Anyone who owns a smartphone has interacted with the Google Play Store, the primary hub for downloading apps on Android devices. We all know it as the place to find games, tools, and various applications, but there’s much more beneath the surface that’s crucial for developers and marketers.

With the rise of mobile technology and digital consumption, data has become an invaluable asset, and the Google Play Store is no exception. Understanding Google Play Store stats can help you navigate the app market effectively and make informed decisions.

Ready to dive deep into the numbers and learn the must-know Google Play Store Statistics? Let’s get started.

Google Play Store Overview (2025)

- Launch Year: 2008, originally as Android Market.

- Rebranding: Became Google Play in 2012.

- App Count: Approximately 1.56 million apps available as of February 2025.

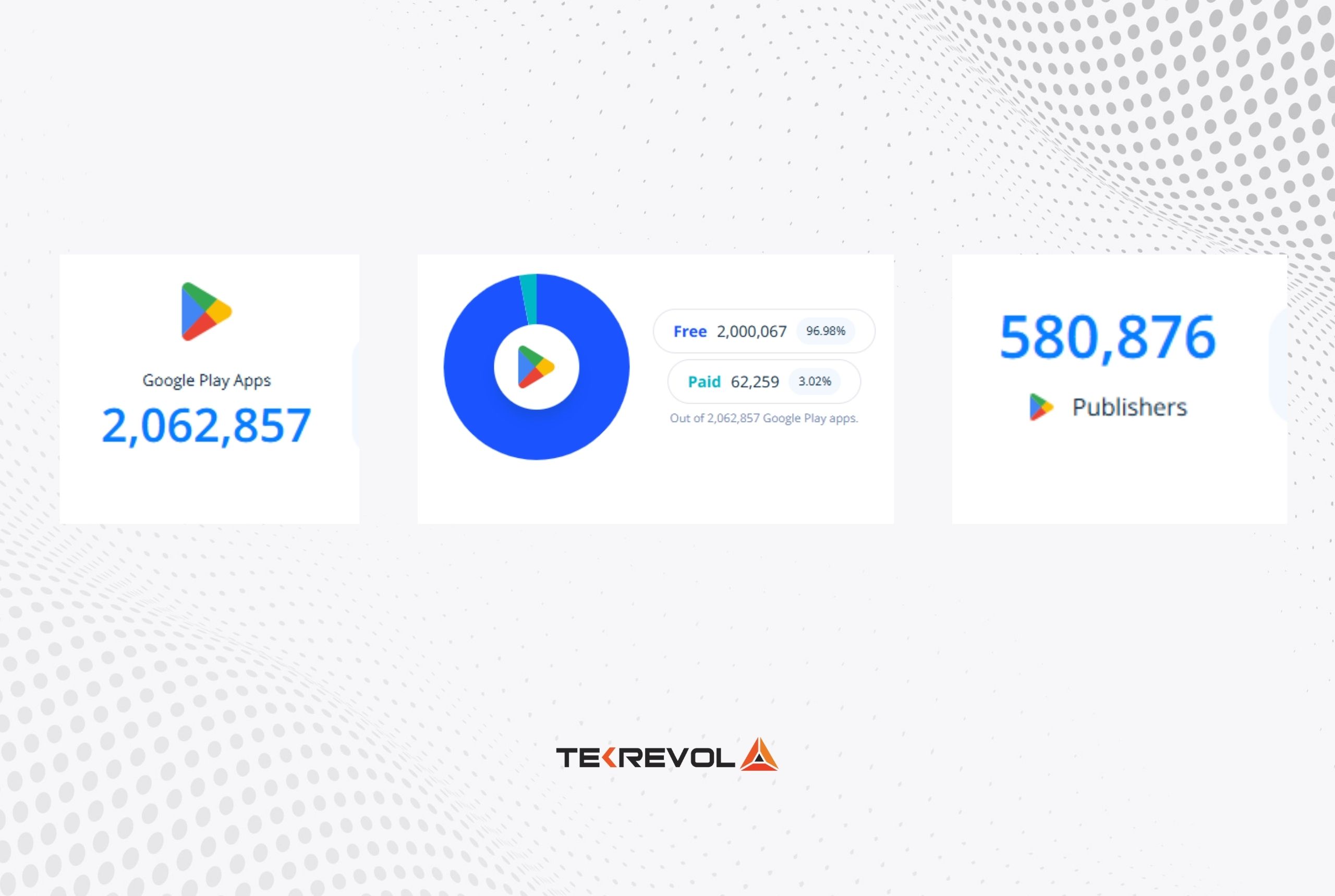

- Active Publishers: Around 580,876 active publishers contributing to the platform.

