So, you’ve decided to get started with an online store of your own in the UAE, and now you’re asking yourself, “How would I even get paid?” – Ah, the very first concern of everybody! Well, you’re in luck!

The UAE has a thriving e-commerce market, set to hit $9.2 billion by 2026. But all of that is literally for nothing if you can’t get your customers to rust your payment gateways. Cause seriously, the last thing you’ll ever want is your customer to bang on your door for his money back – that too, the money that you didn’t even receive!

A payment gateway is the bridge between your website and your customer’s bank. It facilitates the payment, provides security, and (hopefully) doesn’t make your customers dream of abandoning their shopping carts.

But with so many options easily available in the market, how do you choose the best payment gateway UAE businesses use?

That’s where this guide comes in – here we’re diving into the top 10+ payment gateways in the UAE, that come in handy with features, cost, and every other thing you need to know about them.

So, without any further ado, let’s get to the nitty-gritty!

What is a Payment Gateway?

Suppose you go to a store, pick your favorite device, and proceed to the cashier. The cashier (let’s hope he or she is polite and not in an irritable mood) accepts your money and issues a receipt.

A UAE payment gateway is an online equivalent of that cashier – verifying your payment information and executing the payment securely.

But hold on, why not simply accept direct payments? Well, unless you don’t want fraud risks and aren’t skilled enough to handle manual transaction issues – a UAE payment gateway is your best bet!

- Encrypting customer information to avoid fraud.

- Processing multiple payment options (credit cards, debit cards, Apple Pay, Google Pay, etc.).

- Seamless checkouts to minimize cart abandonment.

- Automating payment authorizations and refunds.

- Still Collecting Payments the Old-School Way?

- Time to ditch the outdated methods! Let’s integrate a secure, fast, and seamless payment gateway in UAE that actually works for your business.

Types of Payment Gateways

Not all payment gateways are created equal! Depending on your business needs, you’ll want to choose the right type of payment gateway UAE merchants rely on.

Here are the four main types:

-

Hosted Payment Gateways

This is the “plug-and-play” solution. Your customers are routed to a third-party checkout page (such as PayPal or Stripe) to finish their orders.

It’s highly secure, simple to install, and best suited for small companies. However, the disadvantage? Customers abandoning your site in the middle of the checkout might affect conversions.

Best for: Small firms, startups, and businesses needing a hassle-free setup.

-

Self-Hosted Payment Gateways

Need to retain customers on your website while continuing to use an external payment processor? \

A self-hosted gateway enables you to capture payment information on your website and securely transmit it to the gateway provider for processing. It offers a more seamless user experience but entails additional security steps.

Best for: Medium to large companies that desire greater control over the checkout process.

-

API-Hosted Payment Gateways

Developers, rejoice! API-hosted gateways allow you to customize the whole shebang. Your customers remain on your site the entire time, which makes for a smooth experience.

But with great power comes great responsibility—you’ll require robust security protocols and development skills.

Best for: Large companies, SaaS sites, and online stores with internal developers.

-

Local Bank Integration Gateways

If you want a gateway linked directly to a UAE bank, this is your best option. Transactions are processed securely via your bank’s infrastructure, promoting high levels of trust. Integration may be more complicated, though, and choice may be restricted compared to international players.

Best for: Companies seeking direct connections with UAE banks for increased security and regulatory compliance.

