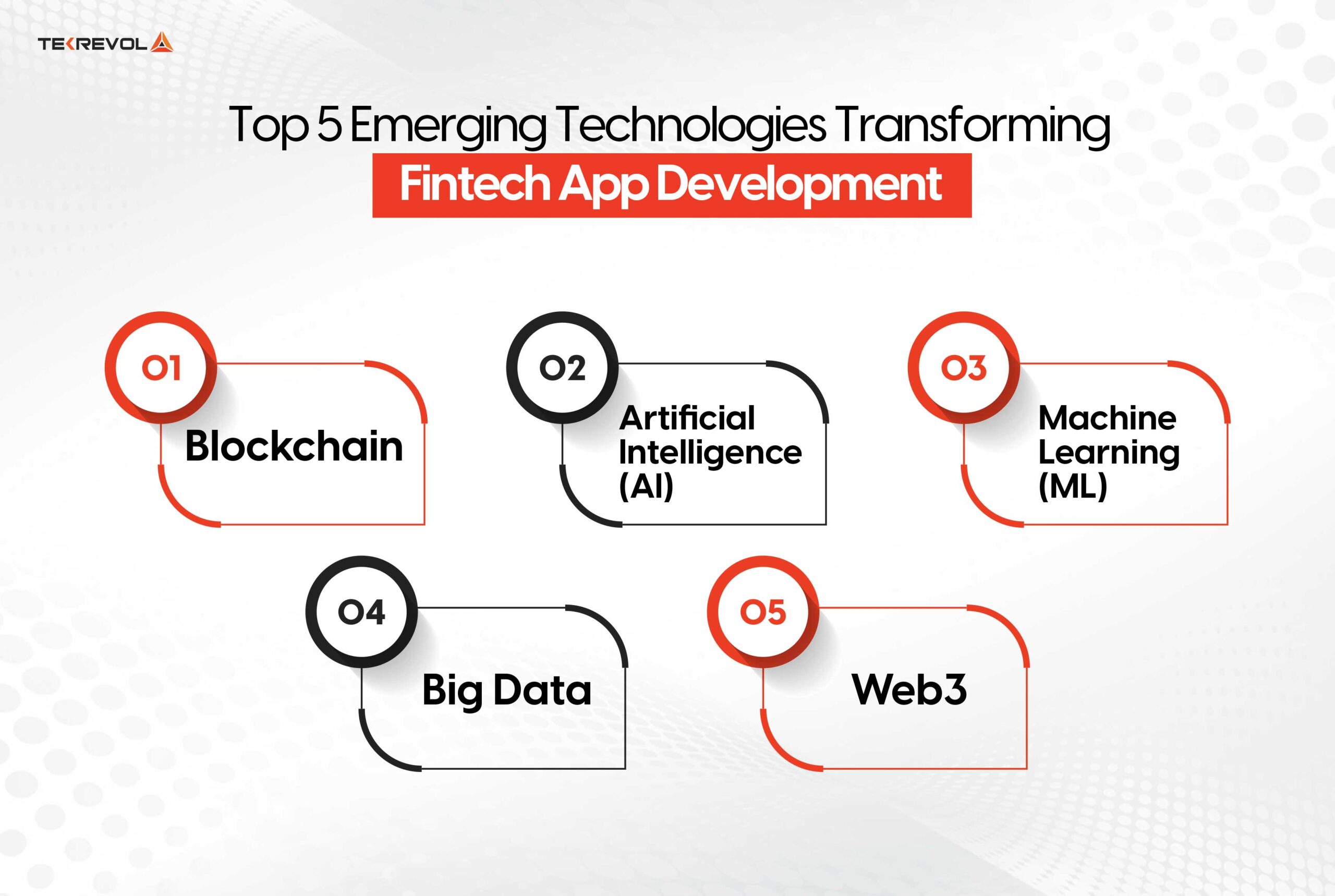

Top 5 Emerging Technologies Transforming Fintech App Development

Fintech is still a growing industry, and new technologies open huge potential for changes and expansion. Here are the top five technologies shaping the future of the industry:

Blockchain

Blockchain is set to redefine the fintech market, with it being expected to hit $ 22.46 billion by 2026. In this case, blockchain displaces third parties and provides efficient, open, and accessible registers that improve transaction security and minimize fraud.

Artificial Intelligence (AI)

AI continues to impact the advancement of fintech through facilities for fraud prevention and customer support. From conversational commerce to improved fraud detection, AI is making financial services more secure and engaging.

Machine Learning (ML)

Machine learning enables the fintech firm to analyze trends in large data sets to make more informed decisions. This allows for a better understanding of each customer’s risk profile, quicker loan processing, and improved fraud prevention in the financial industry.

Big Data

Big data allows the fintech company to gather vast amounts of information from the customer and use it to customize their services. Developing customer profiles strengthens risk evaluation and increases fraud identification while offering services and products that suit customer needs.

Web3

Web3 is disrupting fintech by digitally enabling banking services based on blockchain and decentralization to give customers ownership over their data. While the traditional banking system appears to be cumbersome, there are opportunities for faster financial transactions, greater anonymity, and even customized economic solutions.

How TekRevol Can Help with Fintech App Development

Over the years, TekRevol has built its reputation as a development partner for fintech startups and enterprises, helping them create and implement innovative solutions for the fast-changing financial services market. We understand the critical challenges ventures deal with, including fintech compliance challenges, data protection, and keeping up with market innovations.

TekRevol has a team of experienced developers who offer advanced fintech solutions incorporating technologies like AI and blockchain. Our approach mandates that each solution developed focuses on compliance, security, and functionality.

Whether it be designing intuitive and enjoyable user experiences, architecting analytics and logic, or designing new and unique features, we cover it all. One of our key achievements, Save & Win, reflects our focus on driving success for fintech startups.

- Looking to Build a Game-Changing Fintech Solution?

- Share your preferences with our team and get a tailored, innovative, and secure fintech app.

1228 Views

1228 Views April 6, 2025

April 6, 2025