- Market Share: Android holds a significant portion of the global mobile OS market.

- Revenue: Google Play Store generated substantial revenue in 2024, though it trails behind Apple’s App Store.

- Downloads: Google Play leads in total app downloads, surpassing iOS by a considerable margin.

- User Demographics: Predominantly used by individuals aged 18–34, with significant engagement in emerging markets.

Brief History of Google Play Store

When Was Google Play Created?

- 2003: Android Inc. was founded, initially focusing on software for digital cameras before shifting to mobile devices.

- 2005: Google acquired Android Inc., aiming to enter the mobile market with an open-source platform.

- 2008: The Android Market was launched, offering a modest selection of apps for early Android users.

- 2012: Google rebranded the Android Market to Google Play, integrating apps, music, books, and videos into a single platform.

- 2025: The Google Play Store hosts over 1.56 million apps, serving billions of users worldwide and continually evolving to meet diverse digital needs.

Google Play vs. Apple App Store: A 2025 Comparative Snapshot

In 2025, the competition between Google Play and Apple’s App Store remains intense. Android maintains a dominant market share, with approximately 71.44% of the global mobile operating system market, while iOS holds about 27.89%.

Despite Android’s larger user base, the Apple App Store outpaces Google Play in revenue, generating $103.4 billion in 2024 compared to Google Play’s $46.7 billion.

This disparity suggests that iOS users may have higher spending tendencies within apps.

| Metric | Google Play Store | Apple App Store |

| Market Share | 71.44% | 27.89% |

| 2024 Revenue | $46.7 billion | $103.4 billion |

| Total App Downloads | 3x more than iOS | Baseline |

| Number of Apps (2025) | ~1.56 million | Data not specified |

App Distribution by Type

| Platform | Total Apps | Free Apps | Paid Apps |

| Google Play | 2,062,857 | Data not specified | Data not specified |

| iOS App Store | 1,908,183 | Data not specified | Data not specified |

Note: Detailed breakdown of free and paid apps for each platform is not available in the provided sources.

App Categories on Google Play

| Category | Number of Apps |

| Non-Gaming Apps | 1,817,940 |

| Gaming Apps | 244,917 |

These statistics underscore the dynamic and expansive nature of the Google Play Store, reflecting its pivotal role in the global mobile app ecosystem.

- Is your business app missing out on Google Play?

- Don’t let your competitors dominate! Get expert help to launch and scale your app successfully.

Key Google Play Store Statistics 2025

- Total Number of Apps: Approximately 2.06 million apps are available on the Google Play Store.

- Active Publishers: Around 580,876 developers have released apps on the platform.

- App Creation Rate: An average of 1,205 new apps are added daily.

- Projected Downloads: By 2026, consumers are expected to download approximately 143 billion apps from the Google Play Store, marking a significant increase from 111 billion in 2021.

- Revenue Growth: User spending on the Google Play Store is projected to reach $55.5 billion in 2024, up from $50.5 billion in 2023.

- Free vs. Paid Apps: As of January 2025, about 97% of Android apps are free, while 3% are paid.

- App Update Frequency: 28% of apps are updated weekly, 72% monthly, and over 95% annually.

Total Number of Apps on Google Play Store

As of January 2025, the Google Play Store hosts approximately 2.06 million apps, offering a vast selection to its global user base.

In comparison, the Apple App Store has around 1.64 million apps, highlighting Android’s broader app ecosystem.

App Creation & Release Frequency

How Many Apps Are Created Daily?