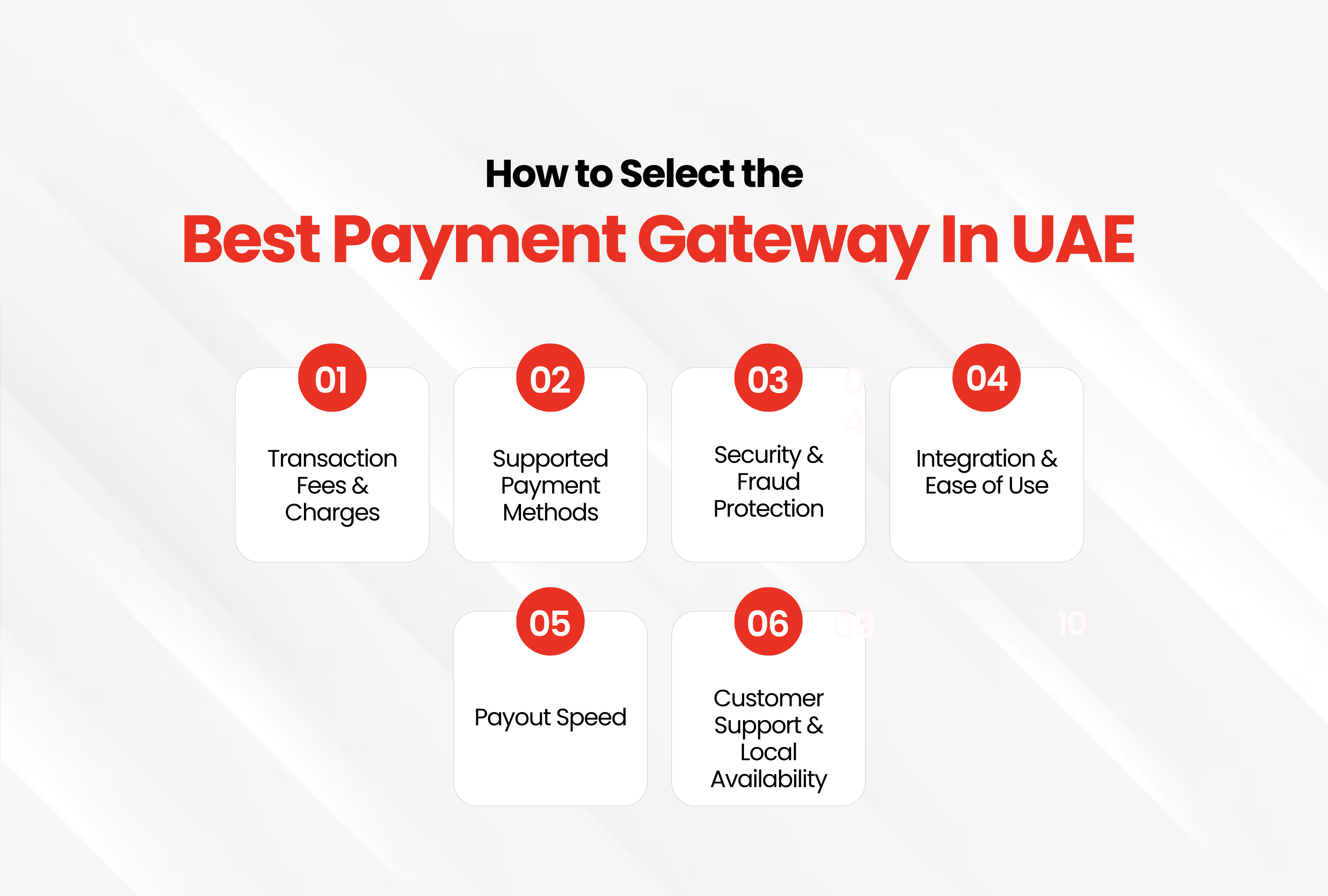

How to Select the Best Payment Gateway in UAE

Choosing the best payment gateway UAE companies depend on isn’t simply a case of selecting the most used one – it’s a matter of choosing the best one for your business requirements.

Some considerations are outlined below:

-

Transaction Fees & Charges

- The gateways charge a flat rate per transaction for some, whereas others charge monthly fees or have setup charges.

- Think about whether a percentage fee (such as 2.9% + AED 1) is suitable for your business model.

-

Supported Payment Methods

- Make sure the gateway is capable of supporting Visa, Mastercard, Apple Pay, Google Pay, and BNPL (Buy Now, Pay Later).

- If your customers are international, multi-currency support is essential.

-

Security & Fraud Protection

- A reputable payment gateway in the UAE should have PCI DSS compliance, tokenization, and fraud detection tools.

- Certain gateways include AI-based fraud detection to reduce risks.

- Integration & Ease of Use

- Does the payment gateway have WooCommerce, Shopify, Magento, or custom API support?

- Look for easy plug-and-play features or developer-friendly APIs.

-

Payout Speed

- Some gateways make payments immediately, while others take 2–7 business days.

- Quick payouts translate to improved cash flow for your business.

-

Customer Support & Local Availability

- A gateway based in the UAE with 24/7 support is always a welcome feature.

- Local customer service can address problems quicker than international providers.

| Factor | Why It Matters | What to Look For |

| Transaction Fees | Affects your profit margins | Low per-transaction fees or volume-based discounts |

| Payment Methods | Determines how customers can pay | Credit/debit cards, Apple Pay, Google Pay, BNPL, cryptocurrencies |

| Security & Fraud Protection | Prevents chargebacks and fraud | PCI DSS compliance, tokenization, AI fraud detection |

| Integration & Ease of Use | Impacts setup time and usability | WooCommerce, Shopify, Magento, API-friendly |

| Payout Speed | Ensures smooth cash flow | Instant payouts or within 2-3 days |

| Customer Support | Critical for issue resolution | 24/7 support, local UAE presence |

- Too Many Payment Gateways, Too Little Time?