Developers contribute significantly to the Google Play Store, with an average of 1,205 new apps released daily.

How Many Apps Are Released on Google Play Per Week?

In December 2024, approximately 41,000 new apps were introduced to the Google Play Store, averaging about 10,250 apps per week.

How Many Apps Are Released on Google Play Per Month?

The month of December 2024 saw around 41,000 new apps added to the platform, indicating a robust growth rate in app development.

This consistent influx of new applications reflects the dynamic nature of the Google Play Store and its appeal to developers worldwide.

Google Play Downloads Statistics

As of 2024, the Google Play Store has achieved remarkable milestones in app downloads. Several applications have surpassed significant download thresholds, reflecting their widespread adoption.

Most Downloaded Apps of All Time (2025 Update):

- More than 10 billion downloads:

- Google Play Services

- YouTube

- Google Maps

- Google Chrome

- Gmail

- More than 5 billion downloads:

- TikTok

- WhatsApp Messenger

- Google Photos

- Messenger (Facebook)

These figures underscore the dominance of both utility and social media applications in the Android ecosystem.

Regarding Google’s own suite of applications, many come pre-installed on Android devices, contributing to their high download numbers. For instance, Google Play Services, essential for app functionality, has exceeded 10 billion downloads.

In the gaming sector, titles like Subway Surfers have achieved over 198 million downloads as of recent data, showcasing the popularity of mobile gaming on the platform.

Overall, the number of Android app downloads continues to grow, reflecting the platform’s expansive user base and the increasing reliance on mobile applications for daily activities.

- The best time to launch your app is NOW!

- Don’t wait for the perfect moment—take action today and secure your spot in the Play Store rankings.

Google Play Store Revenue Insights

In 2025, the Google Play Store’s revenue is projected to continue its growth trend, driven by various monetization strategies employed by developers.

Revenue Breakdown:

- In-App Purchases: A significant portion of the revenue comes from in-app purchases, especially within gaming apps, where users buy virtual goods or premium features.

- Advertisements: Many free apps utilize ads as a primary revenue source, displaying them to users to generate income.

- Subscriptions: Services like streaming platforms and productivity tools offer subscription models, contributing steadily to the overall revenue.

The Google Play Store’s revenue model allows developers to choose the best fit for their app’s audience, ensuring diverse income streams.

Free vs. Paid Apps Distribution

As of February 2025, the Google Play Store continues to be a dynamic platform, offering a vast array of applications to its global user base. Below is a detailed overview of the current statistics and trends:

Total Number of Apps

- Total Apps Available: Approximately 2,062,857 apps are available on the Google Play Store.

App Distribution

- Free vs. Paid Apps:

- Free Apps: Approximately 2,000,067 apps (96.98%) are free to download.

- Paid Apps: Around 62,259 apps (3.02%) require purchase.

Average Price of Paid Apps

The pricing distribution for paid apps is as follows:

- Under $1: Over 20,000 apps

- $1 – $2: Over 17,000 apps

- $2 – $3: Over 10,000 apps

- $3 – $4: Over 6,000 apps

- $4 – $5: Over 4,000 apps

- $5 – $6: Over 2,000 apps

- $6 – $7: Over 1,500 apps

- $7 – $8: Over 1,200 apps

- $8 – $9: Over 1,000 apps

- $9 – $10: Approximately 1,263 apps

App Update Frequency

- Weekly Updates: 28% of apps are updated weekly.

- Monthly Updates: 72% of apps receive updates monthly.

- Annual Updates: Over 95% of apps are updated annually.

Global User Trends

- Projected App Downloads: By 2026, downloads from the Google Play Store are expected to reach 143 billion, up from 111 billion in 2021.

App Usage by Age and Gender

- Age Distribution of Mobile Gamers:

- 16–24 Years Old: 28.3%

- 25–34 Years Old: 29.5%

- 35–44 Years Old: 23.1%

- 45–54 Years Old: 12.8%

- 55 and Older: 6.3%

- Gender Distribution:

- Male Gamers: 53.6%

- Female Gamers: 46.4%

- Wonder what it takes to be at the top?

- Get insider strategies to boost your app’s visibility, downloads, and revenue on Google Play.

Gaming Apps Dominance

- Number of Gaming Apps: Approximately 244,917 gaming apps are available, representing 11.87% of the total apps.

- Non-Gaming Apps: Around 1,817,940 apps (88.13%) are non-gaming.

App Release Rates

- Daily Releases: An average of 1,205 new apps are added daily.

- Weekly Releases: Approximately 6,666 apps are released weekly.

- Monthly Releases: Around 42,213 apps are introduced monthly.

App Ratings

- Apps with Ratings: 1,028,621 apps (49.86%) have user ratings.

- Apps without Ratings: 1,034,236 apps (50.14%) lack user ratings.

Number of Apps on Google Play Over Time

| Year | Number of Apps (in millions) |

| 2025 | 2.062 |

| 2024 | 2.26 |

| 2023 | 2.405 |

| 2022 | 2.740 |

| 2021 | 2.846 |

| 2020 | 2.098 |

| 2019 | 1.668 |

| 2018 | 2.500 |

| 2017 | 3.500 |

| 2016 | 1.900 |

| 2015 | 1.500 |

| 2014 | 1.430 |

| 2013 | 1.030 |

| 2012 | 0.675 |

| 2011 | 0.325 |

| 2010 | 0.090 |

| 2009 | 0.016 |

Note: The data for 2025 is as of February, and the figures for previous years are sourced from various reports.

App Distribution by Type

| Platform | Total Apps | Free Apps | Paid Apps |

| Google Play | 2,062,857 | 2,000,067 | 62,259 |

| iOS App Store | 1,906,380 | 1,817,355 | 87,834 |

Note: The figures for the iOS App Store are as of the latest available data.

Top-Grossing Gaming Genres (2025)

The gaming landscape on the Google Play Store continues to thrive, with various genres contributing to its success. Here’s an updated overview of the top-grossing genres and trends in 2025:

Gaming Genres

- Casual Games: These remain highly popular, with titles like Candy Crush Saga and Subway Surfers consistently ranking among the most downloaded games. Their accessibility and simplicity make them appealing to a broad audience.

- Core Games: This category also contributes significantly to downloads and revenue. Games like PUBG Mobile and Garena Free Fire have been successful in attracting a dedicated player base.

Revenue Contribution

Gaming apps generate a substantial portion of the total Google Play Store revenue. In 2022, mobile games accounted for $31.37 billion in revenue, and this figure is estimated to rise to $34.30 billion in 2023. For 2025, the projected revenue is approximately $40.10 billion, reflecting a continued growth trend.

Free vs. Paid Games

Most mobile games are free to play, with revenue primarily coming from in-app purchases and ads. This model allows developers to reach a wider audience, especially in lower-income countries.

- Millions of games, but is yours standing out?

- Don’t get lost in the crowd—get expert guidance to dominate the Google Play Store.

Most Downloaded Games (2025)

| Rank | Game Title | Platform |

| 1 | Roblox | Android |

| 2 | Block Blast! | Android/iOS |

| 3 | Free Fire x NARUTO SHIPPUDEN | Android |

| 4 | Subway Surfers | Android/iOS |

| 5 | Mini Games: Calm & Relax | Android |

| 6 | Pokémon TCG Pocket | iOS/Android |

| 7 | Candy Crush Saga | Android/iOS |

| 8 | Honor of Kings | iOS/Android |

| 9 | Last War: Survival | iOS/Android |

| 10 | Whiteout Survival | iOS/Android |

Dominant Genres

- Strategy Games: These account for 23% of the revenue share, with top titles like Rise of Kingdoms and Clash of Clans.

- Casino & Social Slots: Contribute 18% to revenue, driven by localized content for emerging markets.

- RPGs: Hold a 15% revenue share, with breakout hits like Tower of God: New World.

- Hybrid-Casual: Represent 12% of revenue, featuring merge mechanics and narrative progression.

Gaming Trends

- Number of Gaming Apps: As of early 2025, there are approximately 244,917 mobile gaming apps available on the Google Play Store.