- We get it—choosing the best payment gateway UAE businesses use is no easy task. Let’s simplify it for you with expert recommendations and seamless integration!

10+ Most Popular Payment Gateways in UAE

Now that you understand what to consider when using a payment gateway in UAE, let’s explore the best payment gateway UAE companies utilize to make transactions secure and reliable.

Whether you have an e-commerce website, a subscription service, or a worldwide business, there is a payment gateway to suit your needs.

-

Stripe Payment Gateway UAE

When it comes to worldwide presence, simplicity of integration, and programmer-friendly APIs, Stripe payment gateway UAE companies’ favorite is the best. Stripe is a giant among startups, SaaS businesses, and organizations that require complex customization.

It allows merchants to receive online payments from various channels, such as credit and debit cards, Apple Pay, Google Pay, and even cryptocurrencies.

Key Features:

- Simple integration with WooCommerce, Shopify, Magento, and bespoke platforms

- Advanced security against fraud using AI-based security tools

- Recurring billing and subscription management made a smooth

- Detailed payment and revenue analytics dashboard

Why Use Stripe?

Stripe is perfect for companies that want flexibility, scalability, and automation. Although some technical expertise is needed to unlock its full potential, its strong API and security make it a first-class option.

-

Telr – UAE’s Locally Trusted Payment Gateway

Telr is one of the most established UAE payment gateway options, catering to businesses of all sizes. It offers online payments, mobile payments, and even cash-on-delivery integrations, which are common for local businesses.

Key Features:

- Supports Visa, Mastercard, American Express, Mada, and UnionPay

- Has an easy installment payment option for customers

- Offers Islamic payment solutions, making it Sharia-compliant

- Fraud prevention tools to reduce chargebacks

Why Choose Telr?

If you’re looking for a payment gateway in UAE that understands the local market and offers multi-language support (English & Arabic), Telr is a great pick. It’s perfect for startups, e-commerce stores, and businesses with a regional focus.

-

PayTabs – Top for Overseas Transactions

PayTabs is a budding sensation among UAE payment gateway vendors offering services for those with clients internationally. PayTabs accommodates more than 168 currencies and, as such, would be ideal for overseas commerce.

Key Features:

- Consists of acceptance of Visa, Mastercard, Amex, Apple Pay, and banks native to the UAE

- Support for AI-led prevention of fraudulence and tokenized security

- Provides invoicing and payment links for simple transactions

- Functions perfectly with mobile apps and websites

Why PayTabs?

PayTabs is ideal for SMEs and enterprise businesses seeking international expansion. It offers a hassle-free checkout experience and accommodates several alternative payments such as SADAD and Meeza.

-

Amazon Payment Services (Previously PayFort)

Amazon owns this UAE payment gateway, which has the confidence of prominent retailers and online businesses operating in the UAE. It has premium security, efficient payment processing, and first-class integration with UAE-based banks.

Key Features:

- Supports regional and foreign banks for instant payment processing

- Empowers business owners to make available flexible payment terms to buyers

- Sophisticated fraud management and risk management tools

- Facilitates multiple payment channels, such as credit/debit cards, Apple Pay, and Mada

Why Amazon Payment Services?

If you’re looking for a payment gateway in UAE supported by one of the largest tech giants, this is a good bet. It’s intended for mid-to-large-sized businesses seeking security, trust, and hassle-free transactions.

-

CC Avenue – A Popular Payment Gateway in UAE for E-commerce

CC Avenue is one of the most popular payment gateway UAE platforms used today, especially for e-commerce companies. It provides a rich selection of payment modes and is multiple-currency compliant, and hence, it is an ideal solution for companies which are concerned about scaling globally.

Key Features:

- Supports 200+ payment options, including Visa, Mastercard, Amex, Net Banking, and digital wallets

- Enables businesses to receive payments in 27 major currencies

- Smart, dynamic routing for quick and secure transactions

- Simple integration with well-known platforms such as Shopify, WooCommerce, and Magento

Why Choose CC Avenue?

For companies requiring a scalable and flexible payment gateway in UAE, CC Avenue is a good choice. It provides an excellent user experience, and with its support for multiple currencies, it’s a great option for global businesses.

-

2Checkout (Verifone) Best Payment Gateway UAE for Digital Businesses

If your business deals in digital products, 2Checkout (now part of Verifone) offers an exceptional payment gateway service designed specifically to cater to global merchants.

Key Features:

- Accepts payments from 180+ Countries: It supports various payment models (one-time purchases, subscriptions and split payments). AI powered fraud prevention with advanced security features also comes standard.