- Gaming Revenue: In 2022, gaming revenue was $31.37 billion, with an estimated increase to $34.30 billion in 2023. For 2025, the projected revenue is approximately $40.10 billion.

- Gaming Downloads: In 2022, there were 47.22 billion game downloads on Google Play, with an estimated increase to 49.32 billion in 2023.

Annual Google Play Gaming Revenue

| Year | Revenue ($bn) |

| 2016 | 14.32 |

| 2017 | 17.42 |

| 2018 | 21.64 |

| 2019 | 25.25 |

| 2020 | 31.94 |

| 2021 | 37.33 |

| 2022 | 31.37 |

| 2023 | 34.30 |

| 2024* | 37.12 |

| 2025* | 40.10 |

Player Insights

- Gender Split: The gap is narrowing, with 52% male and 48% female players in core genres.

- Age Distribution:

- 45% of players are aged 25-34, who are primary spenders.

- 23% are aged 35-44, representing the fastest-growing segment.

Engagement Patterns

- Daily Session Frequency: The global average is 4.7 sessions per day.

- ARPU Leaders:

- South Korea: $12.40/month

- Japan: $11.80/month

- United States: $9.20/month

- Don’t launch blind—get a winning strategy!

- Partner with an expert mobile app team to ensure your app’s success in the competitive Play Store.

Emerging Trends

- AI-Generated Content: 68% of top 100 games use procedural level generation.

- Cloud Gaming Adoption: 29% of Android users try cloud-native games monthly.

- Regional Growth Leaders:

- Southeast Asia: 22% revenue increase YoY.

- Latin America: 18% user base expansion.

- Monetization Shift:

- 41% of revenue now from battle passes.

- Only 28% from traditional loot boxes.

Top-Performing Titles (2025)

- Most Downloaded:

- “Heroes of the Dark” (RPG)

- “Merge & Magic” (Hybrid-Casual)

- “Free Fire MAX” (Battle Royale)

- Highest Revenue:

- Honor of Kings ($2.1B annual revenue)

- Monopoly GO! ($1.8B)

- Royal Match

Gaming Industry Revenue Projection

In 2025, the mobile gaming industry is projected to reach a revenue of approximately $126.06 billion, with Google Play contributing a significant portion of this figure. Here’s an overview of the top-grossing gaming genres:

Top-Grossing Gaming Genres (2025):

| Genre | Revenue ($ billion) |

| Strategy | 17.5 |

| RPG | 16.8 |

| Puzzle | 12.2 |

| Casino | 11.7 |

| Simulation | 6.1 |

| Shooter | 4.3 |

| Action | 3.6 |

| Sports | 2.7 |

These figures highlight the dominance of strategy and role-playing games (RPGs) in the mobile gaming market. The puzzle and casino genres also maintain substantial revenue shares, indicating their widespread appeal among mobile gamers.

The prevalence of free-to-play models remains a key characteristic of the mobile gaming landscape. Developers often monetize through in-app purchases and advertisements, allowing for broader audience reach and sustained revenue generation.

Overall, the mobile gaming industry in 2025 showcases a diverse range of genres that cater to varied player preferences, with strategic and immersive game types leading in revenue generation.

- Struggling with low app downloads?

- Discover what’s stopping users from installing your app and how to fix it fast!

Strategic Considerations

Developer Opportunities:

- Web3 Integration: The integration of blockchain technology and NFTs into mobile games is gaining traction, with an increasing number of games incorporating NFT elements to enhance player engagement and offer unique digital assets.

- Subscription Models: A growing trend in mobile gaming monetization is the adoption of subscription-based models, providing players with exclusive content, ad-free experiences, and other premium features.

Regulatory Impact:

- EU Digital Markets Act: Recent regulatory changes, such as the EU Digital Markets Act, have influenced platform policies, potentially affecting revenue shares and operational practices for developers.

- Age Verification Systems: With increasing emphasis on user safety, especially for younger audiences, major studios are implementing robust age verification systems to comply with regulatory standards and protect underage users.