- Compatible with over 120 shopping carts such as Magento, Shopify, and WooCommerce

Why Choose 2Checkout?

2Checkout Payment Gateway in UAE provides businesses that operate internationally with seamless integrations, wide support of payment methods, and advanced fraud protection capabilities perfect for tech-based enterprises.

-

Checkout.com An Ideal UAE Payment Gateway

Checkout.com is an innovative UAE payment gateway offering an ultra-customizable experience for businesses with high transaction volumes.

Known for its user-friendly API, Checkout allows businesses to customize payment processes suited specifically for them and facilitates seamless payments tailored to individual business requirements.

Key Features:

- These features include support for 150+ currencies and multiple payment methods.

- Machine-learning-based fraud detection system

- Customizable payment solutions via API

- Used by major brands like Careem and Deliveroo).

Why choose Checkout?

Are you an emerging company that needs an excellent payment gateway solution with cutting-edge security and analytics? Checkout.com is an ideal fit.

It provides fully customizable payment gateway solutions backed by cutting-edge security features and analytics, making Checkout an outstanding choice.

-

Network International’s

Network International is one of the premier payment gateway providers in the UAE, supported by local banks and financial institutions. Trusted by leading brands worldwide, Network International provides secure enterprise-level payment solutions.

Key Features:

- Deep integration with UAE banks

- multiple payment methods like Visa, Mastercard, and Amex (PCI DSS Compliant for enhanced Security), including online, mobile, and POS payments.

Why Choose Network International?

Network International is an ideal local payment gateway UAE solution with strong banking partnerships for enterprises looking for payment gateway solutions in their local region.

-

MyFatoorah

MyFatoorah is an effortless payment gateway in UAE that simplifies online transactions for small and medium businesses. By providing links, invoicing integrations, and e-commerce capabilities, MyFatoorah makes accepting payments effortless!

Key Features:

- Payflow Pro for WooCommerce, Magento, and OpenCart

- Include Instant Payment Links that simplify transactions

- KNET, Visa, Mastercard, and Apple Pay support are provided, along with multi-currency support, to facilitate cross-border payments.

Why MyFatoorah?

If you are in some kind of business that demands your customers to make payments online, and you want a solid solution for it, then you really need to give MyFatoorah a shot!

-

PayPal: the Global Payment Giant

Any list of top payment gateway UAE options wouldn’t be complete without PayPal – as for sure it’s one of the world’s leading and most secure payment solutions that the entire world is dependent upon.

Key Features:

- Outstanding solution that supports over 100 currencies with a quick and easy checkout experience

- Buyer and seller protection to secure transactions

- Compatibility with Shopify, WooCommerce, and major e-commerce platforms (ie, Shopify/WooCommerce, etc.).

Why PayPal?

By far one of the world’s most recognized payment gateways in UAE, PayPal provides security, trust, and seamless transactions for businesses of all sizes.

Future Trends in Payment Gateways

The UAE payment industry is evolving quickly due to technological advancement and consumer preferences, and here are some key trends shaping its future:

- AI-Powered Fraud Prevention Payment gateways are increasingly using AI and machine learning technologies to detect and prevent fraud in real time, providing secure transactions.

- More Enhanced Payment Gateways: As we witness more people adopting cryptocurrency, more gateways could support Bitcoin, Ethereum, and stablecoins as payment solutions.

- BNPL (Buy Now, Pay Later) Expansion Services such as Tabby and Tamara have revolutionized consumer financing, making BNPL an indispensable feature.

- Contactless and Biometric Payments Facial recognition and fingerprint authentication can provide added security and convenience in digital transactions.

- Open Banking & FinTech Integrations Seamless API integrations allow businesses to effortlessly connect multiple financial services.

Payment gateways in UAE will likely become faster, safer and more accessible as time progresses businesses must adapt in order to stay competitive!

How Tekrevol Can Assist in Reducing Depression

If you are searching for an easy payment gateway integration for your business? Then your search stops right here! Tekrevol offers custom software development solutions tailored to your own business needs – so that you can be at the mental peace you deserve!

From setting up Stripe Payment Gateway in UAE to AI-powered fraud detection systems to multi-currency payment processors, our experienced team has you covered!

Our team of experts ensure seamless integration, compliance with UAE regulations and an exceptional user experience. Are you ready to expand your business with cutting-edge payment solutions? Get in touch with Tekrevol now and take your transactions to the next level!

- Your Business Deserves Better Payments!

- We are experts in helping businesses like yours get paid faster and smarter.

277 Views

277 Views April 10, 2025

April 10, 2025