Additional Insights

- Global Mobile Gaming Revenue: The mobile gaming market is experiencing robust growth, with projections estimating global revenues to reach $126.06 billion by 2025.

- Google Play Gaming Revenue (2025 Estimate): Google Play is expected to maintain a substantial share of the mobile gaming market, contributing significantly to the overall revenue, driven by a diverse range of gaming apps and a large user base.

App Ratings & Quality Trends

- Percentage of Apps with 4+ Star Ratings:

- Approximately 234,466 apps have ratings of 4.0 stars or higher, with 109,473 apps rated above 4.5 stars.

- Most Common User Complaints (2025 Data):

- Frequent issues include app crashes and privacy concerns.

- Average Rating of Google Play Apps:

- The overall average rating across all apps is not explicitly stated, but many apps achieve high ratings.

These statistics highlight the importance of maintaining high-quality apps to achieve favorable rankings on Google Play distribution platforms.

- Poor Play Store rankings? We can fix that!

- Get expert ASO (App Store Optimization) to push your app to the top of search results.

Regional Insights & Market Trends

Understanding regional preferences is crucial for developers aiming to optimize their apps for specific markets. Analyzing Google Play Store stats reveals distinct trends in app popularity and user engagement across different countries.

Leading App Publishers

- Tencent: Known for apps like WeChat and PUBG Mobile, Tencent remains a dominant force in the app publishing industry.

- ByteDance: The company behind TikTok continues to experience global success.

Revenue Trends

- Global Spending: In 2022, consumers spent approximately $42.3 billion on Google Play apps and games.

- Projected Growth: By 2026, Android app downloads are expected to reach 143 billion, indicating a robust growth trajectory.

Play Store Top Apps by Country (2025)

- United States:

- TikTok, Instagram, and Facebook lead in downloads.

- India:

- WhatsApp Messenger, Facebook, and MX Player are top choices.

- Brazil:

- WhatsApp Messenger and Instagram are highly popular, reflecting broader trends in social media usage.

- Japan:

- LINE, PayPay, and Instagram are highly popular.

These play store top apps by country reflect cultural preferences and local trends influencing app rankings.

Emerging Markets Driving Growth

- Nigeria:

- Experienced significant growth, though exact figures are not specified.

- Indonesia:

- Saw a notable rise in downloads, with gaming apps leading the surge.

- Mexico:

- Reported growth, particularly in finance and education apps.

These app download statistics indicate significant opportunities for developers targeting emerging markets.

Google Play Ranking Factors by Country

- Cultural Preferences:

- In Japan, local apps like LINE dominate due to cultural relevance.

- Language Support:

- Apps offering native language interfaces rank higher in non-English speaking countries.

- Payment Methods:

- In regions where credit card usage is low, apps integrating local payment solutions see better rankings.

Understanding these factors is essential for developers aiming to improve their Google Play app ranking by country.

- Your app idea is brilliant—but does it stand out?

- Competition is tough! Make your app the go-to choice with smart positioning strategies.

Developer & Publisher Insights

Understanding the dynamics of the Google Play Store is crucial for developers and publishers aiming to succeed in the Android market.

Number of Active Publishers on Google Play (2025)

As of 2025, the Google Play Store hosts approximately 2.87 million active publishers, contributing to a vast array of applications across various categories.

Success Rates for New Apps in 2025

With over 3.55 million apps available on the platform, competition is intense. While exact percentages of new apps reaching over 10,000 downloads are not specified, it’s evident that a small fraction achieve significant success.

Developers must employ effective marketing strategies and ensure high-quality user experiences to stand out.

Monetization Strategies That Work

Effective monetization strategies on Google Play include:

- In-App Purchases: Common in gaming apps, allowing users to buy virtual goods or premium features.

- In-App Advertising: Utilized by free apps to generate revenue through ads displayed to users.

- Freemium Models: Offering basic features for free, with advanced features available for purchase.

- Subscriptions: Employed by services like streaming platforms, providing recurring revenue streams.

These strategies have significantly contributed to Google Play’s revenue, which reached $48 billion in 2024.

Challenges & Risks in 2025

Developers face several challenges on the Google Play Store, including policy changes and market saturation.

Policy Changes Impacting Developers

In 2025, Google implemented several security and privacy updates:

- Enhanced Data Protection: Stricter guidelines on user data collection and storage.

- Transparent Permissions: Requiring apps to clearly disclose data usage to users.

- Regular Security Audits: Mandatory security assessments for apps handling sensitive information.

These changes aim to bolster user trust and align with global data protection standards.

Saturation & Competition

The Google Play Store’s vast ecosystem includes millions of apps, leading to significant competition.

While the exact number of apps removed or hidden due to policy violations isn’t specified, developers must focus on quality and compliance to maintain visibility.

On average, thousands of new apps are added daily, intensifying the need for effective App Store Optimization (ASO) and unique value propositions.

- Apps that rank higher, earn higher—yours can too!

- Learn how to increase visibility, downloads, and revenue with the right Play Store approach.

How TekRevol Can Boost Your Google Play Success

In the competitive landscape of the Google Play Store, standing out requires more than just a functional app. TekRevol offers comprehensive solutions to enhance your app’s performance and visibility in the Android market. By leveraging in-depth knowledge of Google Play Store stats, we craft strategies that align with current trends and user preferences.

Our approach begins with meticulous market research, identifying gaps and opportunities within the apps Android store. We then employ cutting-edge development practices to create applications that not only meet but exceed user expectations.

Post-launch, our focus shifts to continuous optimization, utilizing analytics to monitor performance and implementing updates that keep your app relevant and engaging.

Understanding the nuances of Google Play distribution platforms, TekRevol ensures your app reaches its intended audience effectively, maximizing both downloads and user retention.

Android App Development Best Practices (2025)

Staying ahead in the Google Play apps market requires adherence to best practices that evolve with technological advancements. TekRevol’s proven framework focuses on:

- User-Centric Design: Crafting intuitive interfaces that enhance user experience.

- Performance Optimization: Ensuring fast load times and smooth functionality.

- Regular Updates: Keeping the app current with monthly updates, as 72% of apps follow this practice.

- Compliance with Policies: Adhering to Google Play’s guidelines to avoid removals, noting that nearly 700,000 apps were removed in 2022 for non-compliance.

By integrating these elements, we enhance your app’s ranking and visibility on Google Play.

How TekRevol Increased Client App Downloads by 300%

TekRevol’s strategic approach has led to remarkable success stories. For instance, their collaboration with the University of North Alabama resulted in a significant boost in app engagement.

- Challenge: The University sought to enhance job search accessibility for graduates.

- Solution: TekRevol developed the UNA Job Portal app, integrating user-friendly features and seamless navigation.

- Outcome: The app experienced a substantial increase in user downloads and engagement.

This is one of many case studies that exemplify TekRevol’s ability to transform client objectives into tangible results.

Tools & Services for App Analytics, ASO, and User Retention

To ensure sustained success in the Google Play Store app rankings, TekRevol offers:

- App Analytics: Utilizing tools to monitor user behavior and app performance, enabling data-driven decisions.

- App Store Optimization (ASO): Implementing strategies to improve app visibility, including keyword optimization and compelling visuals.

- User Retention Programs: Developing features and campaigns that encourage ongoing user engagement and loyalty.

These services are designed to adapt to various markets, recognizing that Google Play app rankings can vary by country due to cultural preferences and regional trends.

Conclusion

Navigating the Google Play Store requires a strategic approach informed by current statistics and user behaviors. Key takeaways include:

- Market Awareness: Understanding that approximately 3.3 million apps are available on Google Play as of 2025.

- Revenue Opportunities: Recognizing the potential in a market where consumers spent $42.3 billion on apps and games in 2022.

- Continuous Improvement: Emphasizing the importance of regular updates and user engagement to maintain relevance.

For developers and marketers aiming to excel, partnering with experts like TekRevol can provide the necessary tools and insights to thrive in the dynamic Google Play ecosystem.

- Is your app optimized for Play Store success?

- Poor rankings mean poor revenue! Get an expert strategy to rise to the top.